"America Is Back!!": President Trump Celebrates S&P Topping 7,000 As 'Gamma Wall' Looms

After continuously hitting the 'Gamma Wall' discussed by Goldman's Brian Garrett...

...the S&P 500 index opened higher this morning after strong results from ASML (and a slew of AI industry headlines), trading above 7,000 for the first time...

President Trump took the opportunity to exclaim "America Is Back!!"

Will that jinx it?

Maybe... but there's another potential problem.

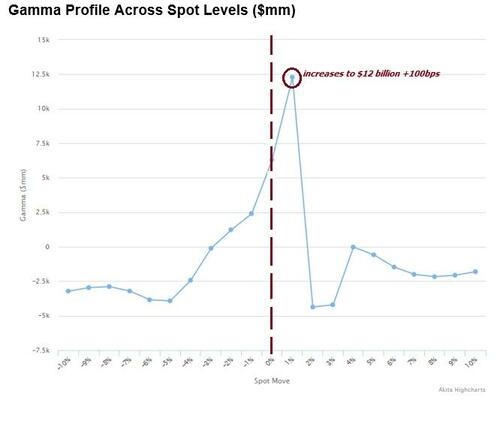

Going back to where we started, GS futures strats calculate $6bn of long gamma at spot, which increases to $12bn long gamma +100bps higher

In English, a 100bps rally in spx cash creates supply of ~35,000 e-minis from market makers

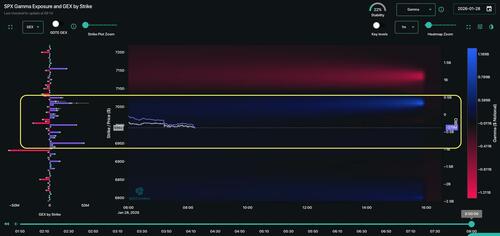

Goldman's vol desk desk believes the 7,000 strike is the peak concentration...

...beyond this level, the market doesn’t necessarily “flip short,” but the dynamic is much cleaner.

While many charts look "ready to break out" and calls are clearly bid (a benign FOMC and solid Mag earnings could certainly allow for fresh ATH), SpotGamma warns that this market is priced for pure perfection, and there is risk embedded in that.

Confirming Garrett's warning, there is a clear block of positive gamma today from 6,950 up to 7,010, which implies the market should be supported in this range.

Below 6,950 is a large negative gamma strike, and so we are now raising our Risk Pivot to 6,950.

Overhead resistance for today is into the 7,000-7,020 range.

Given the risk we see, SpotGamma's preference is for long calls and/or call spreads in the QQQ (vs long stock) as the IV is low and skew is neutral.

Back to the point of "stocks near breaking out", here is the MAGS (Mag7) ETF, and this comes into focus with much of this index reporting today into tomorrow.

Most of these Mag 7 names have estimated earnings moves of 5%, with a skew towards calls.

For bulls, if earnings are decent and these names break out it will be hard for equity indexes to sell off. That being said, there is a lot of positive gamma in these names, and with the skew toward calls it will likely take some really good earnings to evoke a big response. So our expectation here "less than ±5% moves make sense".

The setup into earnings is straightforward. Mega-cap leadership can keep the indexes moving higher, and a Nasdaq breakout gets validated if results and capex guidance are received as intended. While AI capex is squeezing free cash flows, the market is willing to live with that as long as the debt issuance remains capped and ROI improves as past investments start to increasingly pay off.