Q4 GDP Unexpectedly Grows At 1.4%, Half Expected Pace, As Government Shutdown Slams Growth

There was a big surprise at 8:30am ET when the BEA reported the (delayed) GDP print for the last quarter of 2025: With consensus expecting a 2.8% print (and the Atlanta Fed GDPNow model even higher) which would already be a big drop from the 4.4% in Q3, the BEA instead reported that the US economy grew at just 1.4% in the fourth quarter, the slowest growth since the tariff shock of Q1 2025.

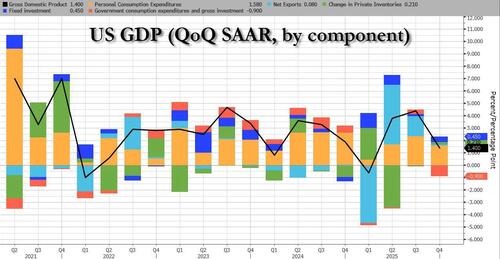

According to the BEA, the contributors to the increase in real GDP in the fourth quarter were increases in consumer spending and investment. These movements were partly offset by decreases in government spending and exports. Imports, which are a subtraction in the calculation of GDP, decreased.

Overall, the economy expanded 2.2% last year, data from the Bureau of Economic Analysis showed.

Specifically, the Q4 breakdown was as follows:

- Personal consumption slowed notably, from 2.34% of the bottom line GDP to just 1.58% or more than 100% of the final 1.42% GDP print

- Fixed Investment contributed to 0.45% of bottom line GDP, up from 0.15% in Q3

- Change in private inventories added 0.21%, up from a decline of -0.12% in Q3

- Net exports (exports less imports) continued to normalize and in Q4 added just 0.08% to the GDP number, down dramatically from 1.62% in Q3

- Last and definitely worse, government was actually a major drawdown, reducing the Q4 GDP by 0.9%, a sharp reversal from the 0.38% addition in Q3.

And visually:

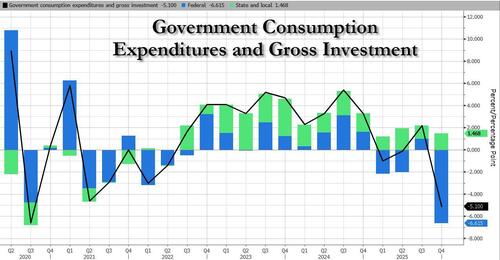

Of the above, the most notable variable was government spending, which due to the government shutdown in Q4 tumbled by 5.1% - the biggest drop since covid - and subtracted 0.9% from the final GDP number.

Knowing in advance how bad the number would be due to the shutdown, less than an hour before the data were released, Trump posted on social media that the shutdown would cost the US “at least two points in GDP.”

That may be an exageration, but it is modest: if one takes the average growth in recent quarters due to government which is about 0.5-0.6% and subtracts the 0.9% hit in Q4, the actual swing is about 1.5%.

Of course, this is just a delayed reversal, and expect to see Q1 GDP offset by this much if not more, meaning Q1 GDP will likely print around 4%.

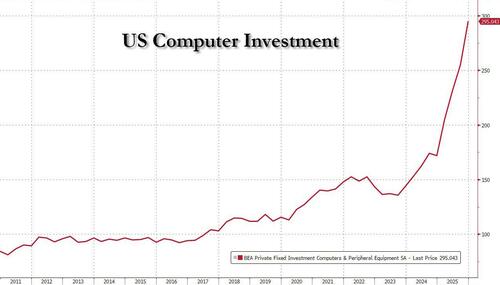

Government slowdown aside, perhaps an even more notable print is the continued explosion in spending on computers/peripheral equipment courtesy of AI, which has surged 70% in the past year and has more than doubled to $300BN at the end of 2025, more than double since the launch of chatGPT in 2022.

Despite the year-end slowdown, the data capped a solid year for the US economy, which shrank in the first quarter amid a monumental pre-tariff surge in imports, only to round out 2025 with one of the strongest growth rates in years. The turnaround came after Trump backed off of his most punitive levies and the Federal Reserve lowered interest rates, helping drive the stock market to record highs and enabling wealthier Americans to keep spending.

Separate monthly data out Friday showed the Fed’s preferred measure of underlying inflation — the core PCE index — rose 0.4% in December, the most in nearly a year. On an annual basis, the core PCE, which excludes food and energy, climbed 3%, compared to 2.8% at the start of 2025. All of these prints were hot...

... suggesting that all else equal, the US is once again flirting with stagflation, although as has so often been the case, the Q4 GDP print is an outlier, as is the December PCE, the first impacted by the government shutdown the second heated up by higher commodity prices which will reverse as soon as the geopolitical circus involving Iran quiets down.