All eyes on the tri-lateral meeting between the US, Ukraine and Russia; European equity futures point to a subdued opening - Newsquawk European Opening News

- BoJ maintained its short-term interest rate at 0.75%, as expected, with an 8-1 vote split as Takata voted for a 25bp hike.

- BoJ Outlook Report revised its 2025 and 2026 GDP forecast higher, while shifting its 2027 forecast lower; 2026 inflation was revised higher to 1.9% (prev. 1.8%).

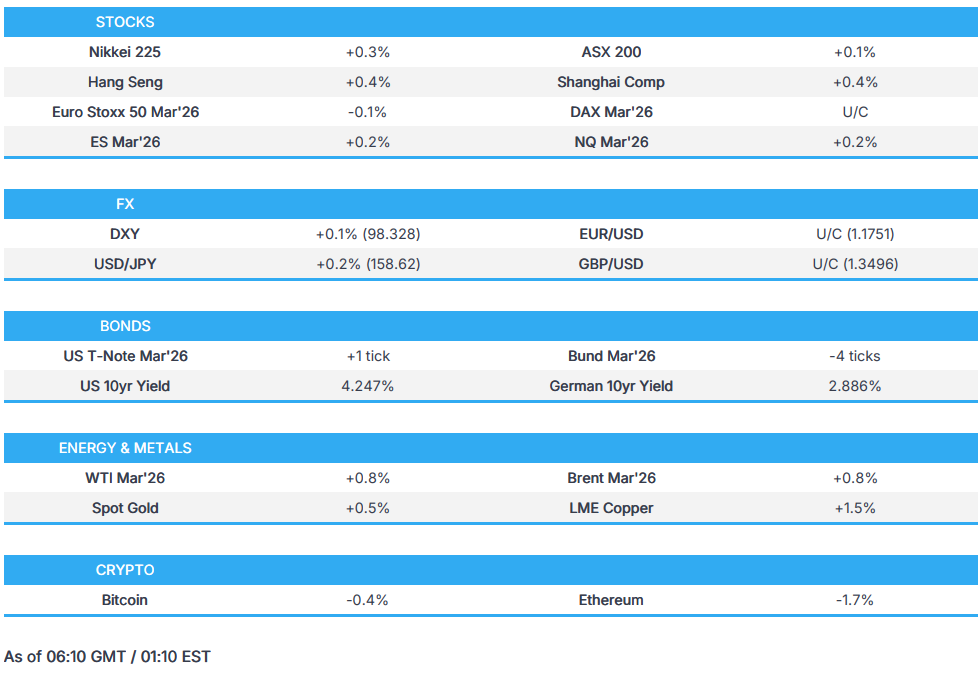

- USD/JPY saw two-way action on the BoJ; JGBs resumed lower following hawkish dissent and 2026 inflation forecast upgrade.

- USD traded muted, CNH strengthened as the PBoC set the yuan’s daily reference rate below 7.0 for the first time since May 2023.

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.2% after cash closed up 1.2% on Thursday.

- Looking ahead, highlights include Global Flash PMIs (Jan), UK Retail Sales (Dec), Canadian Retail Sales (Nov), US UoM Consumer Expectations Final (Jan), BoJ Governor Ueda, BoE’s Greene, Tri-lateral meeting between the US, Ukraine and Russia.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the green, extending on Wednesday's gains driven by Trump backing off from imposing additional tariffs on EU nations over Greenland. A few details emerged surrounding the US-NATO deal. Trump said there will be total access, and he will not be paying anything. This, however, does oppose a late-Wednesday NYT report that the deal would involve small pockets of land. Nonetheless, risk sentiment improved and outweighed a chunky selloff after the open.

- SPX Communications outperformed due to a Meta (META, +5.7%) rally after it received positive commentary at Jefferies. Tesla's (TSLA, +4.2%) rollout of Robotaxis in Austin, with no safety monitor, supported Discretionary gains, while Real Estate and Utilities lagged.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said Chinese President Xi will come to the US towards the end of the year.

- Spanish PM Sanchez said the US is provoking tension in the Transatlantic, EU have the instruments to respond proportionally to coercion.

- The EU is moving to revive its US trade deal after President Trump backed away from his tariff threat tied to Greenland.

- US President Trump said the people who brought the tariff legislation against the US are strongly China-oriented; the US is going so well, giant growth and investment with almost no inflation.

- US Treasury Secretary Bessent said China buying more soybeans isn't required; China's President Xi and US President Trump could meet four times this year.

- Chinese President Xi had a phone call with Brazilian President Lula, Xinhua reported. China is willing to cooperate with Brazil in different areas.

NOTABLE HEADLINES

- US House passes package of FY26 funding bills in a major step towards averting government shutdown on Jan 31st; sending to Senate for final votes.

- US House Speaker Johnson said there is no GOP consensus on whether to use tariff revenue to send USD 2k checks out.

- US President Trump announces intention to bid for the World Expo 2035; will create thousands of jobs and add growth.

- Big northern European investors are reportedly increasingly wary of the risks of holding US assets in the face of geopolitical tensions, according to reports.

- Atlanta Fed GDPnow (Q4): 5.4% (prev. 5.4%).

CENTRAL BANKS

- BoJ maintained its short-term interest rate at 0.75%, as expected; 8-1 vote split with Takata voting for a 25bps hike. Monetary policy: With the price stability target of 2%, it will conduct monetary policy as appropriate, in response to developments in economic activity and prices as well as financial conditions, from the perspective of sustainable and stable achievement of the target. Given that real interest rates are at significantly low levels, if the aforementioned outlook for economic activity and prices is realised, the Bank will continue to raise the policy interest rate and adjust the degree of monetary accommodation. BoJ Outlook Report: Real GDP: Fiscal 2025 median forecast 0.9% (prev. 0.7%). Fiscal 2026 median forecast 1.0% (prev. 0.7%). Fiscal 2027 median forecast 0.8% (prev. 1.0%). Core CPI. Fiscal 2025 median forecast 2.7% (prev. 2.7%). Fiscal 2026 median forecast 1.9% (prev. 1.8%). Fiscal 2027 median forecast 2.0% (prev. 2.0%).

- US President Trump, on the Fed Chair, said he is done with interviews and has someone in mind.

- US President Trump said mortgage rates hit a 3-year low despite "Too Late" Powell; the Fed has been discredited during Chair Powell's reign.

- RBNZ Governor Breman reaffirms commitment to achieve inflation mid-point, core inflation remains within the target range.

NOTABLE US EQUITY HEADLINES

- TikTok said it establishes US JV and names its directors, Bloomberg reported.

- US President Trump thanked Chinese President Xi for working with the US and ultimately approving the TikTok deal, adds that Xi could have gone the other way.

- Intel (INTC) Q4 2025 (USD): Adj. EPS 0.15 EPS (exp. 0.08), Revenue 13.70bln (exp. 13.40bln). Commentary: Demand is quite strong. Chipmaker missed a lot of opportunities and can’t get enough supply to meet orders. Outlook: Q1 Adj. EPS 0.0 (exp. 0.06). Q1 Revenue 11.7-12.7bln (exp. 12.6bln). Shares fell 11% after-hours.

- Apple's (AAPL) CEO Cook not expected to step down as CEO imminently; Apple's Ternus adds design duties in new sign of CEO candidacy.

APAC TRADE

EQUITIES

- APAC stocks traded entirely in the green, though without a clear sector-led driver, as regional sentiment stayed broadly constructive.

- ASX 200 posted modest gains, supported by strength in mining and metals as gold, silver and platinum extended their bid. A strong PMI print — with both manufacturing and services pushing further into expansion — added to the positive tone.

- Nikkei 225 gapped higher at the open but later pared part of its advance, pressured by chip stocks after weak Intel earnings. Offsetting some of the drag, videogame names outperformed, with Nintendo (+5%) boosted by strong US Switch 2 sales data. Following the BoJ rate decision, the Nikkei was unreactive as rates remained unchanged.

- Hang Seng and Shanghai Comp opened higher, with the Hang Seng outperforming after Alibaba (+3.6%) was reported to be preparing the listing of its chipmaking arm. Metals strength following fresh records in gold and silver also supported both indices.

- US equity futures held onto Thursday’s gains heading into the final session of the week.

- European equity futures are indicative of a subdued open with the Euro Stoxx 50 future -0.2% after cash closed up 1.2% on Thursday.

FX

- DXY was flat within a tight 98.297–98.347 band amid scarce newsflow ahead of the BoJ announcement and press conference. The index had weakened on Thursday as geopolitics dominated, while US data showed initial claims again beating expectations and November PCE printing in line, though personal income slightly missed.

- EUR/USD traded similarly flat around 1.1750, holding Thursday’s USD-driven gains, with traders awaiting Eurozone Flash PMIs, which often inject volatility into European trade.

- GBP/USD was uneventful on either side of 1.3500 amid a lack of UK-specific catalysts; holding above 1.3500 keeps the 7th January peak at 1.3417 in view as potential resistance.

- USD/JPY saw two-way action on the BoJ, as the Bank held its policy rate at 0.75%, as expected. JPY initially strengthened, possibly from the upward revision to its 2026 inflation forecast and a hawkish dissent, but immediately reversed the move. Net-net, the report failed to generate any meaningful reaction as traders await the post-policy conference from Governor Ueda.

- Antipodeans were mixed, with AUD supported by strong gold prices, while NZD lagged despite hotter-than-expected Q4 inflation.

- CNH saw immediate strength as the PBoC set the yuan’s daily reference rate below 7.0 for the first time since May 2023.

- PBoC set USD/CNY mid-point at 6.9929 vs exp. 6.9481 (prev. 7.0014).

FIXED INCOME

- 10yr UST futures continued to hold onto gains after Thursday’s heavy data docket, with in-line PCE readings limiting any further move in USTs.

- Bund futures oscillated around Thursday’s settlement as participants awaited Eurozone flash PMIs for directional cues.

- 10yr JGB futures initially traded flat going into the Tokyo lunch break and the BoJ rate decision. Following the hawkish dissent and upward revision to its 2026 inflation forecast, JGBs reopened lower but volatility remained light going into Governor Ueda's post-policy press conference.

- US sold USD 21bln of 10yr TIPS; tails 2bps. High Yield: 1.940% (prev. 1.734%); WI: 1.960%. Tail: 2bps (prev. 5bps). b/c: 2.38x (prev. 2.20x). Dealer: 12.2% (prev. 17.8%). Direct: 20.4% (prev. 26.1%). Indirect: 67.42% (prev. 56.1%).

- US 30-yr fixed rate mortgage averages 6.09% in Jan 22 week vs 6.06% prior week.

COMMODITIES

- Crude futures consolidated after the prior session’s pressure, as geopolitical risk premia unwound on more constructive signals around US–Greenland and Russia–Ukraine developments. WTI traded within a USD 59.52–59.81/bbl band, while Brent held a USD 64.29–64.53/bbl range.

- US natural gas futures eased slightly as traders digested the recent weather-driven surge tied to freezing US conditions and heightened heating demand.

- Spot gold extended its climb toward USD 5,000/oz, printing a peak of USD 4,967.52/oz, while spot silver hit a fresh ATH near USD 99/oz. Gains persisted despite calmer geopolitical headlines, with participants seemingly viewing dips as buying opportunities in an ongoing momentum-driven rally.

- Copper futures firmed alongside broader base metals, tracking positive APAC sentiment. 3M LME copper edged closer to USD 13,000/t, trading within a USD 12,848–12,937/t range.

- Goldman Sachs lowers its Summer'26 Henry Hub forecast to USD 3.75/MMBtu (prev. USD 4.50/MMBtu), maintains 2027 forecast at USD 3.80/MMBtu.

- US President Trump said Venezuelan oil will be divided up.

- Petrobras (PBR) refineries expected to operate at about 95% of capacity in 2026 (prev. 92% in 2025).

- Trump admin has required the majority of Venezuelan oil to be sold to the US and China can buy the oil at 'fair market prices'. Allowing China to purchase Venezuelan oil but not at "unfair, undercut" prices that Maduro sold oil to China to pay debts.

- US EIA Crude Oil Stocks Change (Jan/16) 3.602M vs. Exp. 1.1M (Prev. 3.391M).

- US EIA Cushing Crude Oil Stocks Change (Jan/16) 1.478 (Prev. 0.745).

- US EIA Gasoline Stocks Change (Jan/16) 5.977M vs. Exp. 1.7M (Prev. 8.977M).

- US EIA Gasoline Production Change (Jan/16) -0.246 (Prev. 0.029).

- US EIA Distillate Stocks Change (Jan/16) 3.348M vs. Exp. -0.2M (Prev. -0.029M).

- US EIA Weekly Crude Production Change, bbl -21k (Prev. -58k).

- Copper production at a Capstone Copper Corp. mine in northern Chile has halted amid a nearly three-week labour strike, Bloomberg reported.

CRYPTO

- Bitcoin saw mild gains but failed to mount USD 90,000 to the upside.

NOTABLE ASIA-PAC HEADLINES

- Japan's Lower House has been dissolved, as expected.

- China is likely to set 2026 economic growth target between 4.5-5.0%, SCMP reported citing sources.

- Japanese Finance Minister Katayama said details of the planned sales tax cut have not been decided; JGB rout appears to have receded. Have been in constant contact with US Treasury Secretary Bessent. Closely monitoring financial markets with a high sense of urgency.

DATA RECAP

- Japanese Inflation Rate YoY (Dec) Y/Y 2.1% (Exp. 2.2%, Prev. 2.9%).

- Japanese Core Inflation Rate YoY (Dec) Y/Y 2.4% vs. Exp. 2.4% (Prev. 3.0%).

- Japanese Inflation Rate MoM (Dec) M/M -0.1% (Prev. 0.3%, Rev. From 0.4%).

- Japanese Inflation Rate Ex-Food and Energy YoY (Dec) Y/Y 2.9% vs. Exp. 2.8% (Prev. 3%).

- Japanese S&P Global Manufacturing PMI Flash (Jan) 51.5 (Prev. 50.0).

- Japanese S&P Global Composite PMI Flash (Jan) 52.8 (Prev. 51.1).

- Japanese S&P Global Services PMI Flash (Jan) 53.4 (Prev. 51.6).

- Australian S&P Global Manufacturing PMI Flash (Jan) 52.4 (Prev. 51.6).

- Australian S&P Global Services PMI Flash (Jan) 56.0 (Prev. 51.1).

- Australian S&P Global Composite PMI Flash (Jan) 55.5 (Prev. 51).

- New Zealand Inflation Rate QoQ (Q4) Q/Q 0.6% vs. Exp. 0.5% (Prev. 1%).

- New Zealand Inflation Rate YoY (Q4) Y/Y 3.1% vs. Exp. 3% (Prev. 3%).

NOTABLE APAC EQUITY HEADLINES

- China is considering tighter rules for firms to list in Hong Kong amid deal quality concerns, Bloomberg reports.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said Greenland proposal and Board of Peace were discussed with US envoys; talks were constructive. Without solving the territorial issue, there is no prospect of long-term settlement in Ukraine.

- Russian envoy Dmitriev called the meeting between President Putin and US envoys important.

- Russia's Kremlin said the talks between President Putin and US envoys have concluded.

- US President Trump said Russian President Putin, alongside others, will have to make concessions to end the war in Ukraine. Putin and Zelensky want to make a deal. Ukraine war doesn't affect the US, it affects Europe.

- EU Commission President von der Leyen said Europe will continue to work on Arctic security, step up investments in Greenland and Arctic-ready equipment and deepen cooperation with partners in the region. Well-prepared with measures if tariffs are applied. Europe should use defence spending 'surge' on Arctic-ready equipment. Close to prosperity deal with the US and Ukraine.

- Russian defence ministry reported strategic bomber patrols conducted over Baltic Sea.

MIDDLE EAST

- US President Trump, on Iran, said they have a big force going towards Iran; watching Iran very closely and would rather not see something happen on Iran; will be doing a 25% secondary tariff on Iran.

OTHERS

- US President Trump posted "Maybe we should have put NATO to the test: Invoked Article 5, and forced NATO to come here and protect our Southern Border from further Invasions of Illegal Immigrants".

- US President Trump posted that the Board of Peace withdraws its offer for Canada to join.

- US President Trump said the US will work with NATO on Greenland security; there are good things for Europe within the framework. On the trilateral meeting with Ukraine and Russia, said "anytime we meet, it is good". There will be something on Greenland in 2 weeks.

- NATO's Rutte and Denmark's PM is to meet on Friday morning.

- US House narrowly rejects resolution to limit President Trump's war powers in Venezuela.

EU/UK

NOTABLE EUROPEAN EQUITY HEADLINES

- BASF (BAS GY) FY (EUR): Sales 59.7bln (exp. 60.7bln), Adj. EBITDA 6.6bln (exp. 6.87bln), EBIT 1.6bln, Net income 1.6bln, FCF 1.3bln. Guidance: FY FCF -600mln. FY adj. EBITDA 6.6bln (exp. 7.35bln).

- Ericsson (ERICB SS) Q4 2025 (SEK): Adj. EBITDA 12.70bln (exp. 10.48bln). Revenue 69.3bln (exp. 66.6bln); mandates a SEK 15bln share buyback.