EU NatGas Spikes Most In Two Years As "Perfect Storm" Unfolds

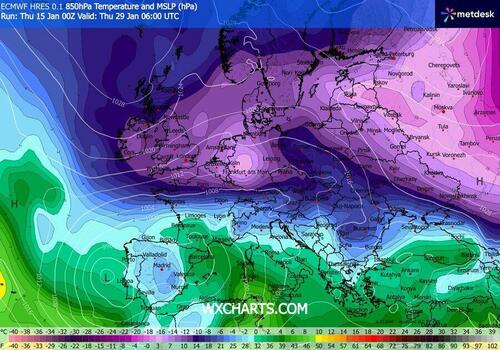

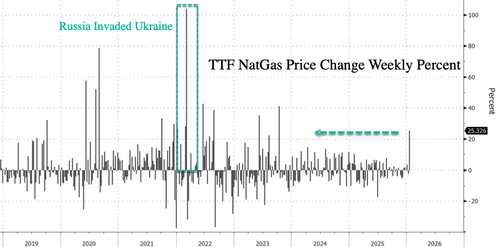

Dutch TTF natural gas futures, Europe's benchmark gas contract, are up 25% on the week and on track for their largest weekly gain since October 2023. The abrupt reversal in sentiment reflects tightening storage levels, short covering, and a burst of unusually cold weather sweeping across the continent.

"Sentiment has completely turned ... you could almost call it a perfect storm," Global Risk Management analyst Arne Lohmann Rasmussen wrote in a note.

TTF futures are set for the largest weekly gain (25%) since the week of October 13, 2023.

TTF futures have rocketed higher this week from lows, now trading at nearly 36 euros per megawatt-hour.

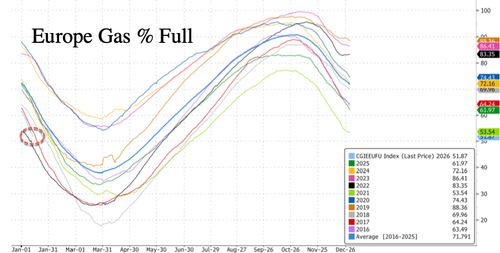

Lohmann Rasmussen noted that sizable NatGas withdrawals have also brought stockpiling risks into focus ahead of next summer. According to Bloomberg data, inventories across the continent currently stand at around 52%, well below the 10-year average of 71% for this time of year.

Bloomberg noted, "The rally highlights a deeper structural shift. Europe has lost much of the flexibility it once relied on to absorb supply shocks, leaving storage as one of its few remaining buffers as it procures liquefied natural gas from across the globe."

The good news is that Europe has secured ample LNG supply this winter and Norwegian pipeline flows remain steady, but the lack of a meaningful buffer when temperatures plunge and heating demand surges highlights just how fragile Europe's energy system has become.