Sponsored Content

Demand for Battery Metal Manganese is Set to Explode Higher; Electric Metals (USA) Limited is a Great Way to Play this Growth Trend

Around 85%-90% of all mined manganese -- a hard, brittle, silvery metal -- is currently used as an alloy in iron and stainless steel production. Manganese improves the strength and workability of steel and increases its resistance to wear. The metal is also a key element in glass making, fertilizers and ceramics -- and increasingly in the batteries of electric vehicles (EVs). In greater detail, manganese is a stabilizing component in the cathodes of nickel-manganese-cobalt lithium-ion batteries. Manganese not only increases the energy density of the battery, which in turn boosts the driving range of the vehicle, it also decreases the combustibility of an EV battery pack. In addition, the cost of manganese is far lower than most other battery metals such as nickel and cobalt.

Manganese is the 12th most abundant metal in the world. It is found -- and mined -- primarily in South Africa, China, Australia, Brazil, India, and Gabon. Across the globe, annual manganese production totals about 50 million tonnes. However, only about 1% of the amount mined is pure enough for battery applications. Despite its crucial importance to the steel industry and now to the EV industry, no U.S. or Canadian mine produces manganese. Indeed, no manganese has been produced in the U.S. since 1970.

This limitation in battery-grade manganese supply, coupled with the metal’s heavy usage in batteries -- lithium nickel manganese cobalt oxide (NMC) battery chemistry was used in around half of lithium-ion batteries in 2022 and could comprise 60% of such batteries by 2030, per CPM Group forecasts -- and the near exponential projected increases in battery demand for the foreseeable future, points to the need for similarly sharp increases in high-purity manganese mines and processing plants. As of 2020, only twelve independent plants existed in the world, almost all located in China, with the capability to produce high-purity manganese sulfate monohydrate.

To be more specific, Benchmark Mineral Intelligence believes manganese cathode demand will increase a remarkable 600% by 2040. In turn, an increase in mining and processing capacity is more necessary for manganese than any other battery metal, according to the CPM Group. Absent extraordinarily rapid action, and corresponding capital spending commitments, a structural manganese deficit is likely to develop, particularly in North America.

Cell and cathode material producers, as well as major EV manufacturers, are increasingly emphasizing high purity manganese sulfate in emerging battery chemistries. A desire to limit cobalt usage -- based on high and volatile cobalt pricing and widespread reports of dangerous cobalt mining conditions, particularly in the Democratic Republic of the Congo -- is the impetus behind this movement. At least seven major EV manufacturers (Tesla, Stellantis, Ford, Volkswagen, Renault, Nissan, and Mitsubishi) which in aggregate produce more than 30 million vehicles per year have committed to developing manganese-based batteries.

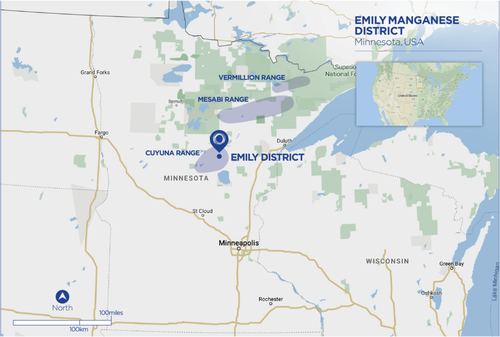

With all this in mind, Electric Metals (USA) Limited (TSXV: EML, OTC: EMUSF) represents an intriguing play on the rapidly tightening market for battery-grade manganese. The company, which has a stock market capitalization of only C$43 million, owns the Emily Manganese Project, the highest-grade NI 43-101 independently verified manganese resource in North America, and one of the highest globally. The pre-development stage Emily Project contains 6.5 million tonnes of mineral resources at a manganese grade of 19.6%. A substantial investment exceeding US$26 million has been dedicated to the Emily Project, strategically situated amidst the esteemed Cuyuna Iron Range mining district in central Minnesota.

Electric Metals commenced a 30-hole drilling program at the Emily Project in February 2023, and assay results on the first three holes were extremely encouraging. Electric Metals intersected high-grade manganese mineralization at around the expected depths. Furthermore, two of the drill holes intersected segments with manganese concentrations of more than 40%. These concentrations exceed the assay results of any other publicly traded miner. Given these successes, investors will closely monitor Electric Metals’ drilling results from the remaining 27 holes.

Based largely on these constructive early drilling results, shares of Electric Metals shares have soared about 140% since late January 2023. Furthermore, the stock has jumped around 30% in just the first few days of July as EV makers including Tesla and Rivian reported impressive production results for the second quarter of 2023.

Five Reasons Electric Metals Should Be on Your Watchlist

- High purity manganese is a key element of the cathode in most EV batteries today, and the metal’s role only promises to grow in this rapidly expanding industry for many years. Manganese is both one of the more inexpensive battery metals and the battery metal which requires the most mining/processing future investment to meet forecasted demand.

- Electric Metals’ Emily Manganese Project is the highest grade manganese resource in either the U.S. or Canada. Importantly, manganese is considered a qualifying critical metal in the United States. This designation, combined with the Emily Project’s Minnesota location, means that any manganese produced there would qualify for the tax incentives outlined in the U.S. Inflation Reduction Act (IRA). In turn, any manganese output from Emily would be highly prized by EV manufacturers.

- Electric Metals launched a 30-hole drilling program at Emily in early 2023. The first two holes intersected prominent +40% manganese intervals, which exceeds the grade of any other publicly listed manganese company in North America. If the assay results on the remaining holes yield similarly constructive data, the size of Emily’s estimated resources could ultimately be revised significantly higher.

- Electric Metals’ CEO Gary Lewis and his team have been responsible for impressive exploration successes and the development of mines. In addition, the management group has significant M&A expertise.

- Insiders, including Electric Metals’ management and its Board of Directors, own nearly one-third of the company’s shares. This percentage ownership stake is much higher than the positions owned by insiders at most other junior mining companies.

Electric Metals (USA) Limited last traded at C$0.37 on the TSX Venture Exchange and USD$0.35 on the OTC Markets, as of July 21st 2023.