Sponsored Content

Empty Ports and Half-Full Container Ships: A Ticking Clock for Consumers and Investors

Something is shifting under the surface of the global economy. Shipping traffic is thinning out. Ports are quieter than they should be. And container ships leaving China are running half-empty, even as we head toward what’s usually a busy season.

This slowdown isn’t just a seasonal blip. It’s a sign of deeper pressure—and a lot of it traces straight back to tariffs.

Tariffs Are Tightening the Screws

Companies that once moved goods freely across borders are now grappling with higher costs, tougher decisions, and fewer shipments. Some are stockpiling inventory to get ahead of even higher prices. Others are cutting orders, wary of passing new costs onto already-strained consumers.

Either way, the effect is the same: fewer goods moving across oceans and onto shelves.

When Trade Slows, the Risks Start Piling Up

A slowdown in shipping often shows up before the bigger cracks in the economy become obvious. It can lead to:

- Rising prices as supply tightens

- Slower growth as trade grinds down

- More inflationary pressure at a time when rates are already a major concern

- Eroding consumer confidence, especially if shelves start to thin out

The risk of a deeper economic slowdown is getting harder to ignore.

Real Assets Don’t Need Supply Chains

While the world worries about empty ports and trade disruptions, gold and silver remain untouched by border closures, bottlenecks, or broken promises. When systems fail, metals hold firm.

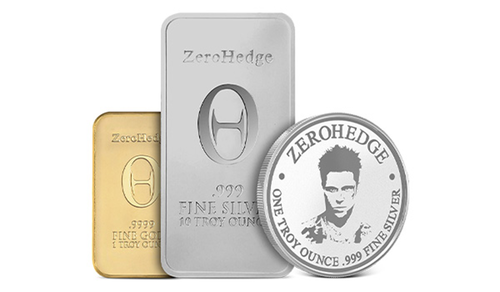

The ZeroHedge Bullion Collection, available only from JM Bullion, ZeroHedge’s preferred bullion dealer, is built for times like these:

1 oz ZeroHedge Gold Bar: .9999 fine gold, sealed in an assay blister pack. A symbol of independence, stamped with the ZeroHedge logo.

10 oz Silver Bar: Solid, stackable, and .999 pure. The foundation of any serious metals portfolio.

1 oz Silver Round: Compact, flexible, and ideal for those who value mobility and real value.

When trade routes stall and uncertainty grows, metals don’t just survive—they thrive. Secure your real assets now—before the next shock hits.