Sponsored Content

The Fed’s Standing Still — but Inflation Isn’t

The Federal Reserve just held interest rates steady at 4.25%–4.50%, pointing to signs of progress in the fight against inflation. But beneath the headlines, the message was clear: this fight isn’t over — and it may get harder before it gets easier.

Recent projections from the San Francisco Fed indicate that inflation could rise again in the near term, especially as proposed tariff policies inject new uncertainty into the economy. And Fed Governor Adriana Kugler isn’t mincing words — she’s warning that tariffs could put further upward pressure on prices, potentially complicating the Fed’s ability to act.

Inflation Is Cooling — but Only on the Surface

On paper, inflation looks tame. The headline PCE index rose just 0.1% in March and April. But core inflation, which excludes food and energy, is still sitting at 2.6% — and it’s not moving much.

This “stickiness” suggests that the real cost of living isn’t improving for most Americans. And if tariffs drive up the cost of imported goods, inflation could rise again before the Fed gets any room to cut.

Monetary Policy Can’t Fix Structural Risk

The Fed is cornered. Cutting rates now risks reigniting inflation. Raising rates risks breaking growth. Holding steady does little to resolve either.

Meanwhile, average Americans are left navigating higher prices, tighter credit, and an uncertain future — all while the dollar quietly loses purchasing power.

Gold Doesn’t Rely on Policy or Politics

In contrast, gold doesn’t require a rate cut, a pivot, or a political consensus. It doesn’t answer to Washington or Wall Street. That’s why it continues to attract investors looking for stability in a system that feels increasingly fragile.

Throughout history, gold has protected wealth when currencies falter and policymakers get boxed in. This is one of those moments.

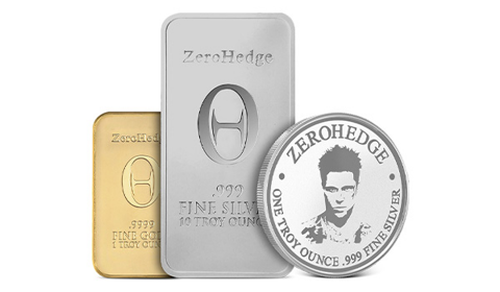

The ZeroHedge Bullion Collection: Real Assets for Uncertain Times

We created the ZeroHedge Bullion Collection with one goal: to help investors take back control. Offered exclusively through JM Bullion, ZeroHedge’s preferred bullion dealer, each piece is trusted by stackers, savers, and skeptics alike.

1 oz ZeroHedge Gold Bar: .9999 fine gold, sealed in an assay blister pack. A symbol of independence, stamped with the ZeroHedge logo.

10 oz Silver Bar: Solid, stackable, and .999 pure. The foundation of any serious metals portfolio.

1 oz Silver Round: Compact, flexible, and ideal for those who value mobility and real value.

If inflation’s not going away, neither should your preparation.