economics

Technological revolutions often coincide with speculative manias...

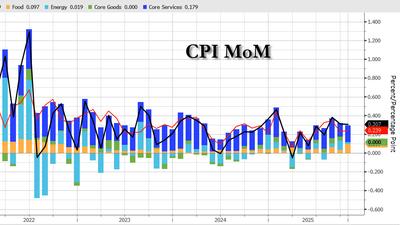

Double-digit increases in employee health insurance costs hold down wage increases...

The gold market is quietly escaping central bank control

Sponsored Content By Monetary Metals

Sponsored Content By Monetary Metals

Jersey Democrats were exposed for hiding data that showed a budgetary crisis going back to 2023. Now they admit the crisis exists and they say it's Trump's fault...

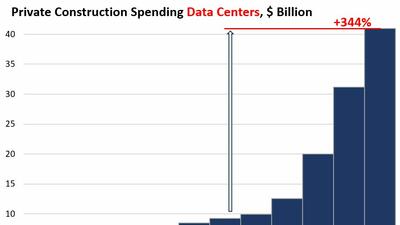

Despite the hoopla about data centers, spending on factory construction was five times larger.

Look beneath the hood...

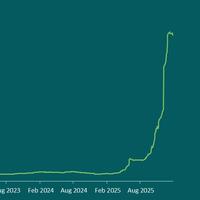

Memory chips have quietly become the most important commodities in the global economy...

..higher than the highest analyst's expectation.

Meanwhile rare earth shortages worsen in US aerospace, chips despite trade truce...

A 13-page report from FTI Consulting is providing some insight on how the U.S. government has rewritten the rules for critical minerals

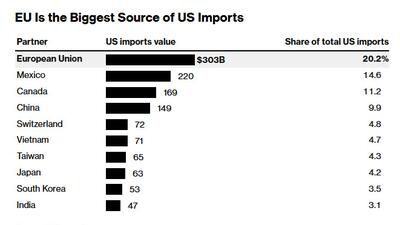

EU said “we have no other option” but to delay the approval process to seek clarity on the situation.

Increased money supply sparks an exchange of nothing for something. This diverts resources from wealth-generators to non-wealth generators. Consequently, this weakens the wealth-formation process and, in turn, weakens economic growth...

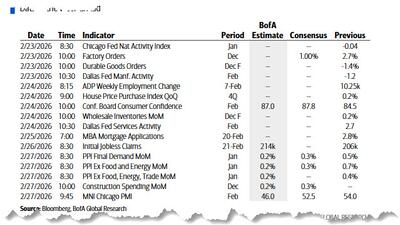

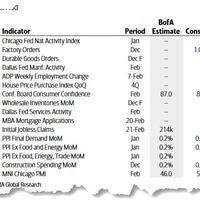

Another very busy week ahead...

From February 17 to 19, France’s President Emmanuel Macron visited India - the newly discovered object of European diplomatic desire...

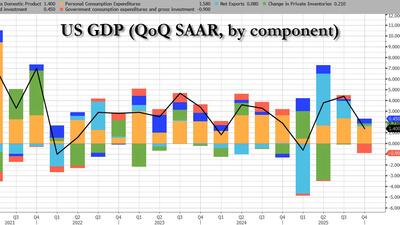

The BEA reported that the US economy grew at just 1.4% in the fourth quarter, the slowest growth since the tariff shock of Q1 2025; this was the direct result of the government slowdown subtracting 0.9% from GDP in Q4.

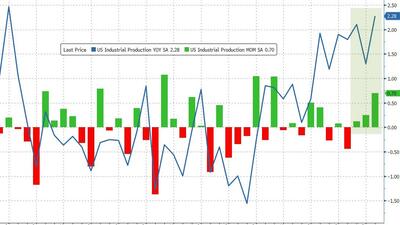

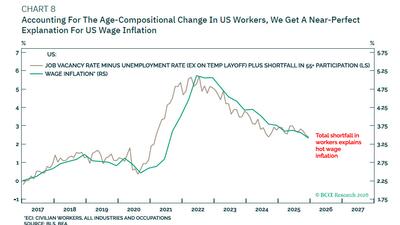

Labor demand still looks "shaky"...

...as ISM Manufacturing survey mysteriously exploded higher.

Inflation, bloating GDP with public spending and immigration and hidden unemployment are the ingredients of the so-called “economic miracle” of the Sánchez administration...

The latest social financing figures from China show an economy that is increasingly relying on government debt while private demand for credit remains weak...

faced with the double jeopardy of declining labor demand or declining labor supply, the Fed will turn a blind eye to this structural uplift in wage inflation. It will do this by de facto moving its inflation target to 2.5-3.5 percent

"The market is expressing a view that the macro data is going to turn softer and is adding duration ahead of the next batch of risk events"