Sponsored Content

Is This The Company That Breaks America’s Dependence On Chinese Antimony?

Summary

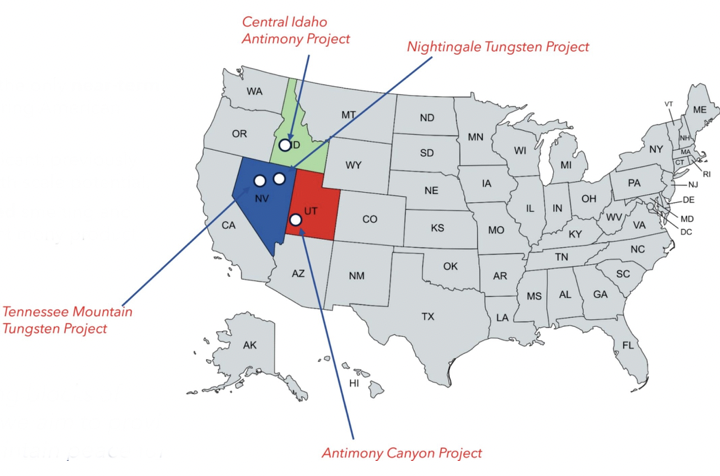

Trigg Minerals Limited (OTCQB: $TMGLF) has four antimony (Sb) and tungsten (W) development projects in the mining-friendly states of Utah, Nevada, and Idaho. These metals, which play key roles in the defense, semiconductor, communications, and optical systems industries, are largely produced in nations which are adversaries of the U.S., including China and Russia. Neither of these metals have been mined in the U.S. for some time, and the U.S. government actively supports the establishment of Sb and W mines that will lessen the nation’s dependence on unreliable sources of supply that are heavily affected by geopolitics. More specifically, in November 2025, the U.S. launched a new national effort, called the Genesis Mission, to accelerate scientific discovery and technological innovation using AI. Crucial to this effort will be securing a domestic supply of minerals, such as Sb and W, that are critical for creating and operating AI systems. The Genesis Mission promises to increase the demand for Sb and W for many years to come.

$TMGLF has assembled a world-class Antimony mining team, allowing the company to implement its vertically integrated strategy of mine to smelter. Notably, $TMGLF is in advanced stages of securing a site for its U.S.-based Antimony smelter. Furthermore, $TMGLF believes its flagship Canyon Antimony Project could begin production as soon as late 2026. If even one of $TMGLF’s projects proves to have substantial resources, the company’s stock could increase by 5x to 10x.

Antimony

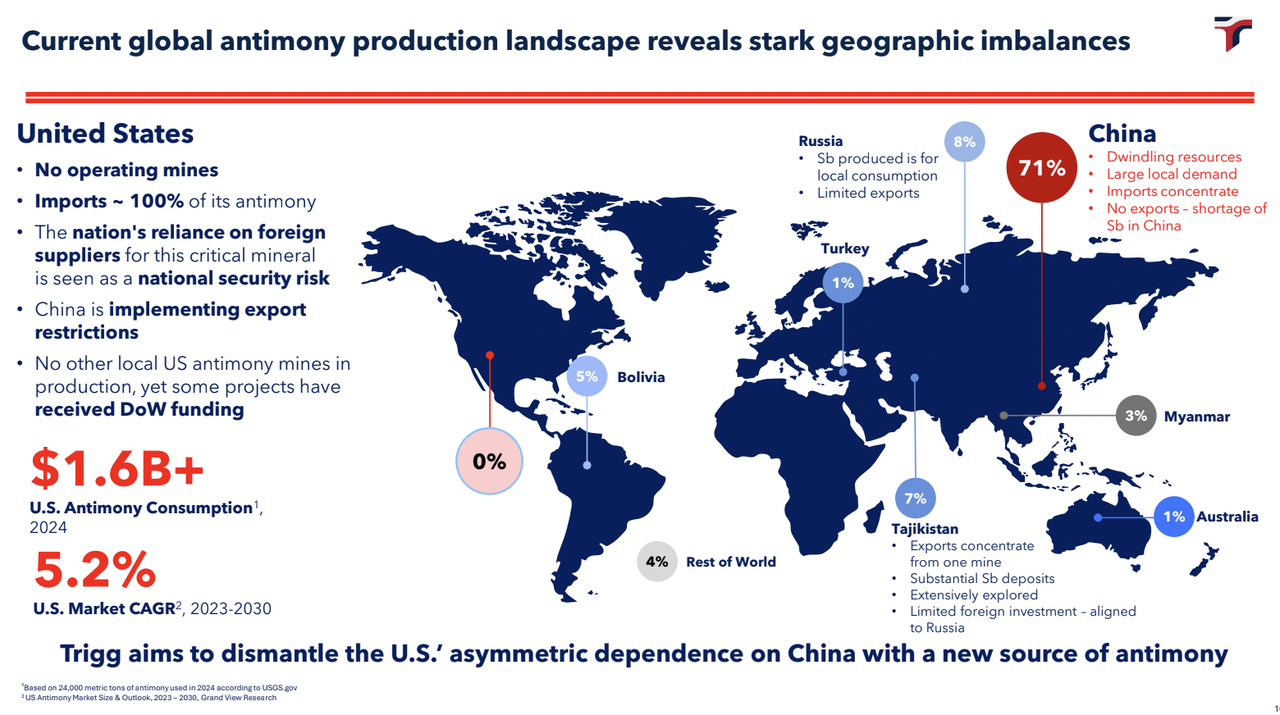

The shortage of rare earth elements (REE) has become both a headline topic in the investment world and a major factor in U.S.-China trade negotiations. But antimony (periodic table symbol Sb), which is classified as a critical mineral by the U.S. Geological Survey due to supply chain vulnerabilities and its use in defense, solar panels, and electronics applications, has even tighter supply-demand characteristics than most REEs. Indeed, MDPI, a respected publisher of open access journals, believes the demand for Sb exceeds supply by 10%. Furthermore, antimony is in dwindling supply and is generally mined in undependable regions across the globe: 71% is produced in China and another 8% in Russia. The U.S. has no operating antimony mines.

About 100,000 tonnes of antimony were mined in 2024, down from 106,000 tonnes in 2023 and down dramatically from 187,000 tonnes in 2011. The chief reasons for the declines: stricter environmental regulations in China and the closure of some mines. The shrinking supply of Sb is occurring at a time when demand for the lustrous gray metal which has vital flame retardant properties is growing. For example, a good rule of thumb is that 50 tons of Sb are consumed for every one gigawatt (GW) of photovoltaic modules produced. In 2024, 728 GW were produced, up 18.5% from 2023. Further increases are expected in 2025. This implies that nearly 40% of mined Sb must be allocated to the solar energy industry alone. At the same time, Sb demand is growing in other sectors, including ammunition, the medical industry (in surgical tools and as a shield from radiation), semiconductors, communications, and high velocity missile systems.

China is keenly aware of the importance of and the tight supply-demand situation for Sb. It restricted exports of Sb, gallium, and germanium between August 2023 and September 2024 and banned their sale to the U.S. in December 2024 in response to chip export curbs imposed by the Biden Administration. In early November 2025, China suspended the U.S. sales ban for a one-year period through November 27, 2026 after President Trump met with Chinese President Xi; however, China kept the three metals on the dual-use export control list, meaning that sales to the U.S. will be limited as Chinese exporters still need to obtain licenses for foreign sales.

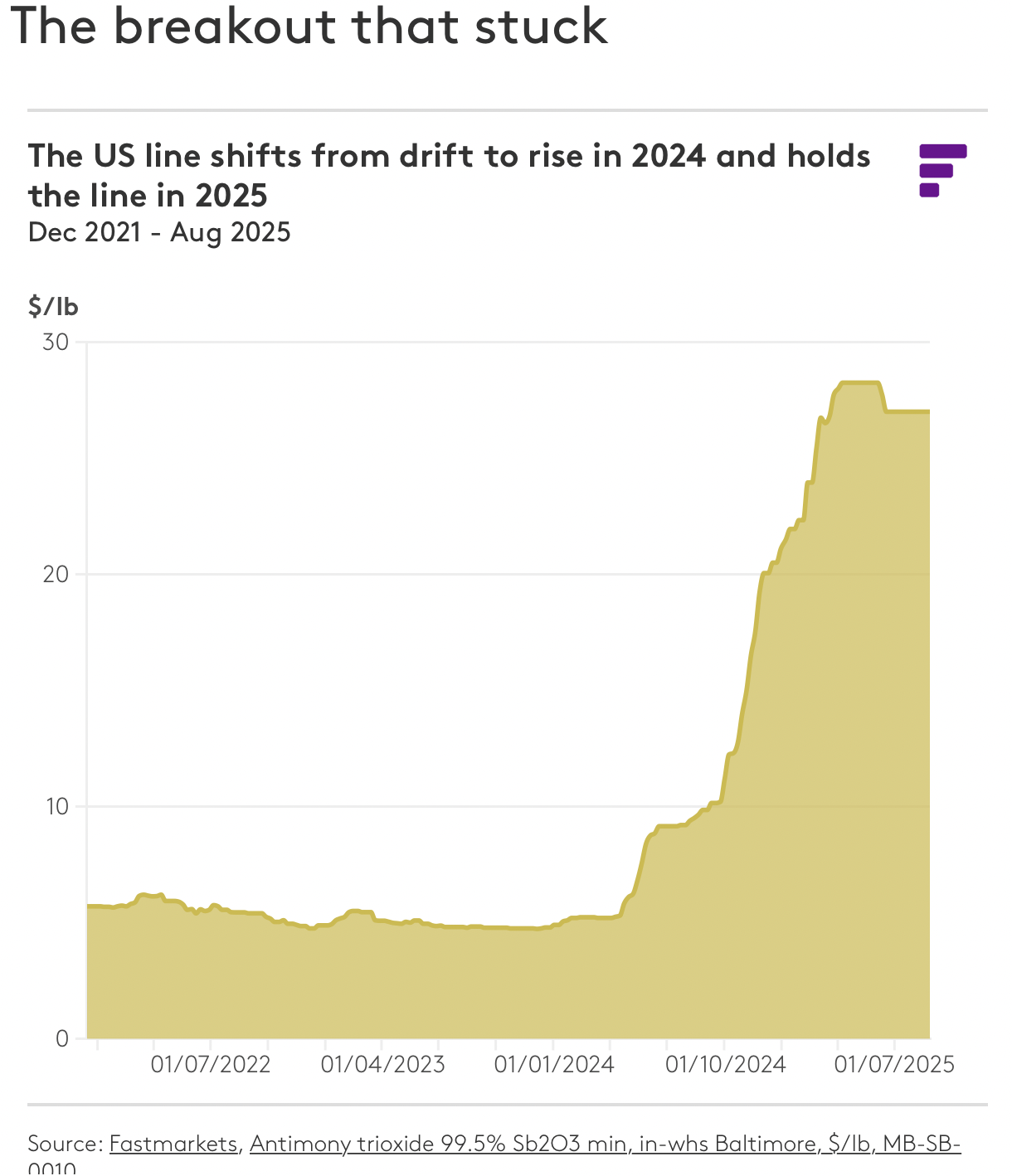

Not surprisingly, given this backdrop of strong demand and limited supply (which could grow even more limited based on the intensity of geopolitical tensions), the price of Sb has soared. In about 18 months, the price per pound paid by a U.S. purchaser has quintupled, making it among the best-performing commodities in the world. To put this move into perspective, the prices of gold and Bitcoin have each increased around 50% over this period.

Excerpt from World Economic Forum publication on November 13, 2025:

Tungsten

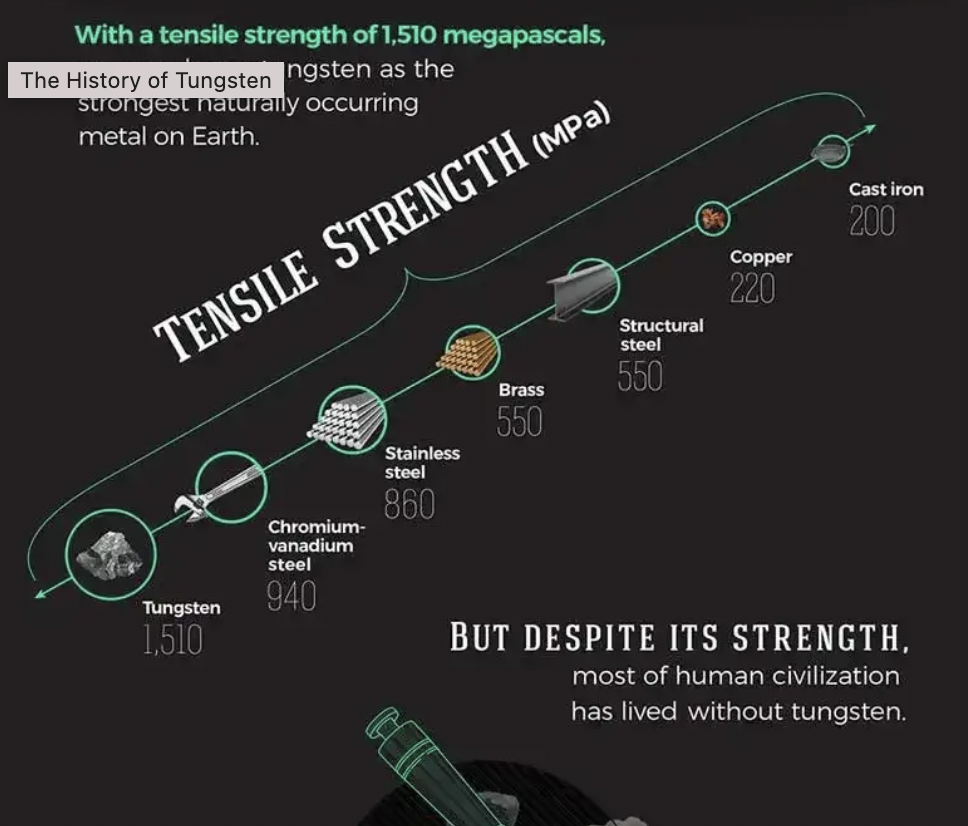

Another metal for which demand is growing and supply shrinking is tungsten (periodic table symbol W), a dense, brittle mineral with the highest melting point and tensile strength of any pure metal (three times as strong as structural steel, nearly twice as strong as stainless steel). Given these characteristics, W is used to create high-speed cutting tools, durable alloys, armor-piercing projectiles, and new energy applications. More specifically, tungsten carbide is utilized in the production of semiconductors and integrated circuits because of its heat management capabilities; and tungsten-diamond wires precisely cut silicon wafers in the photovoltaic industry.

The global tungsten market is large, estimated to be US$6.5 billion in 2025, but, as in the case of antimony, China produces the lion’s share (> 80%) of the world’s tungsten. According to the U.S. Geological Survey, the U.S. has not mined W since 2015. The Pentagon can no longer source tungsten from adversarial nations like China and Russia. On January 1, 2027, this preclusion expands to any tungsten mined in these nations.

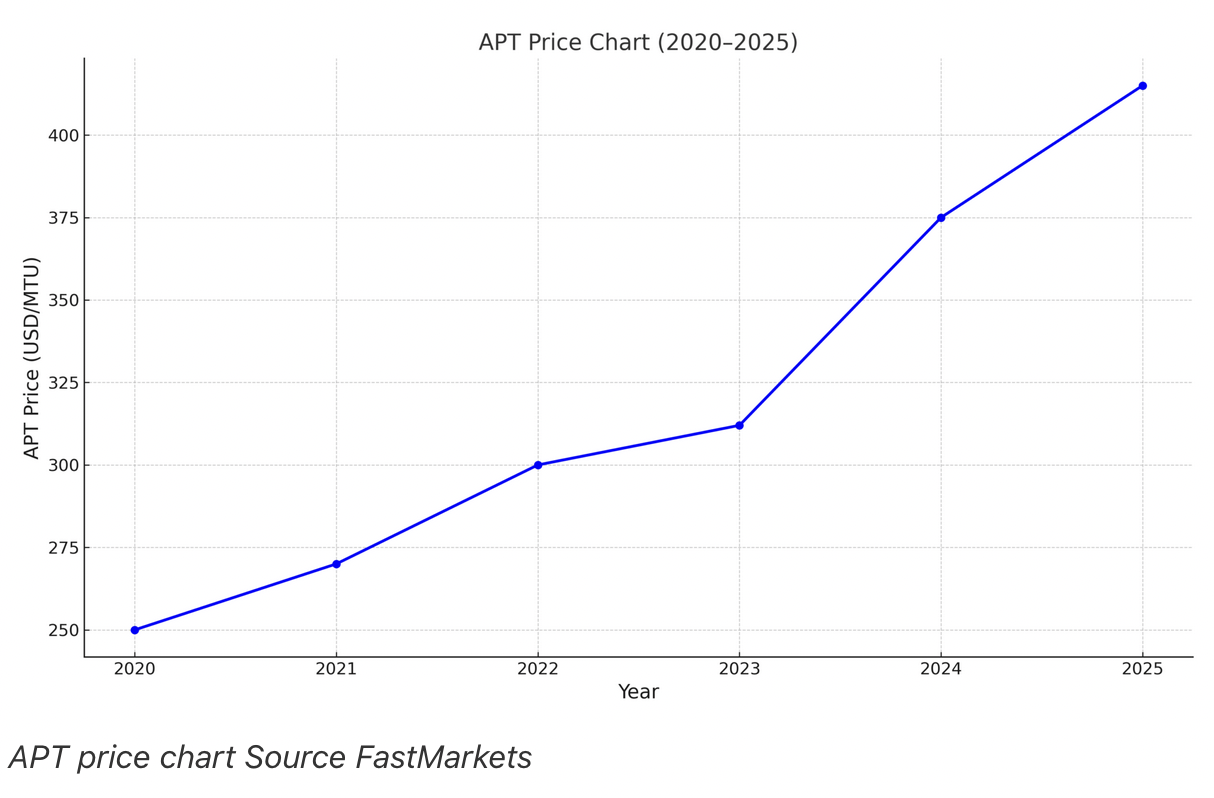

Also much like antimony, tungsten prices are soaring. Indeed, the price of ammonia paratungstate (APT) , the benchmark tungsten product, has jumped 33% in the last two years.

Trigg Minerals Limited (OTCQB: $TMGLF) represents an intriguing and potentially extremely undervalued U.S.-based play on these two unusual and scarce metals. For example, Trigg’s Antimony Canyon project is not just one of the only antimony sources that can be developed in the near term, it is also one of the highest grade Sb systems in the U.S. Based on soil sampling and shallow drilling results, Antimony Canyon may contain up to 1.5% Sb content -- 3x to 5x higher than typical global grades -- across millions of tonnes of resources. In addition, Trigg owns the Central Idaho Antimony (CIA) Project. Historic drilling results there show up to 17.6% Sb concentrations in some samples.

In addition, Trigg has two high-grade tungsten projects in Nevada: Tennessee Mountain and Nightingale. Historic drilling samples at the projects reveal thick, high-grade intercepts with 0.7% to 0.9% tungsten concentrations, roughly twice the tungsten grades in existing mines.

Perhaps nothing underscores Trigg’s commitment to developing viable and economic domestic sources of Sb and W that are aligned with U.S. national security objectives than the Board’s recent decision to change the name of the company. In mid-December 2025, Trigg will formally become American Antimony and Tungsten Ltd.

Five Reasons Trigg Minerals $TMGLF Limited Should Be on Your Watchlist

- With a stock market capitalization of just US$86 million, Trigg represents an extremely discounted way to invest in viable projects that the U.S. needs to ensure domestic supply of Sb and W -- commodities that are demanded by many industries and which are effectively solely supplied today by America’s adversaries. If just one of these projects were to reach production, the valuation of Trigg could jump five- or ten-fold.

- Such appreciation potential is not a pie-in-the-sky possibility. When the stock market discovers a company with substantial and extremely valuable commodity resources that has announced positive fundamental developments and/or received important government support, the stock typically soars. For example, MP Materials (a REE miner) jumped 700% between August 2025 and early October 2025; Perpetua Resources Corp. (which owns antimony, gold, and silver resources in Idaho) gained a roughly similar amount between February 2024 and early October 2025; and United States Antimony Corporation (which mines antimony in Mexico and processes it in Montana) soared around 800% between July 2025 and early October 2025.

- Per Trigg’s current plans, antimony mining could begin at Antimony Canyon by year-end 2026, and processing of the mined ore could commence in the first half of 2027. Importantly, Trigg has sufficient cash on hand (US$16.5 million) to execute its short- to medium-term strategy.

- Not surprisingly given the key roles that both Sb and W play in a variety of industries, Trigg is working to form strategic partnerships with U.S. suppliers and government agencies. Of course, the formal announcement of such partnerships could prove to be a catalyst for Trigg’s stock price.

- Trigg’s management team, including non-executive directors, have more than 90 years of aggregate experience in the mining/resources/antimony markets, making this group uniquely qualified to develop and operate the company’s projects and to maximize Trigg’s shareholder value. In particular, Trigg’s Managing Director Andre Booyzen is a specialist in antimony mining, mine development, and offtake agreements. He has 25+ years of operational, senior, and executive experience in the mining industry.