TradFi Trust & DeFi Dominance Favor Ethereum Over Bitcoin; StanChart

Standard Chartered's Geoff Kendrick raised his ETH forecasts in August 2025 to reflect Ethereum’s structural advantages, along with supportive regulatory developments and increased buying by ETFs and DATs.

The outlook has turned more nuanced since then.

In absolute terms, Bitcoin’s weaker-than-expected performance has prompted Kendricks to downgrade his BTC forecasts and push out our eventual USD 500,000 forecast to 2030 (also downgrading his ETH-USD forecasts for the next few years).

However, in relative terms, the SnanChart crypto guru thinks prospects for Ethereum have turned more positive.

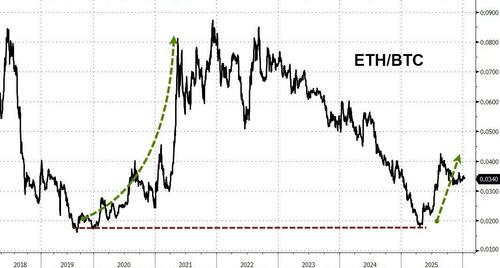

He has therefore turned more constructive on ETH-BTC, seeing the cross eventually returning to the 2021 highs around 0.08...

Source: Bloomberg

Kendricks sees three main factors for ETH's outperformance:

1. Flows

We think flows – via ETFs and DATs – are less important for ETH than for BTC, as ETH has a strong use case and fundamentals, whereas BTC functions purely as a decentralised store of value. However, flows still matter – and while they have weakened overall, they are more constructive for ETH than for BTC at present.

ETF inflows have stalled for both BTC and ETH in the past few months (Figure 2).

However, we think this is a temporary phenomenon rather than a change of direction (as we detailed in Bitcoin – Lowering our forecasts). Decision-making by investment committees takes time, so we expect the buildout of both the BTC and ETH ETF markets to take several years. Gold ETFs, the most relevant historical example, took about seven years after their November 2004 US introduction to reach a structural equilibrium that allowed flows to become more cyclical.

DAT buying of digital assets has mostly ended, in our view, following the late 2025 collapse in mNAVs (a valuation metric that divides corporate market cap by the value of digital assets held). DAT buying was enabled by mNAVs significantly above 1.0, which effectively allowed DATs to turn USD 1.00 into USD 1.50. However, a number of DATs now have mNAVs below 1.0, including MSTR (the largest BTC DAT) and SBET (the second-largest ETH DAT). These mNAVs failed to rise much even after MSCI announced on 6 January that it would not exclude DATs from its indices for now (mNAVs fell in October 2025 when MSCI announced its review on this topic).

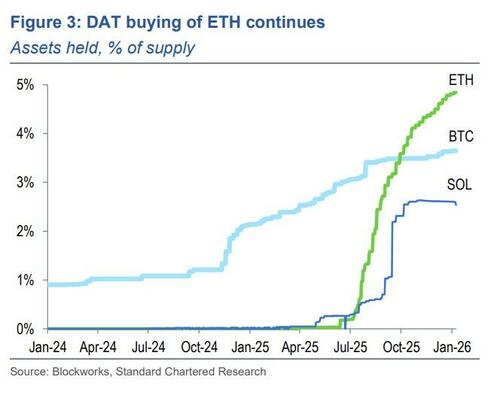

However, BMNR – the largest ETH DAT – has seen its mNAV hold at around 1.1 or 1.2. As a result, it continues to buy ETH at a reasonably fast pace, as per Figure 3.

Indeed, BMNR now holds 3.4% of all ETH in circulation and remains on track to reach its publicly stated goal of 5%, the current pace of buying would suggest that this will be achieved by late Q1 or early Q2. Against this backdrop, DAT buying of ETH appears more sustainable than DAT buying of BTC.

2. Stablecoin, RWA and DeFi dominance

We are very bullish on prospects for stablecoins, tokenised real-world-assets (RWAs) and decentralised finance (DeFi) over the next few years. Specifically, we forecast that both stablecoins and RWAs will reach market caps of USD 2tn by end-2028, up from current levels of USD 308bn for stablecoins (source: Artemis) and USD 40bn for RWAs (source: The Block).

The majority of this will be done on Ethereum. Currently, 55% of all stablecoins and 52% of all RWAs are on Ethereum, according to data from Artemis and The Block (note that the RWA share excludes Figure’s private credit project on the Provenance blockchain – this is a one-off and is not indicative of future projects, in our view). We expect Ethereum’s shares to continue to grow as more TradFi activities move into the blockchain space, given that Ethereum is trusted in the TradFi world. Ethereum has been operating for over 10 years and its network has never gone down. While other blockchains may be faster or cheaper, reliability will always trump marginal speed and cost savings for TradFi operators, in our view.

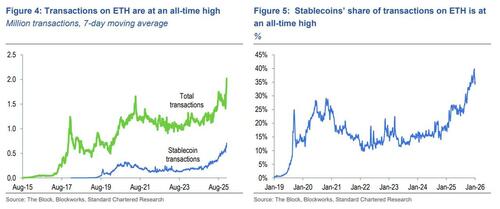

We also see stablecoins as an important driver of Ethereum outperformance. The rapid increase in stablecoin transactions has helped push the total number of transactions on Ethereum to a fresh all-time high in recent weeks (Figures 4 and 5).

Without stablecoins, which now account for 35-40% of all transactions on Ethereum, this high would not have been reached.

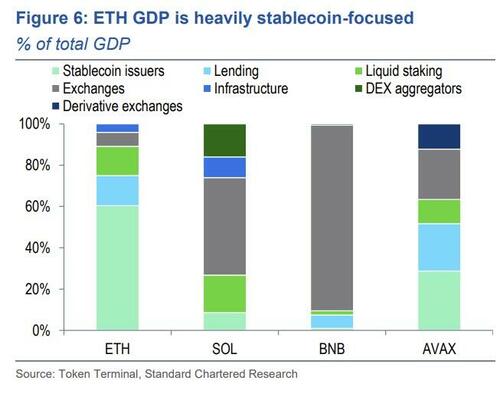

A breakdown of blockchain ‘GDP’ also underscore the important role stablecoins are playing for Ethereum. On this measure (which adds up the fees earned by protocols from various sources), around 60% of 2025 activity on Ethereum was associated with stablecoin issuers – a far larger share than for competitors (Figure 6).

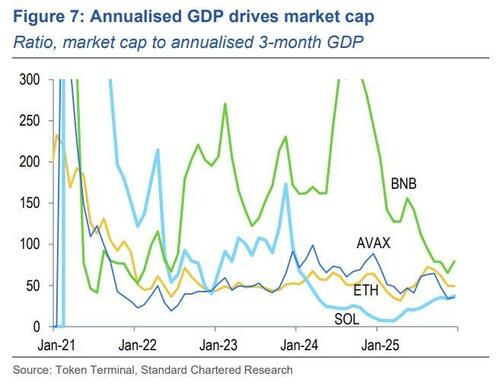

In addition to gauging blockchains’ sectoral exposure, the GDP measure can be compared to a blockchain’s market cap to create a P/E-type measure, allowing comparison both across different blockchains and over time (as shown in Figure 7).

This measure for ETH has been very stable at around 50 in recent years, suggesting that more activity – as measured by GDP – should result in a higher market cap.

3. Enabling greater activity

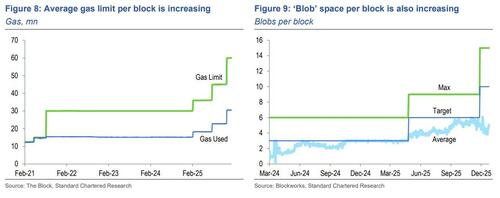

In June 2025, Ethereum co-founder Vitalik Buterin announced plans to increase ETH’s layer 1 throughput by 10x over two to three years. Since then, the Fusaka upgrade in December 2025 has enabled a further increase in both the gas limit (the amount of data that can be recorded per block) and the amount of ‘blobs’ per block (the amount of information that can be squeezed into each block, increasing total information per data recorded). Proactive steps are being taken to enable the planned 10x throughput increase (Figures 8 and 9).

Achieving this is critical to ETH price action. This, combined with a stable ‘P/E’ measure, accounts for most of the long-term price growth we forecast for ETH.

Other drivers of ETH price action

Another key premise of our constructive ETH-USD forecasts is our view that Bitcoin will reach a fresh all-time high (above USD 126,000) in H1.

This would defy expectations among some in the market that BTC is poised for further price declines at this stage of its ‘halving’ cycle; we believe the halving cycle is no longer relevant.

USD 126,000 is a long way from current BTC prices around USD 90,000; reaching that level would require US equities to remain strong, FOMC rate-cut pricing to increase, and the regulatory environment to improve.

Passage of the CLARITY Act is key in this regard; the legislation is currently moving through Congress and we expect it to pass in Q1.

Kendricks' bottom line: While they lower their ETH-USD forecasts for 2026-28, in line with the recent reductions in their BTC-USD forecasts; they expect ETH to outperform BTC, and remain positive longer-term