Sponsored Content

Gold at all-time highs: should I buy?

Gold continues to cross new all-time highs, breaking past $4,600 per ounce.

This moment has left many investors wondering whether to sell their gold and lock in their gains or to buy more, hoping this is just the beginning or a further bull run.

Although we are bullish on gold prices, we think there’s a better way to think about gold ownership that breaks the buy/sell stalemate entirely.

Gold didn’t go up. The dollar went down.

There is no such thing as a gold bull market without a dollar bear market. One is simply the inverse of the other.

As we wrote in our 2025 Gold Outlook Report:

“We are in a gold bull market today for a very different reason than in 2009–2011. It’s not about the fear of rising consumer prices. It’s about the fear of being a creditor to an increasingly obvious Ponzi scheme.”

That remains the driver. Not CPI. Not ETF flows. Not sentiment. This is about trust—or more precisely, the accelerating loss of trust—in irredeemable paper currencies.

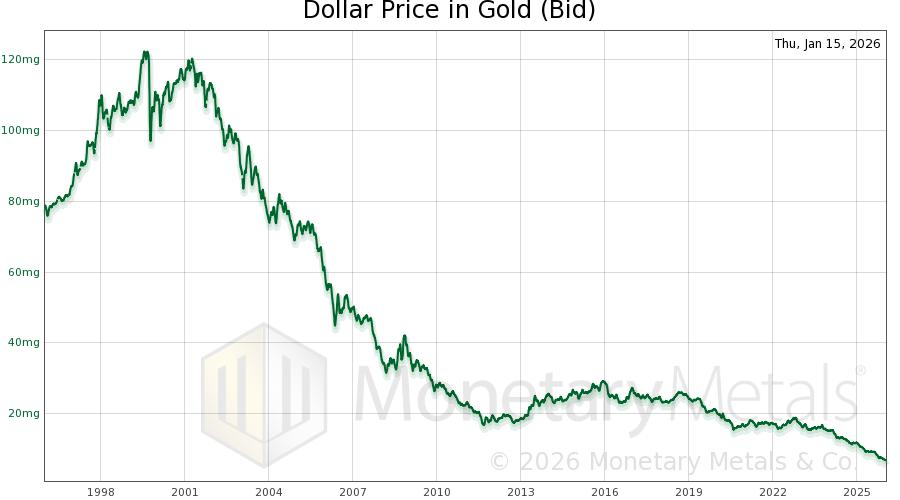

Measured in gold, the dollar has declined steadily for decades. In 1996, one dollar bought more than 120 milligrams of gold. Today, it buys less than 10.

The question is not whether that trend continues, but whether there are any credible mechanisms left to stop it.

What would signal a top in gold?

Gold tops occur when structural monetary risks are resolved. None of the forces driving gold to new all-time highs have been. If anything, they are quietly compounding.

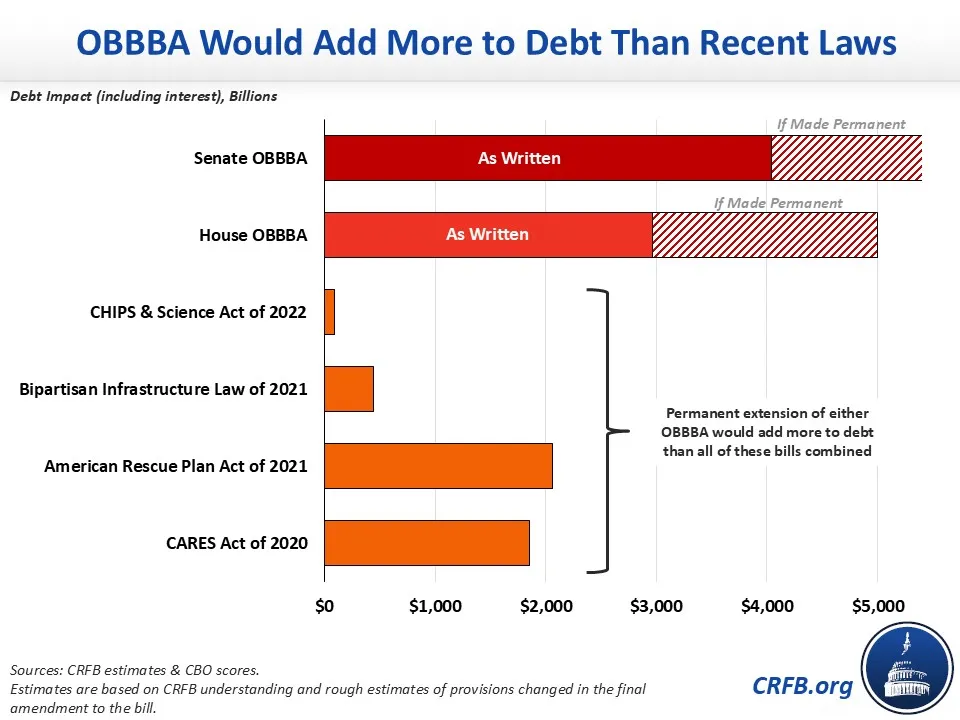

For example, the “One Big Beautiful Bill,” if extended permanently, would add more to U.S. debt than the CARES Act, the American Rescue Plan, the Bipartisan Infrastructure Law, and the CHIPS Act combined.

Keep in mind that this is not emergency spending, but rather normal, baseline spending.

Gold is responding to this bleak math.

The old buy-or-sell question no longer works

Because of the debt situation, investors understand that holding dollars can be risky. That’s why gold ownership has expanded steadily. But a new dilemma has emerged.

Gold prices are high enough to make new buyers hesitant, yet the structural risks are severe enough to make selling feel reckless.

The default advice of “just hold” assumes that wealth preservation alone is sufficient.

In a period of prolonged inflation, high interest rates, or rallying equities, that can be a costly assumption.

Capital that does not compound loses relative ground over time, even if its nominal value rises. Preservation of capital matters but productivity of capital can matter even more.

Gold no longer has to sit idle.

For most of modern financial history, gold has been treated as inert insurance—useful in crises, but otherwise unproductive. That framework no longer reflects reality.

Today, physical gold can function as productive capital in the real economy. Gold can be leased to operating businesses and earn a return, paid in additional ounces of gold, while remaining physical metal.

At Monetary Metals, we facilitate this through gold leasing arrangements that pay a yield on gold, in gold. The metal is deployed productively, and the return is measured in ounces—not dollars.

Title, ownership, and gold price exposure remain, but without the drag of storage fees, insurance costs, or ounces sitting idle.

The real divide is no longer bulls versus bears

The critical distinction today is not between those who are bullish or bearish on gold prices. It’s between those who hold gold passively and those who hold it productively.

Whether gold trades higher, consolidates, or pulls back in the near term does not change the core reality: the dollar’s role as a reliable store of value continues to erode, while debt obligations compound.

Gold is doing its job. The dollar is not.

The old question “Should I buy more gold or sell some?” belongs to a different monetary regime.

In today’s monetary reality, the more relevant question is whether your gold capital is positioned to simply endure the system’s failures, or to grow and compound through them.

Learn how to put your gold to work with Monetary Metals today by downloading the free Passive Income in Gold report.