Warsh Likes It Hot, And Will Move The Fed's Inflation Target To 2.5-3.5%

By Dhaval Joshi of BCA Research

Executive Summary:

The Fed will run the US economy hot – because, with labour demand and supply now in balance, both demand and supply must expand to keep output expanding.

Short-term US real rates will come down further because the Fed will continue to cut even with inflation in the 2.5-3.5 percent range.

The US dollar will continue to weaken, given the currency’s dependence on real interest rate differentials.

The US yield curve will undergo a ‘bear steepening’ as US inflation expectations ratchet higher. Meaning, T-bonds will underperform cash, as well as other major sovereign bonds.

Stocks will continue to outperform bonds.

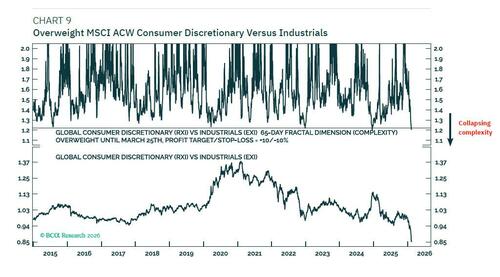

New tactical trade: Overweight MSCI ACW Consumer Discretionary versus Industrials.

Some Like It Hot

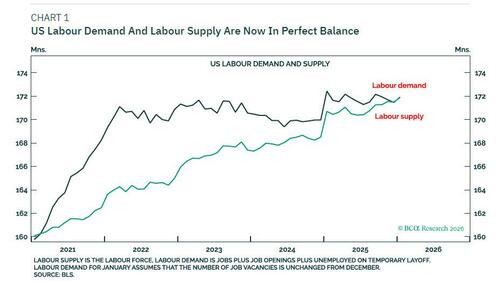

The US economy has reached a watershed. For the first time since the pandemic, labor demand and labor supply are in perfect balance, with both now standing at 172 million workers.

Labor supply equals the number of available workers: those with jobs plus those without jobs. Labor demand equals the number of people in work plus job vacancies plus workers on temporary layoff. Many people miss this last component of labor demand. Labor demand must include workers on temporary layoff because there is demand for these workers, albeit they are on temporary layoff for idiosyncratic reasons (such as a government shutdown).

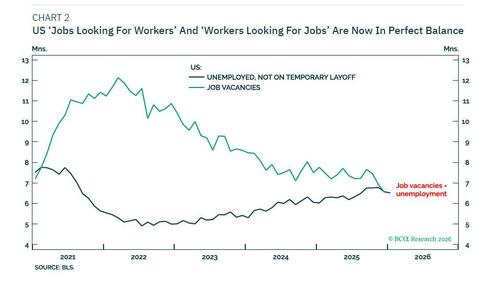

Put a different but equivalent way, the labor market is balanced when the number of ‘jobs looking for workers’ (job vacancies) equals the number of ‘workers looking for jobs.’ The latter means the unemployed. But given that those on temporary layoff are not looking for jobs, it more correctly means the unemployed that are not on temporary layoff.

The number of job vacancies and the number of unemployed not on temporary layoff both now stand at 6.6 million workers

So, correctly measured either way, the US labor market is now in balance.

A Labor Market In Balance Means Double Jeopardy

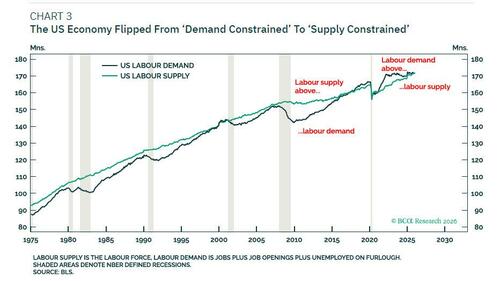

The US labor market is in balance, but such a balance is extremely rare. In the normal state, that prevailed for decades prior to the pandemic, labor demand runs short of labor supply. Meaning the economy is demand-constrained.

Since the pandemic though, in a highly unusual state, the relationship flipped. Labor supply has been running short of labor demand. Meaning the economy has been supply-constrained.

The distinction between demand-constrained and supply-constrained is crucial because it is the constraint on the economy – the lower of demand and supply – that drives economic output.

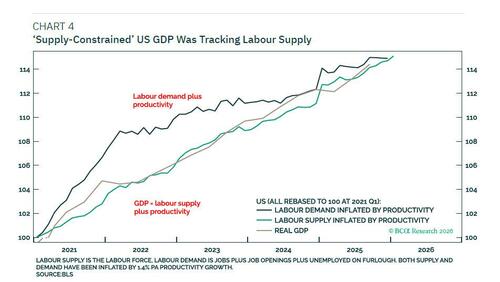

In a normal demand-constrained economy therefore, a demand recession causes a GDP recession. In a supply-constrained economy however, it takes a supply recession to cause a GDP recession. This explains why the abnormally supply-constrained US economy cheated a GDP recession when demand went into recession through 2023-24. The growth in the constraint – labor supply – kept output growing.

Now though, the US economy is at a watershed that puts it in ‘double jeopardy’. Given that labor demand and labor supply are in perfect balance, a drop in either would cause output to contract.

Put another way, both demand and supply must expand. To counter this double jeopardy, the Fed must run the economy hot.

Stimulate demand. But also stimulate supply by creating conditions for labor participation to rise – to offset the Immigration and Customs Enforcement (ICE) expulsions of (illegal) migrant workers.

Don’t Bet On An AI-Driven Productivity Surge

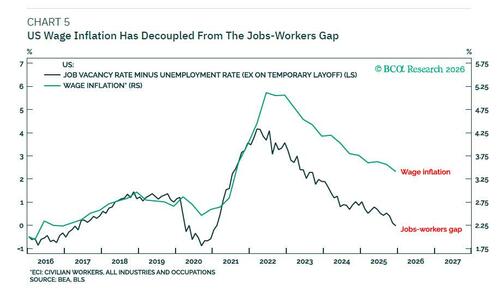

If the US labor market is back in the balance it was pre-pandemic, then why is US wage inflation still running hotter than pre-pandemic?

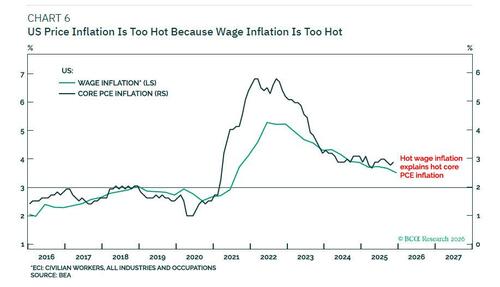

You might counter that the just-released Employment Cost Index (ECI) showed quarter-on-quarter wage inflation slowing to just 3 percent (annualized rate). Yet quarter-on-quarter wage inflation is highly volatile. More meaningful is the smoother 4-quarter wage inflation rate, running at 3.4 percent.

You might further counter that even 3.4 percent achieves the target of 3.5 percent wage inflation that several Fed governors have claimed is consistent with 2 percent price inflation.

Yet 3.5 percent ECI inflation is not consistent with 2 percent price inflation.

The very well-established relationship between ECI inflation and core PCE inflation tells us that, to be consistent with core PCE inflation at 2 percent, ECI inflation must be at 3 percent

Again, you might counter that such a 1 percent gap between ECI inflation and core PCE inflation implies that productivity growth is 1 percent, which is implausibly low. Yet while other more comprehensive measures of productivity growth may show a higher number, 1 percent is the well-established gap between these two specific datasets.

Finally, you might counter that even this specific 1 percent gap should widen if AI boosts productivity growth, allowing wage inflation to run hotter. Yet, despite much wishful thinking, the fact that the gap has not widened warns us that we should not bet on an AI-driven productivity surge as our base case.

The Warsh Fed Will Let The US Economy Run Hot

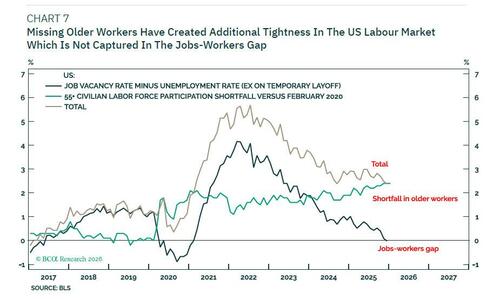

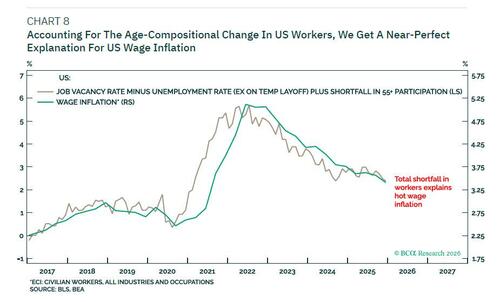

The reason that wage inflation has gapped structurally higher versus the jobs-workers gap is that the composition of the US labor market has structurally changed. As I highlighted in Why The World’s Fate Hangs On 2.5 Million Older American, there are almost 3 million fewer older workers in the US labor supply now than before the pandemic.

The loss of millions of older workers is significant because many jobs are non-fungible by age. Just as older workers cannot do younger-aged jobs that require physical strength or athleticism, younger workers cannot do older-aged jobs that require decades of acquired skills or experience.

Therefore, the shortfall of older workers has created an additional tightness in the US labor market which is not captured in the aggregate jobs-workers gap. Once we account for this additional tightness, we get a near-perfect explanation for the evolution of US wage inflation.

To repeat, faced with the double jeopardy of declining labor demand or declining labor supply, the Fed will turn a blind eye to this structural uplift in wage inflation. It will do this by de facto moving its inflation target to 2.5-3.5 percent. In effect, a Warsh-led Fed will let the US economy run hot.

There are several investment conclusions:

- Short-term US real rates will come down further because the Fed will continue to cut even with inflation in the 2.5-3.5 percent range.

- The US dollar will continue to weaken, given the currency’s dependence on real interest rate differentials.

- The US yield curve will undergo a ‘bear steepening’ as US inflation expectations ratchet higher. Meaning, T-bonds will underperform cash, as well as other major sovereign bonds.

- Stocks will continue to outperform bonds, as the Fed runs the US economy hot.

New Tactical Trade: Overweight Consumer Discretionary Versus Industrials

Consumer Discretionary has underperformed Industrials by almost 20 percent through the last 65 trading days. But the collapsed complexity of this near-vertical underperformance suggests that the magnitude and pace is overdone.

The potential pivot could be the market warming to the US consumer, given the combined effect of ultra-low US real interest rates, fiscal stimulus, and a still-robust labour market.

Hence, in line with our thesis that the Fed will run the US economy hot, and given the stark underperformance of Consumer Discretionary, a new tactical trade is to go overweight MSCI ACW Consumer Discretionary versus Industrials.

Set the profit target/stop-loss at +/-10 percent, and trade expiry on March 25th.