AI frightens logistics stocks; Markets await US CPI - Newsquawk EU Market Open

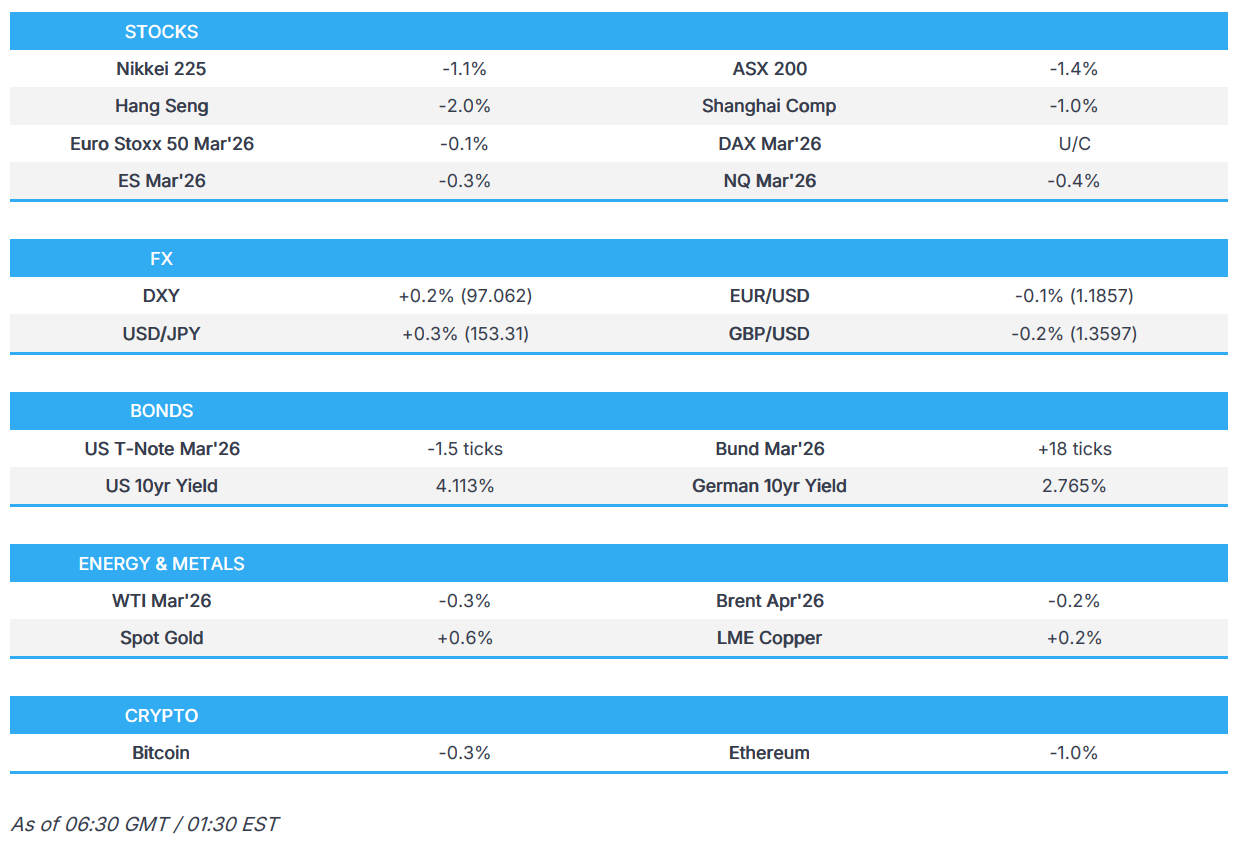

- APAC stocks were mostly lower as the region took its cue from the losses stateside, where tech underperformed as AI-disruption concerns re-emerged, and logistics/industrials stocks were also pressured after Algorhythm Holdings (RIME) released its AI freight scaling tool.

- US President Trump said we have to make a deal with Iran and could reach a deal over the next month.

- US President Trump reiterated he is going to China in April and that Chinese President Xi will visit the US later this year, while he added the relationship with China is very good right now.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with losses of 0.4% on Thursday.

- Looking ahead, highlights include German Wholesale Prices (Jan), Swiss CPI (Jan), EZ Prelim Employment (Q4), GDP 2nd Estimate (Q4), US CPI (Jan), Speakers including ECB’s de Guindos, BoE’s Pill, Earnings from Moderna & NatWest.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks declined as tech-related concerns were stoked by further AI disruption fears, as attention focused on an update from AI penny stock Algorhythm Holdings (RIME) that its SemiCab platform is enabling customers to scale freight volumes by 300-400%, without an increase in headcount. This largely weighed on the logistics/industrials sector, but other sectors exposed to AI disruption (software, gaming, financials) also slumped, while the sectors that are least exposed to AI disruption (consumer staples) outperformed.

- The risk-off trade sparked upside in T-Notes, with the curve bull flattening led by the long-end, and peaks were seen after a stellar 30-year auction, while crude prices tracked risk sentiment lower but settled just off troughs. On the geopolitical footing, Trump reiterated that they have to make a deal with Iran, and could reach a deal over the next month, but warned that it will be very traumatic for Iran if they do not agree to a deal.

- SPX -1.55% at 6,834, NDX -2.04% at 24,688, DJI -1.34% at 49,452, RUT -2.15% at 2,612.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump reiterated he is going to China in April and that Chinese President Xi will visit the US later this year, while he added the relationship with China is very good right now. It was also reported that President Trump paused China tech bans ahead of the Xi summit.

- US President Trump reportedly plans to roll back tariffs on metal and aluminium goods, amid voter anxiety regarding affordability in the US ahead of the midterm elections, according to FT.

- US and Taiwan signed a reciprocal trade agreement with Taiwan to eliminate or reduce 99% of tariff barriers on US goods, while the US confirmed 15% tariff rate on Taiwanese goods. It was also reported that the US and North Macedonia agreed to a trade framework with the US to impose 15% tariff on North Macedonian goods, while North Macedonia is to eliminate all tariffs on US goods.

- Taiwan's President Lai said the trade deal with the US marks a pivotal moment for Taiwan's economy and industries, while he added that they secured significant benefits for Taiwan's industries and the overall economy, as well as solidified the Taiwan-US high-tech strategic partnership.

- Japanese Trade Minister Akazawa engaged with US Commerce Secretary Lutnick on US-bound investment initiatives and confirmed progress on talks to launch the USD 550bln investment fund.

NOTABLE HEADLINES

- Fed's Miran (voter) said some of the concerns he has on labour markets are a little less than he had before, while he added that a range of policies are pushing out the supply of the economy and will increase economic growth in a non-inflationary way. Miran also commented that the Fed is one of the biggest risks to growth and monetary policy has passively tightened, and suggested that they may be underestimating how restrictive monetary policy actually is.

- NY Fed said the desk plans to conduct additional reserve management purchases of approximately USD 40bln and around USD 13.4bln in reinvestment purchases between February 13th and March 12th.

- US House is done voting for the week and there is a recess next week, while the DHS shuts down tomorrow night, according to Punchbowl.

- OpenAI accused DeepSeek of distilling US models for competitive advantage and said it had ongoing efforts to 'free ride' on US technology, according to a memo to lawmakers.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower as the region took its cue from the losses stateside, where tech underperformed as AI-disruption concerns re-emerged, and logistics/industrials stocks were also pressured after Algorhythm Holdings (RIME) released its AI freight scaling tool.

- ASX 200 was dragged lower by losses in tech stocks, and as participants also digested earnings releases.

- Nikkei 225 retreated at the open after recent currency strength and with focus also on earnings reports, including from SoftBank, which returned to profit in Q3 but missed expectations, while its shares were also not helped by its AI exposure.

- Hang Seng and Shanghai Comp suffered alongside the broad downbeat mood in the region, and despite reports that President Trump paused some China tech bans ahead of his summit with Xi in April, while it is also the last trading day in the mainland before the Lunar New Year and Spring Festival holiday closures.

- US equity futures remained subdued and slightly extended beneath the prior day's trough.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with losses of 0.4% on Thursday.

FX

- DXY lacked firm direction following yesterday's two-way price action, in which the DXY ultimately returned to flat territory after early weakness was pared alongside the risk-off mood, while there was little reaction to slightly higher-than-expected Initial Jobless Claims, and participants now await incoming US CPI data.

- EUR/USD traded rangebound overnight amid a lack of catalysts and after the latest bout of commentary from ECB officials provided very little to influence the outlook.

- GBP/USD was confined to within a tight range following yesterday's indecisive performance in which the pair largely shrugged off the weaker-than-expected preliminary Q4 GDP data.

- USD/JPY marginally edged higher following the recent oscillations around the 153.00 level and with little in the way of fresh catalysts or tier-one data from Japan to influence trade. Furthermore, comments from BoJ's Tamura also failed to spur price action, in which he reiterated that they would keep raising rates if the outlook is met, and stated that we may be able to judge that BoJ's price goal has been achieved as early as this spring.

- Antipodeans conformed to the uneventful trade across the FX space amid the downbeat mood in stocks and partial rebound across the metals complex.

- PBoC set USD/CNY mid-point at 6.9398 vs exp. 6.9045 (Prev. 6.9457).

FIXED INCOME

- 10yr UST futures took a breather after advancing yesterday amid a flight-to-quality in risk-off trade and with peaks seen following a stellar 30-year auction stateside.

- US sold USD 25bln of 30-year bonds at a high yield of 4.750%, Stops through 2.1bps.

- Bund futures lingered around YTD highs after advancing to above the 129.00 level, and with German Chancellor Merz pushing back on calls for a joint European debt issuance, while German WPI data is due later.

- 10yr JGB futures remained afloat but are well off yesterday's best levels after pulling back from resistance at the 132.00 level and with supply from an enhanced liquidity auction for long- to super-long JGBs.

COMMODITIES

- Crude futures were subdued after sliding yesterday alongside the broad risk-off sentiment and an intraday rebound in the dollar, while demand was not helped by comments from US President Trump, who stated they have to make a deal with Iran and could reach an agreement over the next month, but warned it would be traumatic for Iran if it does not agree to a deal.

- US Energy Secretary Wright said they have completed over USD 1bln in Venezuelan oil sales, while he stated that Venezuela will increase production 30-40% in the first year and that Russia, China and Iran's influence in Venezuela will wane. Furthermore, it was reported that Chevron is already stepping up investments in Venezuela and that the US will sell Venezuelan oil to China.

- Venezuela's state-owned PDVSA is reportedly offering neighbouring areas to JV partners, and talks have progressed with US and European oil companies on possible JV expansions.

- Qatar hiked April term price for Al Shaheen oil to USD 0.87/bbl over Dubai quotes.

- Oil supplies to Slovakia via the Druzhba pipeline have reportedly been halted.

- Spot gold clawed back some of the prior day's losses after the commodities complex suffered alongside the broad weakness across risk assets.

- Copper futures partially nursed recent losses but with the recovery contained by the downbeat risk tone.

CRYPTO

- Bitcoin marginally edged higher after recovering from a brief dip beneath the USD 66,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ's Tamura said he feels Japan's recent inflation is becoming sticky and reiterated that they will keep raising rates if the outlook is met, while he noted they may be able to judge that the BoJ's price goal has been achieved as early as this spring. Tamura also commented that even if the BoJ raises the policy rate further, monetary conditions will remain accommodative, and that once the BoJ's policy rate goes above 1%, the stimulative impact of monetary policy is expected to gradually diminish.

- Japanese PM Takaichi's adviser Honda suggested the BoJ may consider raising interest rates later this year, but noted the unlikelihood of a hike in March.

DATA RECAP

- Chinese House Price Index MM (Jan) Y/Y -0.4% (Prev. -0.4%)

- Chinese House Price Index YY (Jan) Y/Y -3.1% (Prev. -2.7%)

- New Zealand 1yr Inflation Expectation (Q1) 2.6% (Prev. 2.4%)

- New Zealand 2yr Inflation Expectation (Q1) 2.4% (Prev. 2.6%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said we have to make a deal with Iran and could reach a deal over the next month, while he added it will be very traumatic for Iran if they do not agree to a deal. Trump also stated that Iran should agree very quickly, and they will talk to Iran for as long as he likes.

- Israeli PM Netanyahu said the conditions Trump is setting on Iran, combined with their understanding that they made a mistake last time by not reaching a deal, could lead Iran to accept terms that would make it possible to achieve a good deal, according to Axios.

- US aircraft carrier U.S.S Gerald R. Ford will be sent to the Middle East from Venezuela, according to officials cited by NYT.

- US officials said President Trump is to announce a multi-billion-dollar funding plan for Gaza at the first board of peace meeting next week.

OTHER

- Japan seized a Chinese fishing boat off the Nagasaki coast, according to Japanese press.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer is set to call for a multinational defence initiative to reduce the costs of rearmament.

- German Chancellor Merz said he does not support joint eurobonds.