Oil, Dollars, Gold, & Venezuela In A Nutshell

Authored by Matthew Piepenburg via VonGreyerz.gold,

Putting any kind of bow on the current headlines to conveniently explain or “wrap up” recent events in Venezuela would be a fool’s errand. The extraordinary mix, as well as polarized views, as to the personalities, policies, economics, military acumen, and even international legality of the entire saga makes consensus impossible.

Political Optics?

The operation itself, of course, has all the Hollywood features of a daring and successful military drama, which can create tailwind optics for a President.

The opposite, of course, happened for Jimmy Carter, when his April 1980 Iranian hostage rescue mission stalled tragically in the desert, along with any hope of his re-election shortly thereafter.

Political “optics,” however, are often as short and capricious as politics itself. We all remember, for example, President Bush’s famous “mission accomplished” moment on the deck of the USS Abraham Lincoln long before the mission, in fact, was not accomplished…

From Politics to Economics

But moving away from the undeniably swampy terrain of politics to the Realpolitik of hard math, we can begin to discern certain financial and sovereign motives that speak far more honestly than patriotic narratives of bringing “bad guys” to justice or the stemming of drug trafficking.

There is something far more basic, and even mathematical, behind the headlines in Venezuela whose roots lie years deeper, and whose ripple effects will run far longer into an admittedly unknowable yet nevertheless somewhat precarious future.

The Past – Hegemonic to Broke(n)

This future will directly involve, and impact, gold’s international profile in the years ahead. But to put the present and even future into a greater context, let’s first take a brief look backwards.

For years, we have tracked, debated and observed the many intertwining themes of the slow decline of American hegemony on the global stage and its widening economic fissures and inequalities at the national level.

As always, the familiar themes begin with irrational and unsustainable debt levels, which have compounded under every red or blue administration since Nixon took away the gold standard in 1971.

What followed was an era of extraordinary credit expansion and hence currency debasement, wealth inequality, social unrest and the subsequent centralization schemes which always follow.

Within this mix of ever-changing financial forces and headlines, of course, includes the central theme of the U.S. Dollar and Treasury markets, whose health and strength are absolutely central to U.S. hegemony on the global stage. Period.

Times, Dollars & Trust Are Changing

But that USD and UST, we also know, have been losing strength, credibility and trust in the backdrop of a world slowly moving away from a paper-money system in general and a weaponized USD in particular.

The reasons and forces behind the mounting de-dollarization headlines are both complex yet paradoxically simple.

At a basic level, the over-issuance of IOUs from a nation whose debt levels have gone from $250B in 1971 to $38T in 2026 speaks for itself.

The trillions in mouse-clicked dollars engineered by the Fed to monetize those IOUs and the credit expansion that followed has had an undeniable impact on the absolute purchasing power of that USD.

This is objectively apparent when recognizing the dollar’s 99% decline in purchasing power when measured against gold since 1971.

In addition to the distrust which always follows an IOU or currency from an over-indebted issuer, the subsequent weaponization of the dollar in 2022 only made Uncle Sam’s UST and USD even less trusted and hence less demanded.

The World Is Catching On

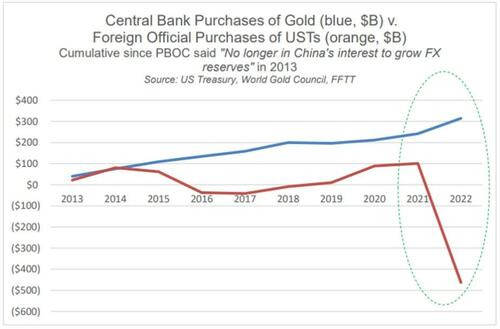

Central banks, seeing this growing distrust, had been net-selling USTs and net-stacking gold since 2014:

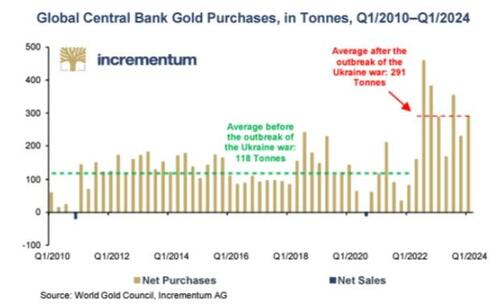

Through no coincidence at all, the pace of this move toward gold tripled after the 2022 sanctions.

Unsurprisingly, central banks now hold more gold than USTs. Even the BIS can’t help but confess that gold is a superior strategic reserve asset than the once-sacred US 10Y Treasury Bond.

This now obvious move away from the dollar toward gold is no longer a warning or cry from the “gold-bug” camp, but a neon indicator of the structural shift in a global trading and monetary system in open flux.

A Nervous U.S. Resisting Change

Needless to say, the US is therefore admittedly concerned.

It needs a commanding currency and buyers for its IOUs beyond just the Fed itself. At some point, too much QE becomes an open signal that the U.S. (and its Greenback) has become broken beyond repair and hence respect.

This explains other alternative-QE tricks in consideration, such as a possible gold revaluation measure.

Such realities, of course brings us full circle back to the headlines of Venezuela, which are intrinsically connected to the complex interplay of the USD, the UST, the oil markets, and, you guessed it, gold itself.

Oil & USTs: The Traditional Pillars of U.S. Hegemony

I have written about the brief history and changing patterns of the critical petrodollar arrangement and gold’s evolving place in its narrative in prior reports here, here, and here.

To simplify, the petrodollar, “agreed” between the U.S. and the OPEC alliance led by Saudi Arabia shortly after the dollar’s gold-decoupling in 1971, was of central importance to maintaining the USD’s dominance in the global currency system.

By effectively tying global oil sales to the USD, the petrodollar arrangement provided an extraordinary source of demand for a dollar whose supply, following its gold decoupling, was otherwise unlimited.

Acting as a treaty-based “sponge” to absorb otherwise grossly over-produced dollars, the petrodollar system was a therefore an essential buffer against otherwise unsustainable currency debasement.

Equally beneficial to Uncle Sam, the petrodollar system mandated that the producers of that oil earmark a significant percentage of their oil revenues toward the purchasing of Uncle Sam’s IOUs. This served as an undeniable source of support for the UST market and hence America’s ability to expand its debt issuance at levels no other nation in the world could mirror.

In short, the petrodollar became an extraordinary source of both USD and UST demand, making global oil sales via the petrodollar a critical pillar to U.S. financial hegemony.

2026 Is not 1974…

In exchange for this dollar-backed oil arrangement, Saudi Arabia/OPEC received U.S. protection from the Soviets in a cold war era that has changed in the intervening decades since 1974.

What has also changed in those intervening decades, of course, are U.S. debt levels, bond yields, dollar strength, and post-2022 trust in the USA.

As de-dollarization headlines increased in the post-sanction era, there was much hype about the end of the petrodollar when Saudi Arabia waffled on renewing/extending its dollar peg in 2025.

As there was no formal petrodollar treaty ratified by the Senate, technically either side could opt out, but in fact, the Saudis were considering a petrodollar 2.0 contingent upon Israel’s culmination of its war in Gaza.

Wobbling Pillars

By 2025, 20% of Saudi oil was being sold in euros, not dollars, but Trump was offering more carrot than stick to keep the petrodollar going, for obvious reasons.

Meanwhile, however, the Saudis, for the equally obvious reasons listed above, were not blind to the USD’s weakening credibility, the UST’s weakening yields (compared to the 1970’s) and China’s strengthening desire to find a non-dollar energy solution.

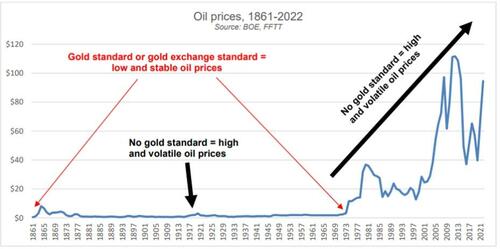

Furthermore, anyone, including OPEC, who tracked oil prices throughout the decades, knew full well that oil priced in gold was infinitely more stable than oil priced in USD.

In short, the petrodollar pillar to USD hegemony was not broken, but it was certainly wobbling.

From Nervous to Violent

The U.S. was thus nervous.

Dollar-backed oil is essential to its paper currency’s survival, which is precisely why figures like Muammar Gaddafi and Saddam Hussein, who had each tried to sell their oil outside the dollar, did not, well… survive at all.

As Kissinger noted decades ago, commanding a world reserve currency equally requires the world’s strongest military. In short, monetary and military might went hand-in-hand to protect U.S. interests.

Thus, the recent military actions in Venezuela don’t require too much imagination to understand. Regardless of whether they were right or wrong, the actions against Nicolas Maduro were a classic reminder of oil’s importance to the U.S.

Which raises the obvious question: Can any major oil power ever leave the petrodollar without a fight?

Although China took only 4% of Venezuelan oil in Yuan purchases from the Belt & Road Initiative, 95% of Iran’s oil goes to China and is sold in Yuan, not dollars. Is it any coincidence that “regime change” in Iran is an almost daily headline?

Folks—it’s all about the oil…

Looking Ahead

The US, whose dollar share of global FX reserves has been sinking like a stone in the past two decades, is viscerally worried about a de-dollarizing world in which the BRICS in general, and China in particular, are developing gold-backed trading currencies and other systems (the BRICS “Unit”, M-Bridge membership, BRICS-Pay etc.) to trade resources in general, and oil in particular, outside the USD.

Again: This terrifies Washington DC.

Could 15 to 20 nations in the global south develop a new oil trade currency via a basket of weighted currencies outside the USD? Could the Saudis slowly look away from the petrodollar?

No one can predict the precise nature, policies, agreements or even wars of the future when it comes to oil and the dollar. We can only track past patterns and measure current cracks in the old system.

And Gold, Of Course…

What we are currently seeing in Venezuela may be desperate, but it’s no surprise.

US refineries are designed for the heavy crude which Venezuela holds. And within hours of meeting representatives from China, Maduro was coincidentally whisked away by DELTA forces before a larger arrangement could be met.

It’s also worth noting that billions worth of Venezuelan gold was frozen in their accounts at the Bank of England.

In short, this interplay of dollars, USTs, oil and gold is also no coincidence.

If the petrodollar weakens in any meaningful way, USTs, already seeing a dramatic decline in demand, would fall even further, meaning UST yields, and hence the cost of Uncle Sam’s massive debt burden, would become fatal rather than just embarrassing.

Such a scenario would compel the Fed to initiate extraordinary money-printing to support Uncle Sam’s unloved IOUs, thereby debasing its paper dollar even more and sending gold’s relative valuations considerably higher.

In addition to such monetary desperation, military desperation is an equally concerning possibility.

I, of course, do not know the future. No one does. We can only track patterns, motives, debt levels and hence debt-based desperations, in everything from stablecoins to foreign policy.

What we can all see and agree upon, however, is that things are clearly changing and shaking up as the chaos meter rings louder with each headline.

Gold, of course, loves chaos, and in a world of dying paper currencies, fracturing geopolitics, systemic monetary shifts and wars, or rumors of wars, gold’s secular direction today and tomorrow should be of no surprise to anyone paying attention.