"Things Are About To Snap": China's Trade Surplus Tops $1 Trillion For The First Time, Sparking Global Howls Of Outrage

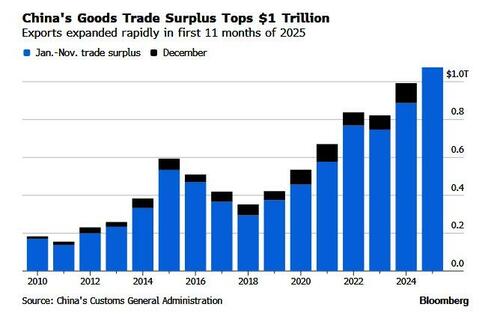

With Europe finally realizing - very belatedly, as usual - that Trump was right all along in his crusade to hammer Beijing's relentless dumping of exports to flood foreign markets with its below-cost wares as China no longer has nearly the required demand for goods and services and so has to crush and dominate foreign markets by selling at far below market prices, overnight we learned that China’s trade surplus in goods surpassed $1 trillion for the first time, highlighting the ongoing boom in the country’s exports despite US President Donald Trump’s tariff war.

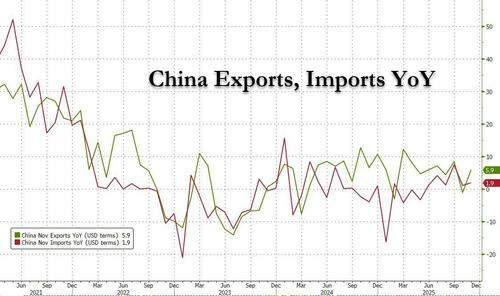

Exports rose 5.9% in November on a year earlier, reversing October's rare decline, while imports rose by 1.9% according to data released by China’s customs administration, which covers goods but not services.

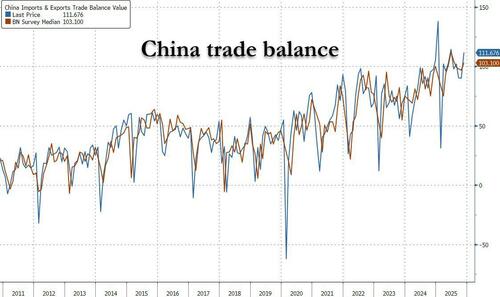

The November surplus came in at $112 billion, the third-largest ever accumulated by China in a single month and far more than forecast by economists.

For the first 11 months of the year, China’s exports increased 5.4% from the year-earlier period to $3.4 trillion, while the country’s imports declined 0.6% over that same stretch to $2.3 trillion. That brought the country’s trade surplus this year to $1.08 trillion, China’s General Administration of Customs said Monday. The equivalent figure for the full year last year was just shy of $1 trillion. The record surplus comes in the wake of a de-escalation in trade tensions between Washington and Beijing, which agreed a year-long truce in October.

That remarkable surplus, never before seen in recorded economic history, is the culmination of decades of industrial policies and human industriousness that helped China emerge from a poor agrarian economy in the late 1970s to become the world’s second-largest economy.

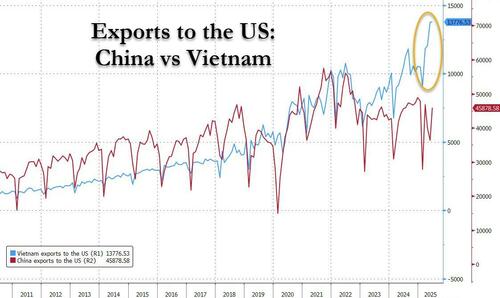

What is remarkable is that China navigated the trade war and growing economic protectionism around the world, and needed just 11 months to catapult it past the full-year record set in 2024. While shipments to the US plummeted 29% in November...

.... the eighth month of double-digit declines and the biggest since August, strong growth in sales to regions like the European Union and Africa more than offset the slump.

Lynn Song, chief Greater China economist at ING Bank NV, said the rebounds in shipments to the EU and Japan were “perhaps a little surprising.”

“The November export data came in a little stronger than expected, despite a further deceleration of exports to the US,” Song said.

Shipments overseas - in many cases to regions such as Vietnam which then transship to the US - have boomed for much of this year, in spite of Trump’s launch of a trade war early in 2025. The world’s second-biggest economy has emerged largely unscathed from the standoff, as it delivered more goods to markets other than the US, which have then proceeded to ship Chinese imports onward to the US.

The display of export dominance is stirring waves of resentment abroad, especially among countries which are forced to shutter domestic industries as they fail to compete with much cheaper Chinese imports.

China’s industrial heft has long been well-known to its trading partners, becoming a central point of contention in its relations with the world. Last year, its trade surplus rose to a record $993 billion. Topping the $1 trillion milestone throws the magnitude of China’s export dominance into even starker relief and is likely to draw more attention to the growing imbalances.

“It is so big that it’s obvious that it’s not just the United States or Europe but the whole world that will have to fund that gap,” Jens Eskelund, president of the European Union Chamber of Commerce in China, told the WSJ.

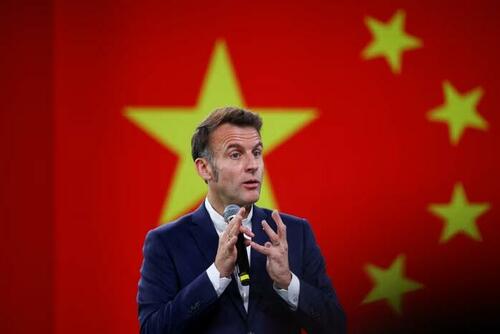

On Sunday, French President Emmanuel Macron, who just returned home after an otherwise cordial three-day summit with Chinese leader Xi Jinping in Beijing and Chengdu, warned that the EU may take “strong measures” including by imposing tariffs, should Beijing fail to address the imbalance.

“I told them that if they didn’t react, we Europeans would be forced, in the very near future, to take strong measures and withdraw from cooperation, like the United States, such as imposing tariffs on Chinese products,” Macron said in an interview with French daily Les Echos.

“China is hitting the heart of the European industrial and innovation model,” he said. French officials have been particularly upset about the Chinese yuan, which has fallen by around 10% against the euro this year.

During a joint appearance with Xi in Beijing last Thursday, Macron said that these trade "imbalances are becoming unbearable."

It was a remark that reflected sharpening French demands on Beijing to spur consumption and curb exports, and one Macron repeated to rapt Sichuan students and at a gathering with French and Chinese business leaders during his fourth trip to the country as president.

ING's Song added that if "the EU indeed does follow suit with tariffs, it would represent a significant risk to the external demand outlook for China."

France’s goods trade deficit with China has doubled in the past decade to €47bn in 2024. French investment in China over the same period is nearly quadruple China’s into France.

Paris is demanding Beijing recalibrate its trade and investment relationship with the EU, according to the FT.

“We are at the last stop before a crisis,” a French official warned. “If we don’t change course, we will worsen global fragmentation,” they added, suggesting Paris would have to consider “protective measures”.

Macron, who was accompanied on his trip by about 40 French business leaders, called for China to transfer technology to France in areas such as clean tech and batteries — a stark reminder of the shifting balance of power in crucial industrial sectors. The French president also defended EU trade investigations into Chinese electric vehicles, saying the bloc was taking a company-by-company approach.

“We need more tech neutrality and a European preference” for domestic industries such as automobiles, Macron said in Chengdu, capital of China’s south-western Sichuan province.

“This is not at all aggressive or protectionist. The Americans and other players in the North American market do it, the Chinese do it,” the president said. “The major risk for Europeans is accelerated deindustrialisation.”

But it’s not just France, says Eskelund of the European chamber, who points to a raft of bilateral trade complaints and actions leveled against China in recent months, including from not just the U.S. and its Western allies, but also from countries in Southeast Asia, Latin America and the Middle East.

“I have no doubt that we’ll see more, not less, in terms of all of these trade defense initiatives all over the world,” he said.

Eskelund says that China’s trade imbalance with the world is even more pronounced than the $1 trillion figure suggests, given the relative weakness of the Chinese yuan.

When calculated by value, China accounts for roughly 15% of global goods exports. But in volume terms, Eskelund estimates that every shipping container being sent from Europe to China is outnumbered by the four containers heading in the other direction. In volume terms, he estimates that China accounts for some 37% of everything being exported in shipping containers.

“Concern is growing,” he said, warning that, in the near future, we may “get to a point where things snap.”

The EU is considering setting “made in Europe” targets of up to 70% for certain products such as cars as it pushes to prioritise domestic goods and cut reliance on China. Brussels is also planning to tighten foreign investment rules to ensure Chinese companies do not gain advantage from the bloc’s open market without generating benefits for local workers and sharing technology.

For its part, China continues to make promises and deliver nothing. China’s commerce ministry on Friday repeated promises to eliminate restrictive measures in the domestic market and to spur consumption. But experts told the FT that Beijing has little intention of drastically altering its economic model. As a result, trade tensions between China and the bloc have sparked anti-dumping investigations in both directions.

The EU dairy sector is awaiting a ruling on a probe Beijing launched last year in retaliation against Brussels’ imposition of additional levies on Chinese EV imports. China could impose tariffs of as much as 40 per cent on dairy products on top of existing duties.

As Bloomberg notes, the trillion dollar milestone reached by China follows the recent de-escalation of tensions with the Trump administration. The huge surplus also underscores how Beijing is "struggling" to rebalance (as in it hasn't even bothered to start) the economy away from its dependence on demand abroad, with net exports accounting for almost a third of economic growth this year.

“It does look like China’s export competitiveness is still standing firm against US tariffs,” said Michelle Lam, Greater China economist at Societe Generale, referring to robust shipments to other markets than America. Rising trade tensions with the EU are “a source of downside risk to watch out for,” she said.

After Macron failed to make any impression on Xi's export aspirations, on Monday, German Foreign Minister Johann Wadephul arrived in China for a two-day trip, becoming the latest senior European official to visit for talks. China’s exports to the EU expanded almost 15% last month - the fastest since July 2022 - with sales to France, Germany and Italy all seeing double-digit growth as Chinese exporters grab market shares from domestic producers. Meanwhile, European domestic industries are being snuffed out in one brutal, manufacturing depression as they fail to compete with Chinese substitutes.

Wadephul said before the trip that he’d raise trade curbs, especially on rare earths, and “overcapacities” in electric vehicles and steel with his Chinese counterparts. China’s auto imports are down almost 39% in the year to date.

Shipments overseas have boomed for much of this year, in spite of Trump’s launch of a trade war early in 2025. The world’s second-biggest economy has emerged largely unscathed from the standoff, as it delivered more goods to markets other than the US.

The year-on-year increase in exports of electronic and machinery products rebounded to almost 10% last month, versus October’s rise of just over 1%, according to Bloomberg calculations based on China’s customs data. Declines in shipments of consumer goods narrowed.

Exports to Africa surged nearly 28% in November, while those to the Southeast Asian trading bloc gained only 8.4%, the least since February. Despite escalating tensions over the self-governing island of Taiwan, imports from Japan rose faster in November than exports to there, resulting in a $1.3 billion deficit for China.

The historic trade surplus will help boost growth in China's GDP after months of deterioration in the economy. Retail sales are coming off their longest stretch of slowdowns since 2021 while investment just shrank by a record amount. Although the Chinese economy is expanding at a slower pace in the last quarter of the year, its strong performance earlier in 2025 means the official growth target of around 5% is likely within reach.

As Bloomberg notes, foreign demand has been the one consistent driver of Chinese growth, helping compensate for lackluster private consumption at home and the prolonged slump in the housing market. But the trade picture has become increasingly unbalanced, with China’s weak demand and increasingly innovative firms slashing demand for imports.

While it’s “ultimately essential” for China to embrace a growth model driven more by domestic demand, such a pivot will take time, according to ING’s Song. In reality it will likely take years, and by then Europe's domestic production will be decimated.

“We need to see what sort of concrete measures are put into place to boost domestic consumption, and how those measures to increase win-win cooperation and establish international consumption centers play out,” he said. “It’s quite clear at this point that relying on external demand as the main growth engine is a risky bet.”