10Y Auction Stops Through In Solid Start For 2026 Treasury Sales

Shortly after a solid 3Y auction, the first of the year, priced just through the WI by 0.1bps, moments ago we got the first sale of benchmark 10Y paper for 2026 in what was another solid auction.

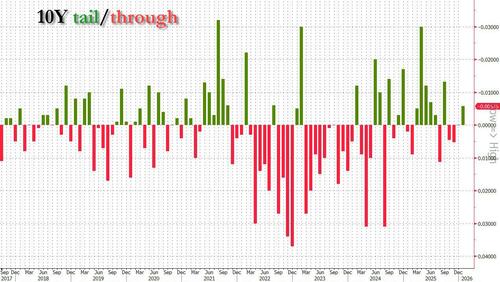

Today's sale of $39BN in 10Y paper priced at 4.173% just after 1pm ET. This was barely changed from the 4.175% in December in what appears to be duration paralysis. And with the When Issued trading at 4.180%, the auction stopped through the WI by 0.7bps, this was the strongest 10Y auction since September.

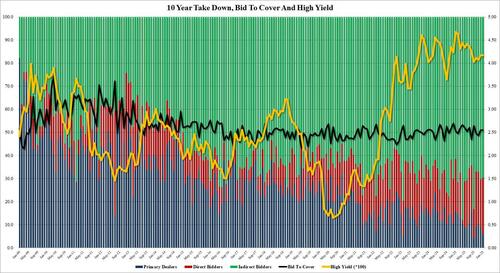

More paralysis: the bid to cover was 2.554, virtually unchanged from last month's 2.550, and just above the six-auction average of 2.51. As one can see in the chart below, we are now about a decade into the BtC being within 10-20bps of 2.50% in what may be the biggest autopilot trade in the US.

Turning to the internals, Indirects took down 69.7% of the auction, just a hair below last month's 70.2% (and just above the 69.5% recent average). Directs took 24.5%, up from 21.0 in December and the highest since 2014. This left Dealers with just 5.8%, the second lowest on record with justs the 4.2% in Sept 25 lower.

Overall, this was a strong 10Y auction, and a solid start to the year for coupon issuance.