SK Hynix Soars On Microsoft Supply Deal Report; KOSPI Breaks Out, Shrugs Off Tariff Threat

SK Hynix shares hit an all-time high in overnight trading in South Korea after a local media outlet reported that the semiconductor company, which specializes in memory chips, has become the sole supplier of advanced memory for Microsoft's new artificial intelligence chip. Also overnight, despite President Trump's tariff threat against South Korea for "not living up" to a trade deal cemented last year, the Korea Composite Stock Price Index surged above 5,000 for the first time.

Business Korea reports that Hynix will exclusively supply high-bandwidth memory (HBM) for Microsoft's next-generation AI chip, the Maia 200.

Here's additional color from the local outlet:

According to industry sources on Jan. 27, SK Hynix is reported to supply its latest product, HBM3E (5th generation), to the Maia 200 AI accelerator that Microsoft unveiled on Jan. 26 (local time). Additionally, SK Hynix appears to be participating as the exclusive supplier for the product.

The Maia 200, manufactured based on Taiwan's TSMC's 3-nanometer (nm; 1nm = 1 billionth of a meter) process, is characterized by enhanced efficiency in AI inference tasks. It uses 216 gigabyte (GB) HBM3E, with six units of SK Hynix's 12-layer HBM3E installed.Microsoft has already installed the chip in its Iowa data center in the United States and is expanding its applications by adding it to its Arizona data center as well.

The report catapulted SK Hynix shares on the KOSPI nearly 9% higher on the session. The stock is now up 23% year to date and trading at record highs.

A larger timeframe shows the trend is absolutely parabolic.

Jung In Yun, chief executive officer at Fibonacci Asset Management Global, said the move higher in Hynix shares supports "dip buying and rising HBM earnings expectations." He added, "We will probably see SK Hynix earnings meeting expectations again."

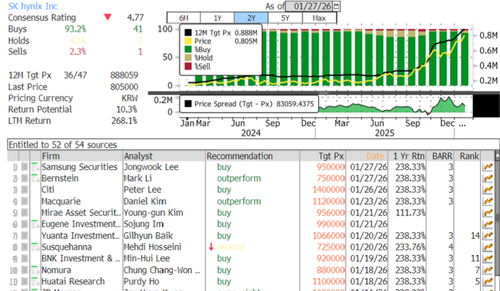

Another positive tailwind emerged after Citigroup analysts raised their price target on SK Hynix by 56% to a street-high 1,400,000 won, reaffirmed its buy rating, and placed the stock on a 30-day upside catalyst watch.

"The memory market is shifting toward semi-customization, with memory customers required to sign a contract a year prior to actual product delivery," analyst Peter Lee wrote. "In 2026, we foresee global DRAM/NAND pricing growth to be significantly better than expected."

According to Bloomberg data, Wall Street analysts rate SK Hynix with 41 buys, 2 holds, and just 1 sell.

More broadly, KOSPI made a "clear breakout above 5,000 and closed @ 5,085 today, marking YTD growth of +21%," Goldman analyst Heather Oh told clients earlier.

Heather provided clients with the drivers in the KOSPI today:

Concerns over potential tariff hikes, with Trump vowing to raise tariffs on Korean goods, including autos and pharma, from 15% to 25%, led to a weaker market open. However, the KOSPI quickly recovered to close at an ATH. Most sectors rallied, with the exception of tariff-impacted areas such as Autos (-0.8%) and Steel (-0.8%). Semiconductors were a notable outperformer, surging by 6.3% ahead of the earnings and ongoing optimism on HBM developments.

What were the main drivers today?

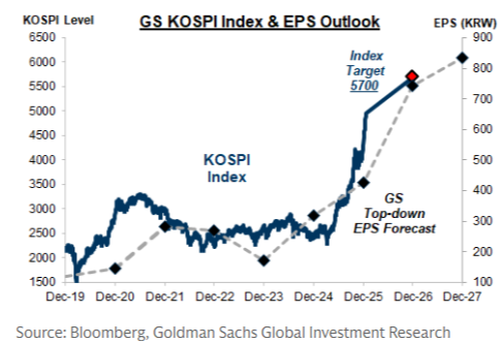

- Optimism is building ahead of the heavy earnings season, with January 29th being a key date for Samsung Electronics (005930, +5%) and SK Hynix (000660, +9%) earnings reports. GIR recently raised its KOSPI target to 5,700 (from 5,000), driven by earnings upgrades rather than P/E multiple expansion.

- Positive sentiment prevails as pension funds are anticipated to inject approximately W7tn more into Korean equities. The largest pension fund has increased its 2026 domestic equities allocation target to 14.9% (up from 14.4%) and will temporarily postpone rebalancing, thereby alleviating selling pressure when allocations diverge from the strategic asset allocation (SAA) range.

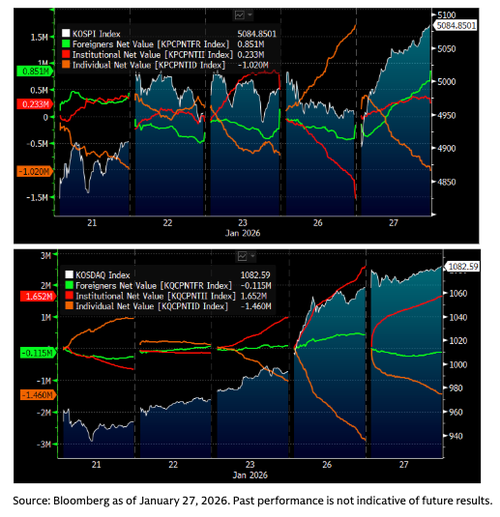

Today's Investor positioning

- Turnover breakdown: Foreign 31%, local institutions 19%, Retails 50%.

- Net Inflows: Institutional flow-led rally today signals a healthy setup for further upside. Foreign: +$588m. Mainly passive program buying led the rally (+$760m). Buying was concentrated in Tech (+$743m) and Financials (+$86m). Local institutions: +$164m. Buying was concentrated in Tech (+$278m). Retail: -$706m. Profit taking was heavily concentrated in Tech (-$1b), followed by Banks (-$93m).

Five Charts That Matter:

KOSPI Price Performance

Earnings

5-Day Investor Positining Trend (KOSPI (left) vs. KOSDAQ (right))

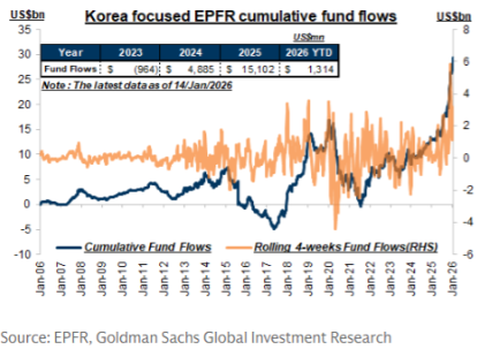

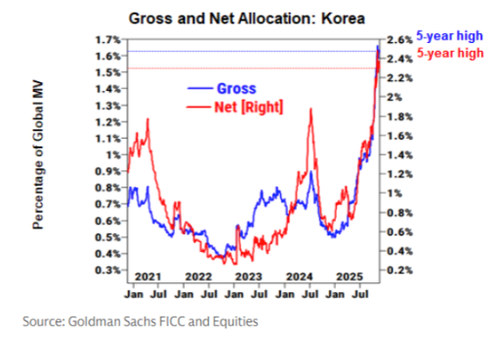

MF Positioning

H/F Positioning

Related research:

First Victims Of 'Great Memory Crunch' Emerge As Data Centers Soak Up Global Supply

"Entered New Era": SK Hynix To Build $13 Billion Memory Plant As Nvidia CEO Says AI Demand Soaring

"Market That Never Existed": Nvidia CEO Sparks Frenzy In Memory Stocks

Soaring Memory Costs Sink Nintendo Shares; Goldman Says Selloff Is Buy-The-Dip Opportunity

UBS Says Soaring Memory Chip Prices To "Turbo-Charge" Samsung Earnings

When your entire market is a couple of memory stocks:

— zerohedge (@zerohedge) January 25, 2026

"This number really blew my mind. GS earning est for Korea in 2026 is - wait for it - 75% (granted its mostly only 2 names). followed by 12% in 2027. And trading at ~11x forward." - GS S&T pic.twitter.com/UZsIrcngMD

The whole discussion on memory is shaping up to be a big theme in 2026 amid data center buildouts.