Sponsored Content

Why is China Buying So Much Gold? What It Signals for Global Investors

While most eyes have been on tariffs and Treasury market turmoil, China has quietly executed one of the most aggressive gold accumulation strategies in the world.

And they’re not just doing it for insurance. There’s a bigger shift underway.

A Strategic Reserve Overhaul

The People’s Bank of China (PBoC) has now increased its gold reserves for 18 consecutive months—adding more than 300 metric tons since late 2022. Official holdings now top 2,200 tons, the highest ever. But some analysts believe the real figure could be far larger.

Behind this buying spree is a clear motivation: reduce exposure to U.S. dollar assets.

Private Investors Are Joining In

It’s not just the central bank. In April 2025, Chinese investors funneled over 70 metric tons into gold ETFs—more than doubling any previous monthly record.

Why? A slowing economy and ongoing trade uncertainty have driven domestic demand for hard assets. Gold is increasingly viewed as the best way to hedge against these shocks.

A Bid to Elevate the Yuan

By backing the yuan with growing gold reserves, China aims to enhance its currency’s global credibility. That’s a direct challenge to the U.S. dollar’s dominance in trade and reserves.

This isn’t a short-term move. It’s part of a long-term effort to reshape the global monetary order—and gold is the foundation.

What It Means for U.S. Investors

China isn’t speculating. Neither are the dozens of other central banks that have added 1,000+ metric tons of gold annually in recent years.

When nations begin treating gold as a strategic asset again, retail investors should take note. These moves aren’t about profit—they’re about survival, trust, and sovereignty. If central banks are using gold to diversify away from U.S. risk, individuals might want to ask: should I be doing the same?

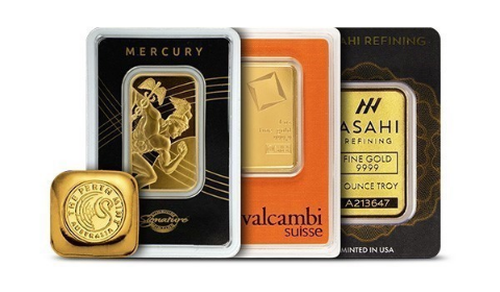

Start With the Real Thing

The Gold Starter Pack, available exclusively at JM Bullion, ZeroHedge’s preferred bullion dealer, gives investors a rare chance to buy 1 ounce of .9999 pure gold at spot price. Real gold, carefully sourced from trusted mints and sealed in protective plastic for long-term security. It’s a simple, secure way to build wealth that stands outside the system.

When the world is stacking gold, individual investors shouldn’t be far behind. Add yours now, before the next price spike makes this opportunity history.