Sponsored Content

The Government Is Quietly Buying Its Own Debt: A Silent Signal Something’s Cracking

The U.S. Treasury just quietly executed the largest debt buyback in history—$10 billion worth of its own bonds, matching an earlier round in the same month.

When the Treasury starts buying back its own IOUs, it signals a deeper problem: the government is having trouble keeping the bond market calm without outside help.

Why Is the Treasury Buying Its Own Debt?

In simple terms, this means the U.S. government is taking old debt off the market — not because it’s paid off, but because rising interest rates are making it harder to manage. Investors offered to sell the Treasury nearly $23 billion worth of bonds. And the government scooped up $10 billion of it in one go. With fewer buyers and rising borrowing costs, the Treasury is taking matters into its own hands to keep interest rates from climbing even faster.

It’s like trying to pay off your credit card by borrowing from another card — you're not solving the problem, just shifting it around.

This is different from just issuing more bonds or letting old ones expire. It’s a more aggressive, hands-on approach, and it smells a lot like the early stages of money printing under a different name.

Why Isn’t the Fed Stepping In? Because It Can’t.

The Fed could normally help by cutting rates and calming markets. But it’s stuck. Why? Inflation is still a threat, and tariffs are part of the reason.

Just last week, Fed Chair Jerome Powell warned that rising tariffs could drive prices higher, making it riskier to ease monetary policy too soon. The Fed is trapped between inflation and instability, and it’s choosing to sit tight.

So the Treasury is stepping in, quietly trying to contain the damage.

Gold Doesn’t Play These Games

Debt buybacks and rate drama are reminders that paper assets live and die by central planning. Gold doesn’t.

It’s not subject to rate hikes, political cycles, or market manipulation. It doesn’t rely on investor confidence or media spin. Gold is one of the few assets where investors turn when the system starts looking shaky.

JM Bullion Gold Starter Pack: A Smarter First Step

If the Treasury is quietly trying to stabilize the debt market behind the scenes, maybe it’s time to think about what that means for you.

The JM Bullion Gold Starter Pack is a simple, low-barrier way to start owning physical gold today.

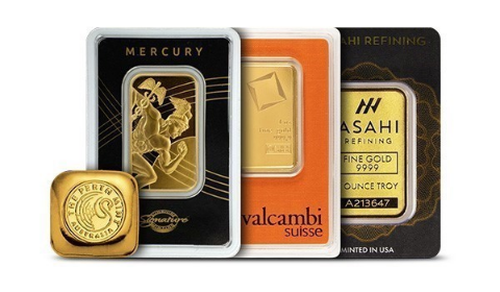

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

Washington’s buying its own debt. Maybe you should be buying something better.