Sponsored Content

What Does China Know? The World's Largest Buyer Is Hoarding Gold

While Western investors chase stocks and ETFs, China is doing something else entirely: buying gold. The People’s Bank of China just logged its 19th straight month of gold accumulation, and some analysts suspect the real number is far higher than what's publicly reported.

Beijing is playing the long game. And they’re doing it in physical metal, not futures contracts or digital proxies.

China’s Central Bank Isn’t Buying for Diversification — It’s Buying for Protection

According to multiple metals analysts, China has likely stockpiled more gold than it admits. Why would the world’s second-largest economy go quiet about its real reserves?

Because gold isn’t a financial asset anymore. It’s becoming a geopolitical one.

Beijing’s motives are clear:

- De-dollarization: As the U.S. weaponizes the dollar, China is hedging against its influence.

- Inflation fears: Gold protects against domestic price instability.

- Sanction insurance: In a world where reserves can be frozen, physical assets are untouchable.

Whether it's for political leverage or economic defense, China is signaling what it values most when the system gets shaky.

Meanwhile, Western Investors Keep Looking the Other Way

While China continues stacking, many American investors are still waiting for a “pullback.” They’re missing the fact that demand is rising, global central banks are buying at record levels, and supply chains are under pressure.

It’s not just China. Poland, Singapore, Turkey, and India have all boosted their gold holdings. The World Gold Council reports 2023 and 2024 saw the strongest central bank gold buying on record. 2025 is already tracking in the same direction.

And yet, the average investor owns nothing — or worse, trusts a paper ETF to do the job of real metal.

Don’t Wait for the Headlines to Catch Up

When sovereign nations start acting like preppers, it’s not paranoia. China’s gold buying is a blueprint.

And by the time mainstream financial media catches up, the smart money will already be locked out of low premiums and accessible supply.

Own What China’s Buying

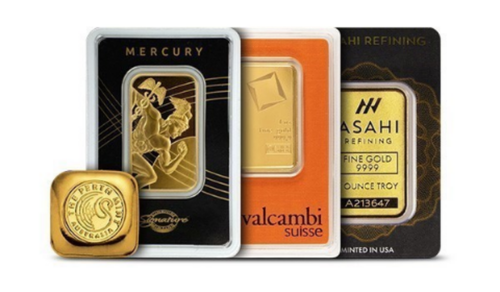

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

When the world is stacking gold, individual investors shouldn’t be far behind. Add yours now, before the next price spike makes this opportunity history.