Sponsored Content

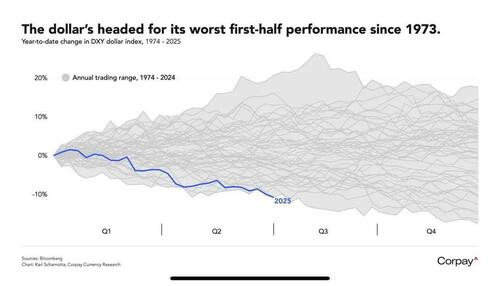

The Dollar Just Had Its Worst Start to a Year Since 1973

The Dollar Just Had Its Worst Start to a Year Since 1973

Here’s what they’re not shouting from the front page: The U.S. dollar has dropped more than 10% in the first half of 2025, marking its worst January-to-June performance since the era of free-floating currencies began in 1973.

It's a crisis quietly unfolding at the heart of the global financial system.

Markets Are Up. But the Foundation Is Cracking.

Global markets are up. But the volatility under the surface has been relentless, and the dollar is leading the breakdown.

Why?

- New tariff proposals are reigniting global trade tensions, putting upward pressure on consumer prices and forcing foreign currencies to re-price risk.

- The Fed is pinned in place, unable to cut rates due to inflation risk, and unwilling to hike into a fragile economy.

- President Trump’s “Big Beautiful Bill”, a multi-trillion-dollar tax-and-spend package, is on track to pass. It’s projected to add $3.3 trillion to the national debt.

Add it up, and global capital is looking for the exits.

The constant back-and-forth on tariffs hasn’t helped. One day it’s a hardline stance, the next it’s a pause — and the numbers keep changing. With new rounds of tariffs set to resume after July 9, and major economies still scrambling for clarity, currency markets have been thrown into disarray. This kind of policy whiplash is exactly what weakens global confidence in the dollar.

The Dollar’s Slide Isn’t Over — It’s Just Beginning

The dollar’s retreat is a structural response to rising deficits, eroding fiscal credibility, and weaponized trade policy.

Foreign buyers are shifting out of Treasuries. Emerging markets are gaining strength. Even gold-producer currencies like Ghana’s cedi and Russia’s ruble are outperforming the greenback.

And remember: the dollar doesn’t need to collapse overnight to lose trust. A steady, quiet erosion is more than enough to push capital elsewhere.

Gold and Silver Aren’t Rallying by Accident

While the dollar’s been slipping, gold is up 25% in 2025 — its best start to a year since the 1970s. Silver is right behind, up 24%.

Gold and silver don’t rely on deficit projections or rate policy. They don’t care about trade negotiations or Congressional theatrics. They just store value.

The ZeroHedge Precious Metals Collection: Opt Out of the Experiment

When the world’s reserve currency starts to fail its own stress test, you don’t double down on digital proxies. You move to something real.

The ZeroHedge Bullion Collection, available only from JM Bullion, ZeroHedge’s preferred bullion dealer, is built for times like these:

1 oz ZeroHedge Gold Bar: .9999 fine gold, sealed in an assay blister pack. A symbol of independence, stamped with the ZeroHedge logo.

10 oz Silver Bar: Solid, stackable, and .999 pure. The foundation of any serious metals portfolio.

1 oz Silver Round: Compact, flexible, and ideal for those who value mobility and real value.

The dollar’s drop is no longer a theory. And the smart money is already moving.