US Services Sector Surveys Signal Solid Growth In January, But...

Following the dramatic rebound in US Manufacturing survey data - driven by a surge in new orders - 'Soft' data has bounced back dramatically from its post-government shutdown lows (which is ironically occurring as the hard data - which was so resilient through the shutdown - has started to roll over)...

...and this morning's Services Sector survey data builds on that rebound

S&P Global's US Services PMI signaled a better than expected expansion of 52.7 in January (52.5 exp), rebounding from April 2025 lows.

ISM's US Services PMI survey also beat expectations in January (53.8 vs 53.5 exp), but was flat from a revised lower 53.8.

But both still solidly in expansion...

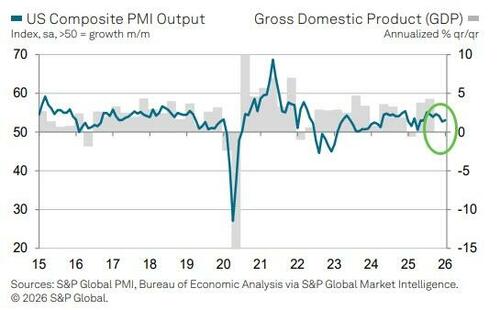

The S&P Global US Composite PMI recorded 53.0 in January. That was up from 52.7 in December and represented a solid rate of growth in private sector activity. Both sectors covered by the survey recorded stronger output expansions, in line with faster gains in new business. Employment meanwhile rose only marginally, while confidence in the outlook softened.

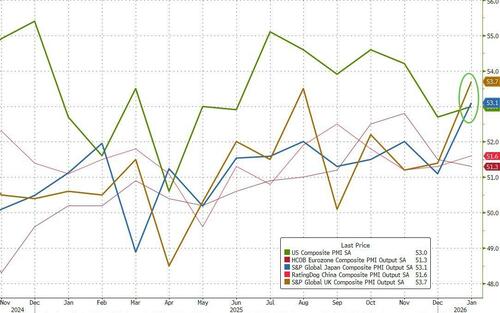

Despite the rebound, US has been overtaken by UK and Japan in terms of global PMIs...

“Sustained service sector growth, supported by a robust rise in manufacturing output in January, indicates the economy is growing at an annualized rate of around 1.7%," according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

However, that is a lower gear compared to the pace of expansion seen prior to December’s slowdown, and hints at GDP growth cooling in the first quarter.

Consumer-facing companies are increasingly reporting a challenging environment, with demand for services falling in January having nearly stalled in December, "reflecting low levels of consumer sentiment and cost of living pressures," Williamson noted.

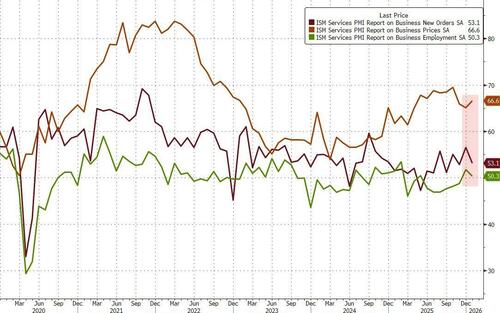

The ISM data showed a triple whammy of higher prices, lower new orders, and lower employment...

However, as Williamson concludes, “inflationary pressures in the service sector meanwhile remain elevated, blamed on the pass though of tariff related price increases and wage growth, though stiff competition is often reported to have limited the impact on final selling prices.”

“While financial and business service providers are reporting a more resilient picture, demand growth here is also showing signs of fraying amid heightened concerns over the economic outlook, in turn often blamed on political uncertainty.

However, there is a silver lining, as Williamson concludes: "lower interest rates and favorable financial conditions, higher government spending, combined with more active sales and marketing efforts, are propping up business sentiment and spending, and also encouraging modest hiring."