AI "Circle Jerk" Rages On: Microsoft, Nvidia Invest $15 Billion In Anthropic

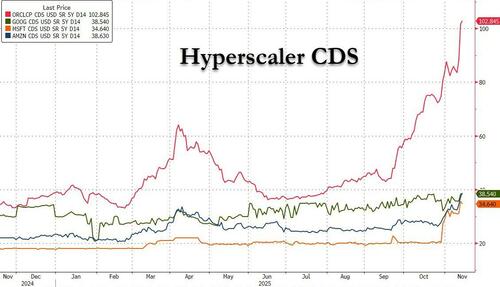

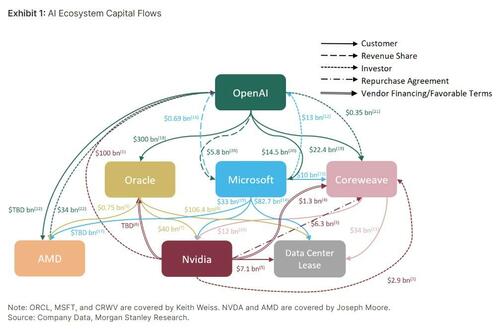

Two months ago, when nobody was talking about the coming AI debt tsunami needed to bankroll trillions in data-center capex, and nobody was paying attention to Oracle's CDS quietly blow out, and well ahead of the Bank of England's AI valuation warning, we published "The Stunning Math Behind The AI Vendor Financing "Circle Jerk," essentially laying out all the weakest links in the swelling global AI bubble.

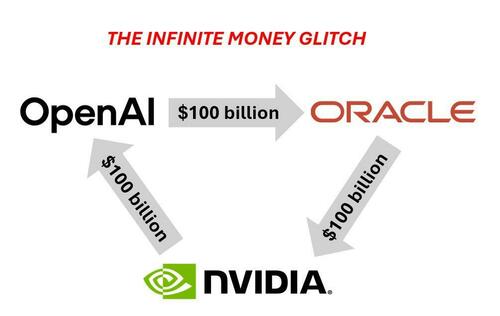

In the report, we laid out the ridiculous circle-jerk vendor financing schemes concocted by the handful of top players to pretend their revenue is growing at a rapid pace. We also called it an "infinite money glitch"...

Most notably, the players.

Fast-forward to Tuesday: the AI bubble keeps deflating, hyperscalers are under pressure, Bitcoin trading in the $92k range, and Microsoft and Amazon were just downgraded to neutral by Rothschild & Co. and Redburn's Alexander Haissl. Now comes fresh news from Microsoft and Nvidia, attempting to revive the AI hype with yet another round of circle-jerking.

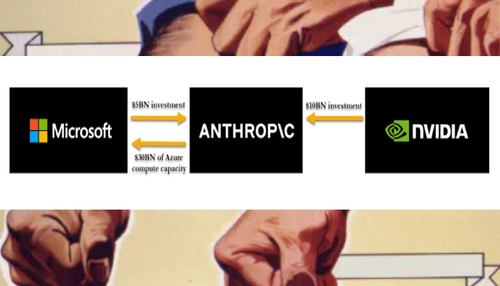

Bloomberg reports Microsoft and Nvidia will invest up to $15 billion in Anthropic. As part of the agreement, Anthropic will purchase $30 billion of compute from Microsoft's Azure, which only confirms more circle-jerking.

"We are increasingly going to be customers of each other — we will use Anthropic models, they will use our infrastructure, and we will go to market together," Microsoft CEO Satya Nadella stated in a video, adding, "Of course, this all builds on the partnership we have with OpenAI, which remains a critical partner for Microsoft."

Satya Nadella explains how the circle jerk works: "We are increasingly going to be customers of each other — we will use Anthropic models, they will use our infrastructure, and we will go to market together"

— zerohedge (@zerohedge) November 18, 2025

And the US taxpayer will bail out everyone.

The end. https://t.co/WIHEzmZOlz

To support the AI-infrastructure buildout, Anthropic plans to spend $50 billion building AI data centers across multiple states. The AI company is simultaneously partnered with Google, which agreed in October to supply up to 1 million AI chips.

Earlier, analyst Haissl warned that the bullish case around generative AI is no longer clear and hyperscalers should be approached with caution.

He noted the industry's "trust us - Gen-AI is just like early cloud 1.0" pitch is flawed and that the underlying economics are far weaker than assumed.

Building on Haissl's warning, we've been very early in covering Oracle's CDS blowout, even offering warnings about AI debt and valuations well before the Bank of England.

Bad news for the AI stocks.

With all free cash flow going into chatbot data center capex, there is nothing left for buybacks and dividends. pic.twitter.com/RcqzDhHLv6

— zerohedge (@zerohedge) October 3, 2025

As we've previously joked.

at this rate tomorrow morning we will get this headline

— zerohedge (@zerohedge) November 4, 2025

*OPENAI SIGNS DEAL WITH OPENAI TO BUY AND SELL $100 TRILLION WORTH OF STUFF TO AND FROM ITSELF

Morgan Stanley analysts need to add Anthropic to the circle jerking.

Harris Kupperman, CIO of Praetorian Capital, posted the following on X,

Love how shareholders look at this deal, realize that this guarantees big losses for years into the future, and sell them like they're shale shit-cos promising to raise production in a $50 oil environment. Welcome to 2016 tech bros. The multiple compression is only just starting...

Rihard Jarc, co-founder and CIO of New Era Funds, pointed out that multiple narratives are converging in the Microsoft-Nvidia-Anthropic partnership:

So many narratives are at play here in the Microsoft-Nvidia-Anthropic partnership:

Nvidia saw Anthropic do a deal with Google's TPUs and Amazon's Trainium, so it had to ensure Anthropic stays committed to Nvidia hardware.

Microsoft is signaling that its future isn't dependent on OpenAI alone.

Anthropic is showing investors it can line up splashy partnerships and meaningful letter-of-intent orders.

And all of them timed this announcement to land on the same day as Google's Gemini 3.0 release - because if Google wins the frontier-model race decisively, all three would feel the pressure.

So many narratives are at play here at the $MSFT & $NVDA & Anthropic partnership IMO:

— Rihard Jarc (@RihardJarc) November 18, 2025

1. $NVDA saw Anthropic do a deal with $GOOGL TPUs, & $AMZN Trainium so it had to make sure Anthropic will use $NVDA

2. $MSFT showing that its fate is not dependent on OpenAI.

3. Anthropic is… https://t.co/QhoYPqyK4F

How does all this end? Trump's AI advisor, David Sacks may have offered a clue: "There will be no federal bailout for AI. The U.S. has at least five major frontier-model companies. If one fails, others will take its place."