Memory Shortage Fears Spread, Raising Alarm At Qualcomm And Arm

Consumers are about to learn that one of the most frustrating side effects of the AI boom will be the "great memory crunch." Surging data center demand is siphoning high-bandwidth memory (HBM) supply away from consumer devices, setting the stage for slower growth across the electronics industry this year.

We have been vocal about this HBM crunch, even citing industry insiders who say shortages are only set intensify. "If you want to buy any consumer goods, PCs, or smartphones ... do it now," one industry insider told Nikkei Asia last week. Read the report here.

On Wednesday, Qualcomm and Arm Holdings also confirmed that the HBM shortage will cap smartphone production and slow near-term growth.

For context, Qualcomm is the largest maker of smartphone processors, and Arm derives much of its revenue from royalties on technology used in the industry.

"Industrywide, memory shortages and price increases are likely to define the overall scale of the handset industry," Qualcomm CEO Cristiano Amon told Wall Street analysts on an earnings call.

Amon warned that Chinese customers have already said they'll build fewer handsets this year because of this emerging crunch.

Last week, Goldman analyst William Chan warned clients:

Memory shortage is real and accelerating due to the AI infra demand, leaving a significant shortage for the conventional side of the industry, think smartphones, PCs and other consumer electronics which require high-bandwidth memory:

Micron Technology Inc. said an ongoing memory chip shortage has accelerated over the past quarter and will last beyond this year due to a surge in demand for high-end semiconductors required for AI infrastructure.

On Friday, Chinese media outlet Jiemian reported that major Chinese smartphone makers including Xiaomi Corp., Oppo and Shenzhen Transsion Holdings Co. are trimming their shipment targets for 2026 due to rising memory costs, with Oppo cutting its forecast by as much as 20%. All three did not respond to requests for comment.

Nintendo emerged as an early casualty of surging memory costs. The company's shares have sagged as rising component prices, especially HBM, are set to dent margins. Goldman analysts first warned about Nintendo's HBM woes in late December (read here).

Other companies have warned about the memory crunch. Chipmaker MediaTek told analysts in a call this week that the situation is "evolving."

Intel CEO Lip-Bu Tan warned the shortages could persist for years: "There's no relief as far as I know."

Also, Goldman's Allen Chang recently had to lower his global PC shipment forecasts for 2026-2028 due to the memory crunch.

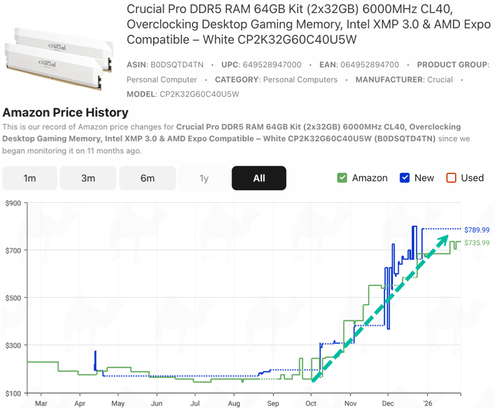

A look at the Amazon price-tracking site CamelCamelCamel shows a parabolic surge in the price of Crucial Pro DDR5 64GB RAM, which has jumped from $145 to $790 in just six months.

TrendForce expects 70% of high-end memory chips produced this year will be consumed by data centers.

Professional subscribers can learn more about the memory industry on our new Marketdesk.ai portal.