OPEC+ Reaffirms Output Pause As Eight Producers Cite Market Stability

Authored by Tom Kool via OilPrice.com,

OPEC+ confirmed on Sunday that it will keep oil production steady through the first quarter of 2026, as eight key producers reaffirmed their commitment to market stability amid a steady global economic outlook and what they described as healthy oil market fundamentals.

Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman met virtually on January 4 to review global market conditions and outlook.

The group reiterated its decision, first announced on November 2, 2025, to pause planned production increases in February and March 2026, citing seasonal demand patterns.

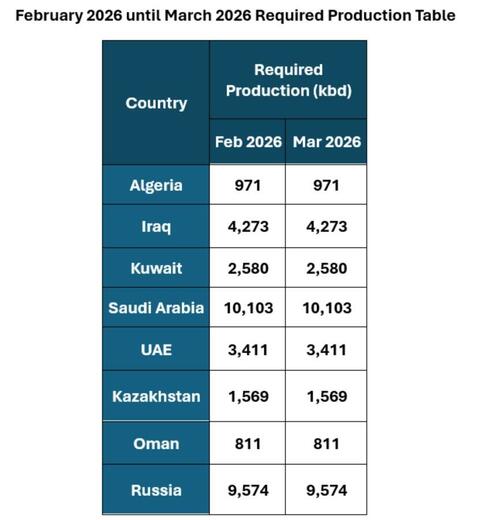

Following the meeting, OPEC+ produced the following production table for February 2026:

In a joint statement, the eight producers said current market conditions remain supportive, pointing to relatively low global inventories as a sign that the oil market is well balanced despite last year’s sharp decline in crude prices.

Oil prices fell more than 18% in 2025, the steepest annual drop since the pandemic, as supply growth outpaced demand and concerns over a growing glut mounted.

The group also emphasized that the previously announced 1.65 million barrels per day of voluntary production cuts could be returned to the market either in part or in full, depending on evolving market conditions, and only in a gradual manner.

The producers stressed that flexibility remains central to their strategy, including the option to extend or reverse additional voluntary adjustments, such as the 2.2 million barrels per day of cuts announced in November 2023.

OPEC+ further reiterated its collective commitment to full conformity with the Declaration of Cooperation. The producers confirmed that any overproduction since January 2024 will be fully compensated, with compliance and compensation to be monitored by the Joint Ministerial Monitoring Committee (JMMC).

Despite heightened geopolitical tensions - including strains between Saudi Arabia and the UAE over Yemen and uncertainty surrounding Venezuela following the U.S. capture of President Nicolas Maduro - delegates said these developments did not alter the group’s near-term policy stance.

“In an environment this fragile, OPEC+ is choosing caution, preserving flexibility rather than introducing new uncertainty into an already volatile market,” said Jorge Leon, an analyst at consultant Rystad Energy AS.

“The political transition in Venezuela adds another major layer of uncertainty.”

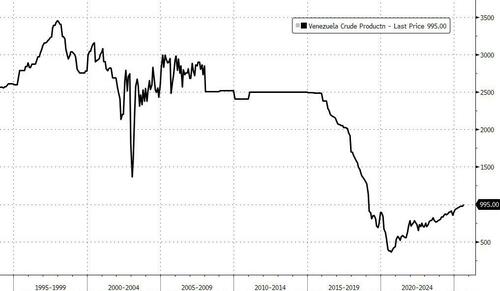

Caracas may hold the world’s biggest oil reserves, but years of under - investment, mismanagement and international isolation have diminished the country to a fraction of its former standing.

But, bear in mind that...

When you hear that Venezuela has the world's largest proven oil reserves, remember that ~2/3 of that comes from the Chavez and Maduro governments using generous assumptions to reclassify large volumes of lower utility, heavy crude as recoverable. https://t.co/SSA7u8Ovjy pic.twitter.com/JG1VrIUqTo

— Dr. Robert Rohde (@RARohde) January 4, 2026

Venezuela currently pumps about one million barrels of oil a day, roughly a third of what it produced a decade ago and under 1% of global supplies.

Washington’s recent seizure and pursuit of tankers while it pressured Maduro’s regime helped curb output in the country’s critical Orinoco Belt by 25%.

Production could rise by about 150,000 barrels a day within a few months if sanctions are lifted, but getting back to 2 million barrels a day or higher would require “massive reforms” and large investments from international oil companies, according to consultants at Kpler.

The eight OPEC+ countries agreed to continue holding monthly meetings to assess market conditions, compliance levels, and compensation progress. Their next meeting is scheduled for February 1, 2026.