Another $3.5 Billion For Gas Power Generation

Talen Energy is following in the footsteps of utility peers Vistra and Constellation by spending billions of dollars acquiring gas generation assets to expand their capacity and grow market share in the growing power demand market.

After spending about $3.5 billion to acquire gas generation capacity in Pennsylvania and Ohio back in July 2025, the company announced it spent another $3.5 billion to acquire two more gas facilities in Ohio. With the newly announced 2.6 GW added to last year’s 2.9 GW, Talen is getting just as aggressive as others with acquiring as much capacity as possible.

We previously discussed Vistra’s stock price popping after they purchased multiple gas plants for $4 billion, adding 5.5 GW to their portfolio across the US. The PJM market seems to be a focus of much of the capacity expansion efforts due to the extreme strain on the grid with data centers growing like weeds in places like northern Virginia. That acquisition is also in addition to their $2 billion Q4 purchase of seven gas plants for 2.6 GW.

Acquisitions by Talen and Vistra are still dwarfed by Constellation’s massive acquisition of Calpine announced one year ago. Acquiring 23 GW of mostly gas power, Constellation paid about $30 billion to further expand their generation capabilities. Constellation also currently holds ownership of the most commercial nuclear reactions in the US.

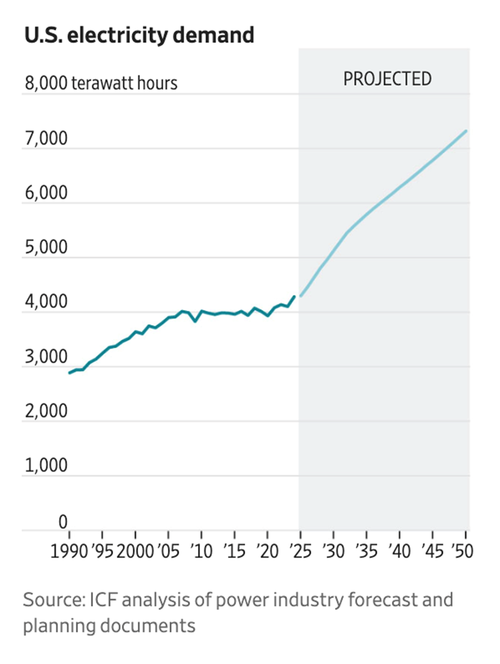

The frantic scramble to acquire as much capacity as possible, as quickly as possible, is due to the desperation for answering the demand from the US grid as it struggles to keep up with new demand growth not seen in decades due to electrification and AI data centers.

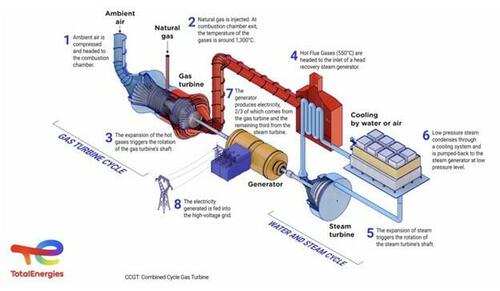

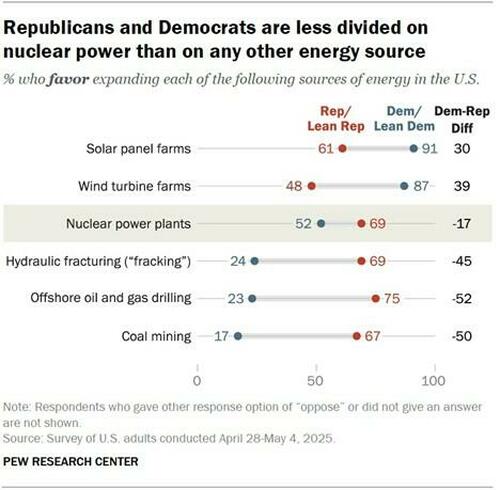

While it is far from being as dangerous as coal plants to the environment, gas generation is far from being considered as friendly as renewable and carbon-free sources like wind, solar, geothermal, and nuclear. This is one of the main reasons nuclear energy has come back into the conversation as more people than ever now approve of the use and construction of new nuclear power plants.

But, with data centers being built right now, the only way to meet their current demands is with gas and existing nuclear while the industry prepares to transfer to new and advanced nuclear in the future, most likely after 2030. There is a general concern that the nuclear bullishness of the Trump administration could be overridden by a left-wing government should parties switch after the next election, but due to nuclear being one of the most “purple” means a power production, those fears could be mostly over blown.

Regardless, Energy Secretary Chris Wright is promoting and pushing nuclear developments harder than anyone since Admiral Rickover, with the near-term potential to bring at least three new reactor designs critical by July 4 of this year.