Sponsored Content

Farewell to the Penny: Final Order Placed by U.S. Mint

The U.S. Mint has placed its final order for penny blanks, signaling the end of the one-cent coin after over 230 years in circulation. This decision, first initiated by DOGE (The Department of Government Efficiency) driven by the rising cost of production (now nearly four cents per penny) and declining utility, marks a significant shift in U.S. currency policy.

A Symbolic End to an Era

The penny, once a staple of American commerce and culture, has become economically impractical. With over 114 billion pennies currently in circulation, the Treasury Department anticipates annual savings of approximately $56 million by ceasing production. This move reflects broader concerns about the sustainability of fiat currency and the government's ability to manage fiscal responsibilities effectively.

The Devaluation of Currency

The discontinuation of the penny is more than a cost-saving measure; it underscores the ongoing devaluation of paper money. As inflation erodes purchasing power, the smallest denominations become obsolete, and the public's trust in fiat currency diminishes. This trend raises critical questions about the future of money and the importance of preserving wealth through tangible assets.

Gold: A Timeless Store of Value

In contrast to the declining value of paper currency, gold has maintained its worth throughout history. It is not subject to the same inflationary pressures and government policies that affect fiat money. As the penny fades into history, gold remains a steadfast option for those seeking to protect their wealth against economic uncertainty.

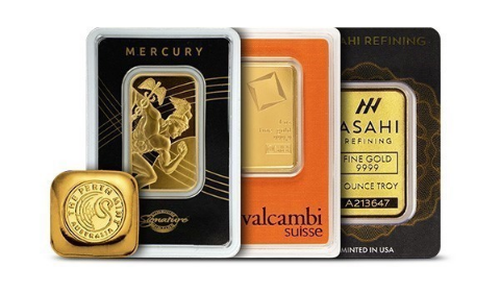

Invest in the Real Thing

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

As traditional currency faces challenges, gold represents a tangible asset with enduring value.