Sponsored Content

Why a flat gold price does not mean flat gold returns

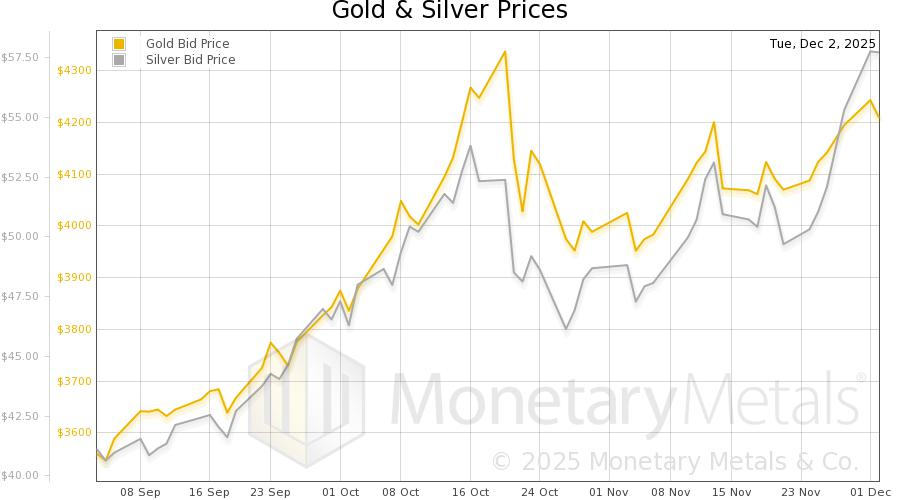

Gold has surged roughly 60% in 2025—outperforming equities, bonds, real estate, and even bitcoin.

But recently the rally has paused. Prices are consolidating below their all-time highs, stalling near the $4,200 level.

Some gold owners are simply waiting for a breakout past $4,500 or even $5,000.

But waiting carries its own risks.

There is no guarantee that gold hasn’t already made its near-term peak.

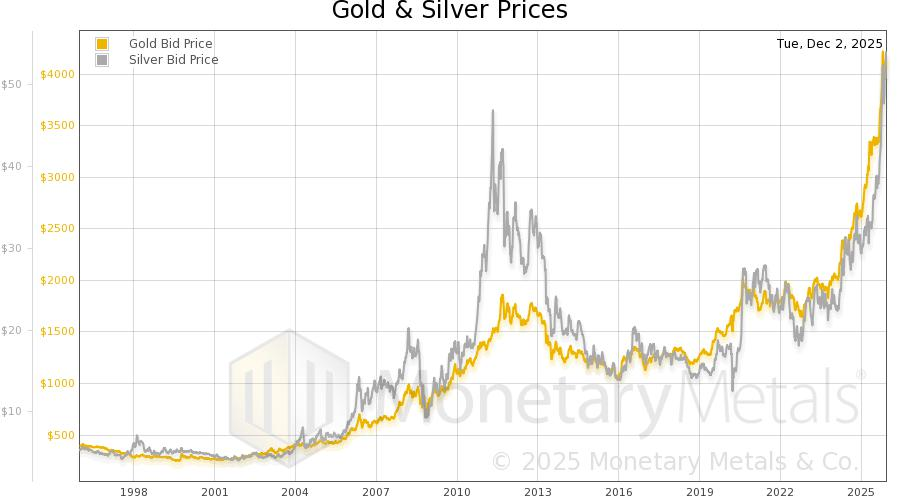

History shows gold can trade sideways for years, sometimes decades, before the next major move.

And that’s why what you do while you wait is as important as the move you’re waiting for.

Every day your gold sits idle is a day you could be earning additional ounces—building exposure ahead of whatever the market delivers next.

CNBC recently reported that many wealthy investors simply aren’t waiting.

They’re already earning income on their idle gold while prices consolidate.

This is the opportunity most gold owners miss: A flat gold price does not mean flat gold returns.

With gold leasing from Monetary Metals®, investors can:

• Earn rental income on their gold—paid in additional ounces of gold

• Retain full title and ownership of their metal

• Keep full exposure to the spot price

• Compound ounces over time, regardless of market direction

Unlike paper derivatives or leveraged trades, this approach doesn’t require selling your gold or betting on short-term price movements.

It relies on something far more controllable: increasing the weight of gold you own, independent of whether the next move in gold prices comes in the next five minutes, five months, or five years from now.

For investors who believe gold in the long-term value of gold, compounding by weight, and not waiting on price, can be a major strategic advantage.

As one long-time Monetary Metals client recently told CNBC after doubling the amount of gold he leases through the platform: “We live in a world where the global debt is unprecedented. Accumulating gold is the easiest, stress-free decision one can make.”

If you’re waiting for gold’s next move, there’s now a productive alternative to zero return: Earning a yield on gold, paid in gold—so you can earn while you wait.

Learn how to put your gold to work with Monetary Metals today by downloading the free Passive Income in Gold report.