Sponsored Content

Trump’s tariff checks face hurdles. Gold lease checks don’t.

Tariff rebate checks are back in the headlines, as President Trump continues to float the idea of sending $2,000 “tariff dividend” payments in 2026, but analysis shows the proposal faces severe financial, political, and legal challenges.

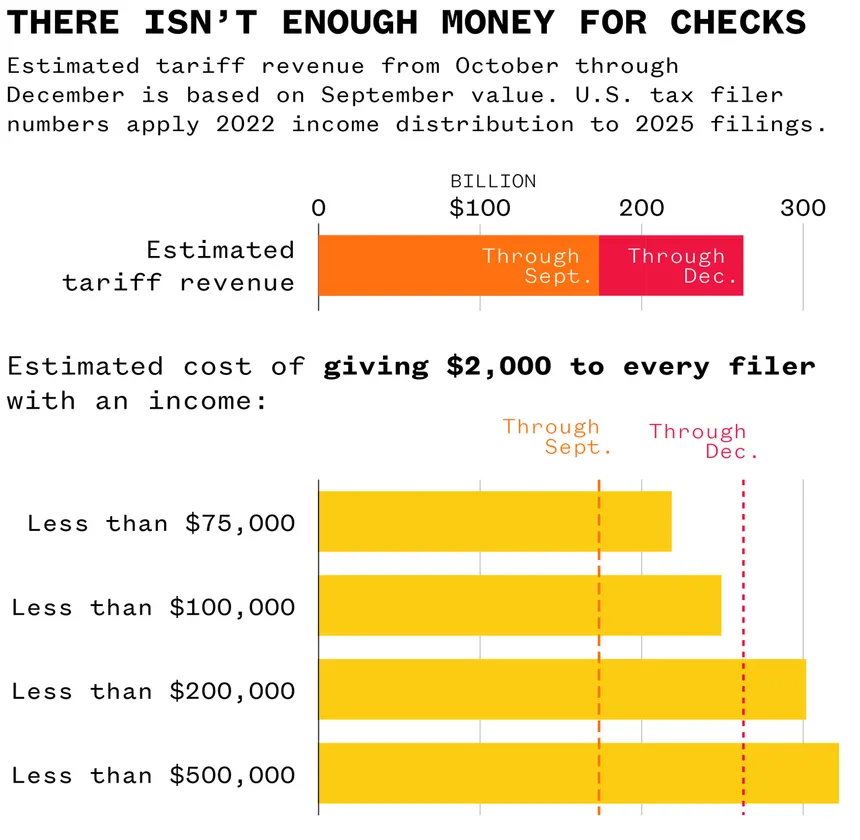

The numbers don’t add up

The Committee for a Responsible Federal Budget estimates that tariffs will raise about $263 billion this year. But distributing $2,000 checks to “low and middle income” Americans would require anywhere from $218-302 billion, depending on how the

The Committee for a Responsible Federal Budget estimates that tariffs will raise about $263 billion this year. But distributing $2,000 checks to “low and middle income” Americans would require anywhere from $218-302 billion, depending on how the income cutoff is defined.

Even a narrow definition of “middle income” would consume virtually all tariff revenue. And as data analyst Philip Bump notes, the White House has no unilateral authority to collect taxes and redistribute them without congressional approval.

Meanwhile, the Supreme Court is weighing whether Trump had the authority to impose many of these tariffs at all—putting up to 75% of revenue at legal risk.

The result: the checks are economically fraught, constitutionally constrained, and fiscally mismatched—like many high-profile promises that never materialize.

Gold owners saw this coming

Gold owners were positioned early for the potential inflation risk, political turbulence, and swelling federal spending. That preparation has paid off: gold has protected purchasing power while Washington debates how to redistribute revenue it hasn’t fully collected.

But protection alone isn’t the endgame for savvy gold investors. Gold doesn’t need Washington’s permission to generate income.

It can start paying its owners long before any rebate plan becomes real.

Wealthy investors aren’t waiting for Washington

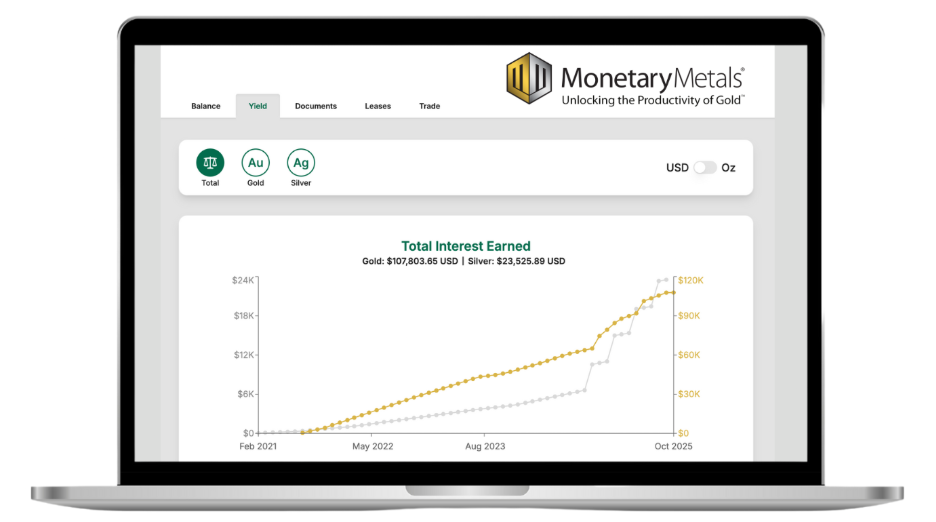

CNBC reports a growing trend: wealthy investors are leasing their idle gold to earn income, as gold prices remain near historic highs.

Many investors now prefer to own gold long term and put it to work earning recurring income in metal rather than dollars.

As Keith Weiner, CEO of gold yield platform Monetary Metals, told CNBC:

“People are no longer just buying gold and waiting for it to go up to $5,000. They want to hold it regardless of price — and then the mind immediately turns to: how do I put it to work?”

Turning gold into a productive asset

Monetary Metals enables investors to lease their gold to qualified businesses—refiners, jewelers, manufacturers—and earn monthly income paid in physical gold, with yields up to 4% annually.

- Earn a return on gold, paid in gold, without selling

- Keep full ownership

- Ounces increase over time

- Maintain exposure to the spot price

- Free storage and insurance

This is the gold version of “mailbox money”—real gold income driven by real business demand, that gets paid directly into your account every month.

The contrast is clear

Tariff rebate checks from Washington

- Politically dependent

- Cost exceeds revenue

- Inflation-sensitive

- One-time

- Dollar-denominated

Gold income from Monetary Metals

- Monthly gold income

- Up to 4% annually

- Inflation-resistant

- Backed by business activity

- Available now

Your gold doesn’t need Washington’s permission to generate income

While Washington debates stimulus checks, gold owners can earn monthly metal income today.

Put your gold to work with Monetary Metals and start earning a yield on gold, paid in gold.