Sponsored Content

The VIX Is Flashing Risk. Gold ETFs Are Filling Up. But Real Metal Still Wins.

The CBOE Volatility Index (VIX) surged above 22 recently, a level not seen in months. The move reflects a sharp rise in fear and uncertainty across financial markets, as traders grow nervous about everything from sticky inflation to unstable global politics.

As expected, investors are rotating into defensive positions, and gold ETFs are seeing a spike in inflows.

But there’s a deeper conversation here: when volatility rises and the system starts to wobble, is a paper-based gold proxy really enough?

The Limits of a Gold ETF in a Risk-Off Environment

There’s no doubt that gold ETFs provide an easy way to get exposure to the metal. But they don’t store your wealth the same way. You can’t hold it. You can’t hide it. These funds are subject to custodial risk, market timing, and paper trail entanglements that simply don’t apply to physical bullion.

If the system truly cracks, you’re trusting that your shares translate into access — something that’s not guaranteed.

In contrast, physical gold stands entirely outside the system. It has no counterparty risk, no algorithmic decay, and no need for approval. When fear takes over and digital assets look shaky, the value of real, touchable metal becomes immediately clear.

Physical Gold Isn’t Just Safer — It’s Smarter

Gold isn’t just about sheltering wealth from volatility. It’s about asserting sovereignty over your assets. Physical metal offers a level of privacy, permanence, and independence that an ETF never will, especially in a world growing more surveillance-heavy and less financially stable by the day.

Protect Your Wealth with Gold

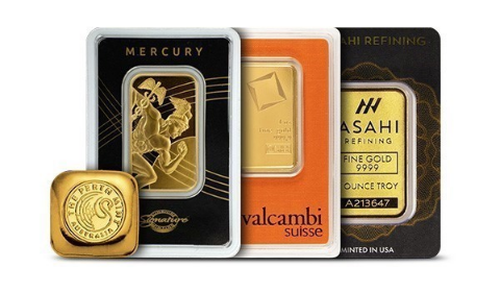

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

Volatility is back. The smart money is going physical.