Trump Signs EO Easing Access For Crypto, Private Assets In 401k Retirement Plans

Update (1545ET): Confirming the earlier rumors, President Trump signed an executive order easing access to private equity, real estate, cryptocurrency and other alternative assets in 401(k)s.

The order directs the Labor Department to reevaluate guidance around alternative asset investments in retirement plans and clarify the government's position on fiduciary responsibilities.

Trump also required Labor Secretary Lori Chavez-DeRemer to work with counterparts at the Treasury Department, Securities and Exchange Commission and other federal regulators to determine whether rule changes should be made to assist in the effort. The SEC is asked to facilitate access to alternative assets for participant-directed retirement plans.

This is obviously a major victory for industries looking to tap some of the roughly $12.5 trillion held in those retirement accounts.

BTC and ETH are rallying further on the news...

* * *

US President Donald Trump will sign an executive order that could open the door for cryptocurrencies to be included in 401(k) retirement plans, potentially reshaping how Americans invest their savings.

The White House Press Office confirmed to Cointelegraph on Thursday that the order directs the US Labor Department to reevaluate restrictions around alternative assets in defined-contribution plans, including digital assets, private equity and real estate.

A senior White House official said the order instructs the Secretary of Labor to clarify the department’s stance on alternative assets and provide guidance on fiduciary processes for offering these types of investments in retirement portfolios.

Trump will allow crypto exposure for $12.5 trillion 401(k) market

Once implemented, Cointelegraph's Ezra Reguerra reports that the order could grant Americans access to digital assets through their 401(k) plans — part of a $12.5 trillion retirement market and a sought-after opportunity for crypto firms aiming to reach more retail investors.

The move would be a significant step forward for the crypto industry, which has long sought broader retail exposure and financial system legitimacy.

Despite institutional investors increasing crypto allocations, everyday savers have been restricted due to fiduciary risk, regulatory uncertainty and volatility concerns.

The White House official said that Trump’s directive would call for inter-agency coordination with the US Treasury and the Securities and Exchange Commission (SEC) to explore rule changes that may support the adoption of alternative investments like crypto in retirement products.

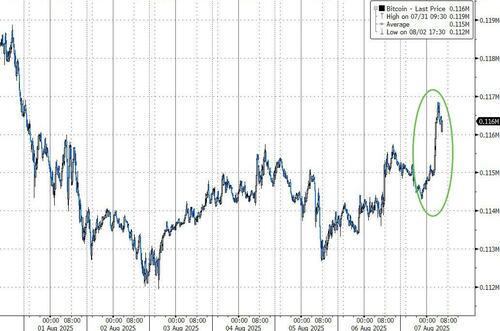

Bitcoin is rallying this morning on the report...

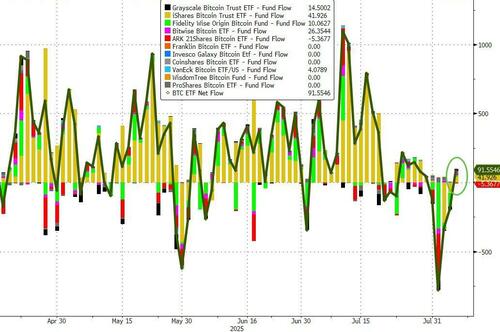

And yesterday saw a reversal of the recent outflows from ETFs...

Trump has final say on the executive order

On July 18, the Financial Times cited anonymous sources saying that the president is eyeing alternative investments like crypto assets for American 401(k) retirement plans.

In a previous statement to Cointelegraph, White House spokesman Kush Desai said that nothing should be deemed official unless it comes from Trump himself.

Desai said Trump is committed to restoring prosperity to everyday Americans and safeguarding their economic future. “No decisions should be deemed official, however, unless they come from President Trump himself,” Desai said.

During a Bloomberg interview, US SEC Chair Paul Atkins said education on the risks associated with crypto as an investment is crucial.

Atkins said disclosure is key and that people should be made aware of what they are getting into. He added that he’s looking forward to what the president will do.

Earlier this year, the Labor Department rescinded an earlier guidance for crypto in 401(k) plans. On May 28, the Labor Department revoked a 2022 guidance that urged fiduciaries to be “extremely cautious” when eyeing crypto for 401(k) retirement plans.