Sponsored Content

The Dollar’s Crisis of Confidence Has Begun

For decades, the U.S. dollar was the ultimate safe haven.

President Trump’s sweeping tariffs were supposed to strengthen the greenback. Instead, they’ve done the opposite—triggering a sharp selloff, stoking recession fears, and putting the dollar’s reserve currency status under the microscope.

What Just Happened?

Trump’s new tariffs—up to 54% on Chinese imports and 10% across the board—have sent shockwaves through global markets. The ICE U.S. Dollar Index fell as much as 3% in a single day, its biggest drop since 2022.

Investors are fleeing—not just from U.S. stocks, but from the dollar itself. Why? Because tariffs could put U.S. growth at risk, sparking fears of stagflation: rising prices, falling demand, and a Fed stuck in neutral.

A Safe Haven No More

Historically, turmoil sends capital flooding into the dollar. But not this time. Foreign money is rotating out of U.S. assets—and that’s bad news for a country running a $36 trillion tab.

Deutsche Bank is warning of a “crisis of confidence” in the dollar. And major investment houses are now reducing dollar exposure in favor of gold, commodities, and foreign currencies.

The New Monetary Order

The three pillars of dollar dominance—U.S. exceptionalism, high interest rates, and strong inflows—are wobbling. What’s left? A world where the dollar is no longer the unquestioned reserve currency—and where gold is once again the asset of last resort.

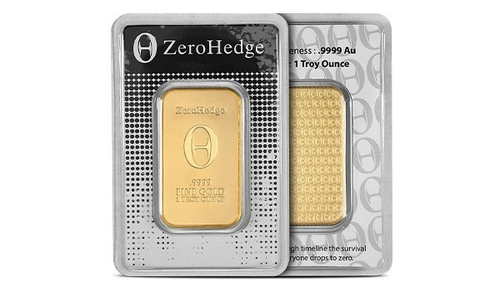

Whether you’re hedging against inflation, a weaker dollar, or growing global uncertainty, physical metals offer protection you can hold. The 1 oz ZeroHedge Gold Bar is .9999 fine gold, sealed in an assay blister pack for authenticity.

✅ Crafted from .9999 pure gold

✅ Features the ZeroHedge logo—a symbol of financial independence

✅ Available only at JM Bullion, ZeroHedge’s trusted bullion dealer

When confidence wavers, gold steps in.