Don-Roe Doctrine: Fall Of Maduro Sends US Oil Stocks Soaring

Brent crude futures were little changed early Monday following President Trump's special operation involving Delta Force commandos that removed socialist leader Nicolás Maduro from power in Venezuela.

While crude futures showed a muted reaction, U.S. energy equities surged in premarket trading, reflecting growing optimism that Chevron and Exxon Mobil are among the best positioned to lead a revival of Venezuela's oil industry under a new geopolitical framework, which we have described as Western Hemisphere defense, or what some in recent days have dubbed the "Don-roe Doctrine."

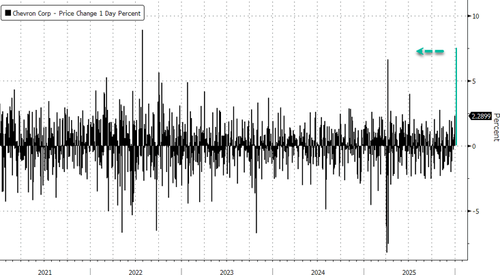

Chevron jumped as much as 10% in premarket trading in New York, with ConocoPhillips up 5% and Exxon Mobil up 3%. If the roughly 7% gains for Chevron hold in the cash session, this would mark the company's largest daily increase since late summer 2022.

Bloomberg Intelligence analyst Vincent G. Piazza described why Chevron is best positioned among the oil majors, already producing about 20% of Venezuela's oil under a US sanctions waiver and exporting crude to US refineries.

Chevron emerges as a clear beneficiary from any shift in Venezuela’s political and sanctions landscape, as it is the only US major still producing there, pumping roughly 200,000–250,000 barrels a day under a US license with infrastructure and export routes in place. A more accommodating regime could allow Chevron to ramp up production, export more freely to US Gulf Coast refineries, and recover billions owed by PDVSA. Exxon Mobil and ConocoPhillips have legal claims rather than near-term operational upside, with the former holding an outstanding arbitration award of more than $1 billion and the latter having secured awards exceeding $10 billion, including interest.

A US-aligned government could prioritize claims settlement. Broader oil equities would be at a disadvantage, as increased Venezuelan supply would pressure prices.

While uncertainty remains as the dust continues to settle, we lean on UBS analyst Henri Patricot, who provided much-needed color on Venezuela's crude industry:

US captures Venezuelan leader, references oil investments, higher exports The US government announced on Saturday the capture of Venezuelan leader Nicolas Maduro following a military operation in Caracas (link). US President Donald Trump said that the U.S. "will oversee Venezuela until a safe transition to a legitimate replacement" and oil was mentioned several times. He said in a press conference that US oil companies would "go in, spend billions of dollars, fix the badly broken infrastructure, oil infrastructure" and that it would be "selling oil, probably in much larger doses" (link).

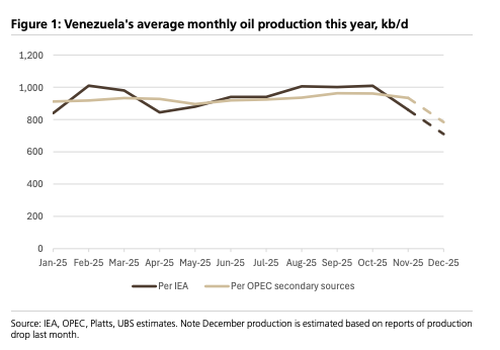

Could drive faster production rebound near-term if sanctions are lifted We see this weekend's developments as slightly negative for the oil price in the near-term. While the US President said that the US embargo on Venezuelan oil remains in full effect, the events likely reduce risk of a further sustained drop in Venezuelan production and there is potential for a sharper rebound in our view. This could be partially offset by a higher geopolitical risk premium. Venezuela has been producing ~0.9Mb/d in 2025, <1% of global supply. Latest reports suggest that production dropped ~150kb/d m/m in December because of US sanctions (link), from ~850kb/d in November (IEA). It had reached 1Mb/d as recently as October 2025 (see Figure 1) and the US strikes reportedly did not impact oil infrastructure (link). Hence, we believe production could return to 1Mb/d fairly quickly, if US restrictions are lifted, a small upside of 150kb/d vs. our 850kb/d base case for 2026. There may be potential to push it slightly further to 1.2-1.3Mb/d. This would be an additional headwind for the oil market in 2026, but would not completely change the picture (1.9Mb/d surplus is our base case).

Greater long-term potential but that requires material investments, stability There would be a greater impact if production returns to the level of 2.5Mb/d from 10 years ago but this would take time and require many things to go right. Unlike for Iran, Venezuela's oil infrastructure has indeed been impacted by years of underinvestment. As we discussed in our expert call on Venezuela back in 2022, raising production by ~0.5Mb/d could be done relatively quickly but getting back to 2.5Mb/d could take as much as 10 years. It would require major investments and for companies to do so, this would require political stability, which remains uncertain at this stage. Precedents of US-led or US-supported regime changes in oil-producing countries show how challenging this can be (see Figure 2). Iraq managed to grow production but we note this was during a different period for oil demand growth, $60 Brent doesn’t support significant growth investment and the US producer landscape and business model are significantly different. Meanwhile Libya has yet to return to pre-2011 production levels...

OPEC+ partners maintain policy at monthly meeting, as expected Separately, the eight OPEC+ countries carrying out the voluntary cuts confirmed on Sunday their plans to pause production increments in February and March 2026 due to seasonality (link). This was in line with OPEC+ delegates' comments (link) and expectations, and so neutral for oil in our view. The statement is similar to the previous one and made no reference to Venezuela. The eight countries will next meet on 1 February but we believe the next important meeting is more likely to be the one in early March, when the group should decide whether or not to raise production in April. Our base case is that they will return to production increases, so as to fully unwind the cuts by year-end, in time to agree on a new framework for the whole group. The alternative would be for the pause to go on, more likely if we see signs of Venezuelan production rebounding, Russia continuing to produce below target and/or prices moving lower.

In a separate note, Goldman analysts led by Daan Struyven noted that the Don-roe Doctrine is "ambiguous" in the short run but negative in the long run:

Following the US deposing of President Maduro, we assess the risks to our unchanged oil price forecast (Brent/WTI 2026 averages of $56/52) from Venezuela.

We see ambiguous but modest risks to oil prices in the short-run from Venezuela depending on how US sanctions policy evolves. We estimate 2026 Brent averages of $58/54 in scenarios where Venezuela crude production declines/rises by 0.4mb/d by end-2026 (vs. our $56 baseline which assumes flat production of 0.9mb/d).

Along with recent Russia and US production beats, potentially higher long-run Venezuela production further increases the downside risks to our oil price forecast for 2027 and beyond. Although Venezuela produced ~3mb/d at its peak in the mid-2000s and holds ~1/5 of global proven oil reserves, any recovery in production would likely be gradual and require substantial investment. We estimate $4/bbl of downside to 2030 oil prices in a scenario where Venezuela crude production rises to 2mb/d in 2030 (vs. our 0.9mb/d base case).

Don-roe Doctrine begins.