Sponsored Content

Trump’s Return: Is Your Portfolio Ready for the Shake-Up?

The first 100 days of a presidency are always pivotal, and Donald Trump’s return to the White House is set to shake up the status quo. His unapologetic approach to putting America first could usher in a new era of economic growth and national strength—but not without its challenges. For investors, it’s a time of both opportunity and caution.

Trump’s presidency is a rallying cry for change, and precious metals are the ultimate tool to navigate this new landscape. Here’s why.

A Federal Reserve Reset: Taking Back Control

Trump’s long-standing criticism of the Federal Reserve highlights his commitment to a more independent monetary policy. With potential shifts in Fed leadership and strategy, we could see an end to decades of unchecked manipulation. But the road to reform could bring short-term volatility in the markets, making gold and silver invaluable as stabilizing assets outside the system.

Geopolitics in the Trump Era: Bold Moves, Big Risks

From taking a tough stance on China to championing energy independence, Trump’s foreign policy is all about American strength. Yet, bold moves can unsettle global markets. Renewed tensions in Taiwan, a NATO reset, and the ongoing Russia-Ukraine conflict create an environment where precious metals thrive. In uncertain times around the world, gold and silver are proven shields.

Rebuilding America: Infrastructure and Prosperity

Trump has big plans to revitalize the American economy. But significant spending could also stoke inflation and balloon the national debt. Precious metals stand as a hedge against rising debt, preserving value while the dollar potentially falters.

Inflation: The Price of Progress

Trump’s policies to revive industry and manufacturing come with a potential inflationary cost. Gold and silver protect your purchasing power, ensuring your wealth when inflation rises - remaining resilient as the economy shifts.

Tax Reform: Strengthening American Enterprise

Proposed tax cuts and business-friendly reforms aim to inject life into the private sector. While these changes are likely to drive innovation and growth, they could also introduce market volatility. For investors looking to safeguard against fluctuations in paper markets, gold and silver provide a stable foundation.

A Smart Way to Protect and Prosper

Trump’s first 100 days are already a wake-up call to reevaluate your financial strategy. With uncertainty on the horizon, there’s no better time to diversify into precious metals.

For those starting out, JM Bullion, ZeroHedge’s preferred bullion dealer, offers two excellent entry points:

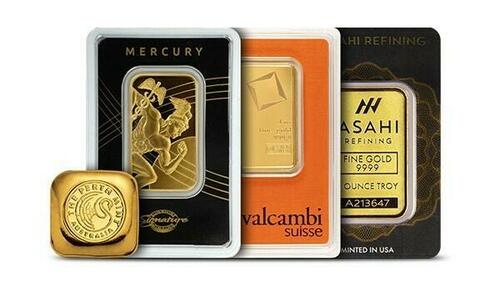

The Gold Starter Pack includes 1 ounce of gold at spot price, carefully sourced from trusted mints and sealed in protective plastic. It’s a simple, secure way to build wealth that stands outside the system.

Prefer silver? The Silver Starter Pack offers 10 ounces of .999 fine silver, delivered in a protective tube and velvet pouch. These packs are an affordable and practical way to diversify your savings.

Both starter packs provide an easy, accessible way to begin investing in tangible assets. Supplies are limited, so don’t wait—secure your financial future today.