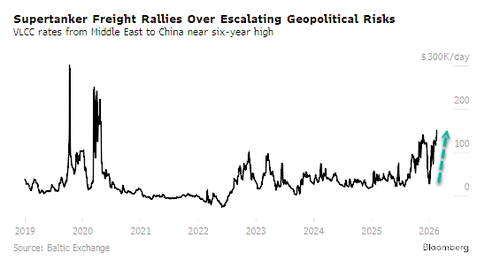

Supertanker Rates Soar As War Fears Put Strait Of Hormuz Chokepoint At Risk

Brent crude futures rose to a six-month high by the end of the week, with prices trading above $71 a barrel (charts here). President Trump said Tehran has 10 to 15 days to reach a deal with Washington over its nuclear program, as US forces assembled across the Middle East. With war risks rising, the cost of chartering a supertanker is soaring.

Bloomberg cites VLCC earnings data from the Baltic Exchange showing that rates on the Middle East-to-China shipping route have tripled this year to about $151,208 per day, the highest rate since 2020.

Traders are hyper-focused on the potential for disruption at the critical maritime chokepoint of the Strait of Hormuz, which could further spike risk premia for charters. Tightness is also being amplified by ownership concentration.

"Military action in the Middle East will likely take VLCC rates to levels not seen since 2019," Oil Brokerage Ltd. analyst Anoop Singh said.

Anxieties are building in crude markets, especially ahead of the weekend, after President Trump said Tehran had about 10 to 15 days to strike a deal over its nuclear program.

"We're either going to get a deal, or it's going to be unfortunate for them," Trump told reporters Thursday aboard Air Force One.

On a deadline, Trump said he thought 10 to 15 days was "pretty much" the "maximum" he would allow for the negotiations period. "I would think that would be enough time," he said.

Bloomberg noted that the military force the US is building in the region is the largest the US has deployed since 2003, adding, "It dwarfs the military buildup that Trump ordered off the coast of Venezuela in the weeks before he ousted President Nicolas Maduro."

Bryan Clark, a defense analyst for the Hudson Institute and a former Navy strategy officer, told the outlet, "With Iran's air defenses largely neutralized by previous US and Israeli strikes, the US strike fighters would operate largely with impunity over Iranian airspace."

"There is always the risk of downed pilots, but I think the bigger risk is to ships. The same cruise and ballistic missiles the Iranians gave to the Houthis could be turned against US ships in the Persian Gulf, Arabian Sea, and Red Sea," Clark said.

Kenneth Hvid, CEO at Teekay Tankers, recently told investors that the combination of consolidation in the VLCC segment and potential war risks in the Middle East means the move in tanker rates is "more in anticipation of something happening," adding, "It's just a situation we need to watch."