Sponsored Content

Trump’s Tariff Pause Is Ending. And the Markets Aren’t Ready

Trump’s Tariff Pause Is Ending. And the Markets Aren’t Ready

The global trade war is about to heat up again, and investors should be paying attention.

President Trump’s temporary tariff pause, enacted earlier this year to cool tensions and avoid an immediate market panic, is officially set to expire. And many on Wall Street aren’t ready for the ripple effects.

A Fragile Calm Before the Next Storm

Markets have been pricing in optimism — or at least hoping that negotiations with key partners like the EU, Canada, and China would prevent a tariff escalation. But with no major trade breakthroughs in sight, the tariff clock is ticking.

Treasury Secretary Scott Bessent warned that even countries negotiating in “good faith” could still face sharply higher tariffs. If that sounds like a warning, it is — especially for investors still clinging to risk assets.

Why Tariffs Threaten the Dollar and Fuel Inflation

If this all feels familiar, it should. Tariffs are essentially taxes, and when applied broadly, they drive up the cost of imported goods, disrupt supply chains, and create pricing pressure across the board.

The result? Rising inflation. And that’s exactly why the Fed has kept interest rates elevated, despite signs of economic slowdown.

Jerome Powell recently cited tariffs as a primary inflation risk. Translation: rate cuts aren’t coming anytime soon, because the inflationary fire is about to get more fuel.

Meanwhile, the dollar is already under pressure, and reactivating tariffs could weaken it further. As import costs rise and confidence falls, foreign holders of U.S. debt may start looking elsewhere.

The Case for Gold in a World of Trade War Fallout

In this climate, owning physical gold becomes a necessity. Gold isn’t tied to the whims of policymakers or the short-term “pause” of tariffs. It holds value across borders, and unlike fiat currencies, it doesn’t weaken with political pressure.

With inflation fears rising and the dollar under siege, investors are quietly rotating into gold. Not just ETFs or paper claims, but real metal.

Get Physical. Get Real.

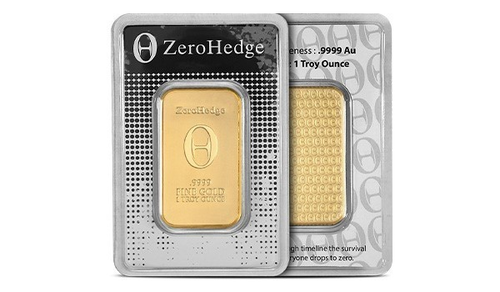

The 1 oz ZeroHedge Gold Bar is .9999 fine gold, sealed in an assay blister pack for authenticity.

✔ Crafted from .9999 pure gold

✔ Features the ZeroHedge logo—a symbol of financial independence

✔ Available only at JM Bullion, ZeroHedge’s trusted bullion dealer

As the trade war reignites, make sure you’re holding what lasts.