Why Coal Is Here To Stay, In One Chart

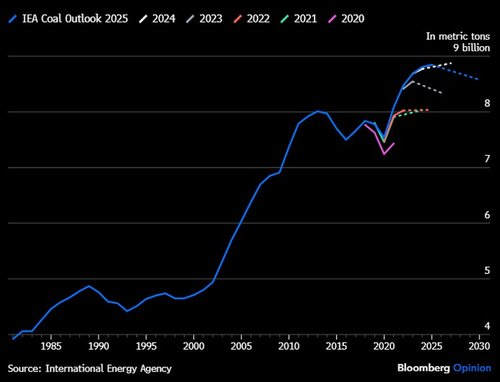

Bloomberg Opinion columnist and chief energy correspondent Javier Blas posted a chart on X from the International Energy Agency's new global coal report showing that coal demand jumped to an all-time high this year, despite years of efforts by the green-industrial complex to end its very existence.

"Global coal demand rose to an all-time high in 2025, up 0.5% y-on-y to 8,845 million tons (also, @IEA revised up 2024)," Blas wrote on X, adding, "Now, IEA says 2025 will mark a peak, with consumption dropping over the next 5 years. Time will tell, but previous peak forecasts were off."

Years of climate alarmists' demonization of coal have seemingly failed. In fact, coal remains structurally embedded in power systems and heavy industry, especially in Asia, even as renewables expand.

IEA's global coal demand forecast:

2025 global coal demand: 8.85 billion tonnes, a new record.

2030 outlook: roughly 3% below 2025 levels, still above pre-2023 norms.

Coal’s role shifts from baseload power to flexibility, backup, and reliability as wind and solar penetration rises.

Industrial coal use declines slowly; substitution is difficult outside power generation.

By country and/or region:

China:

Consumes more coal than the rest of the world combined and fully determines global trends.

Demand is broadly flat through 2025, then declines only marginally by 2030. Rapid renewable buildout reduces coal’s share of generation, but coal remains essential for grid stability.

Coal-to-chemicals and gasification offset declines in cement and steel, creating upside risk to demand forecasts.

India and Southeast Asia

India is the main source of net demand growth through 2030, driven by electricity demand, cement, steel, and coal-based industrial processes.

Southeast Asia shows the fastest growth rate, led by new coal power and metals processing.

Together, these regions offset most declines in advanced economies.

Europe

Structural decline continues, but short-term coal burn remains volatile due to gas prices, wind variability, and security-of-supply concerns.

Coal exits are politically uneven, with delays and carve-outs across several countries.

United States

Near-term coal demand rebounds in 2025 due to higher gas prices, weather effects, and explicit federal policy support.

Long-term trend remains downward, but decline slows materially versus prior expectations.

Coal plants increasingly retained for reliability amid rising power demand and data-center load.

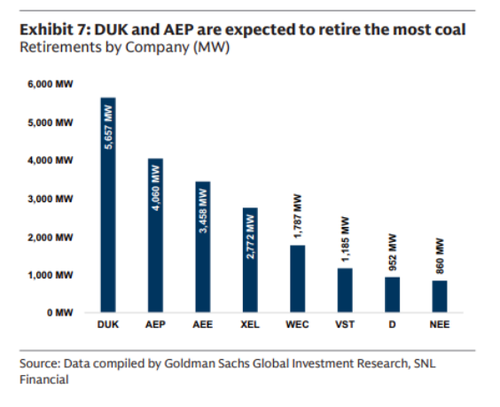

Focusing on the U.S. and separate from the IEA report, Goldman analysts, led by Carly Davenport, wrote in a note to clients earlier this month that U.S. coal retirements would slow.

In this note, we update our US and ERCOT power supply/demand models. We lower our US coal retirement forecast, now expecting ~40 GW of coal capacity retirement through 2030 (vs. 66 GW prior), as we expect assets to remain online to meet growing power demand until new build baseload solutions are more readily available.

What may infuriate climate alarmists is that coal is not disappearing this decade and will continue to serve as a bridge in a world of surging power demand from AI data centers and other electrification trends until sufficient nuclear power generation comes online, which is a 2030s story.

The bigger story should be the climate alarmists who, under the guise of a "climate crisis" hoax, were hellbent on stripping the grid of stable power, while conveniently ignoring China's massive additions of coal-fired power generation. That seems highly suspicious.