Apple Rises After Shocking China Sales Beat Offsets US Revenue Miss

Ahead of today's AAPL earnings report, we've had a very mixed picture from Mag 7 earnings so far: first, there was Microsoft, which crashed after its capex forecast unexpectedly jumped, then there was META, which soared after its capex forecast unexpectedly jumped (only in this case the company made up for it by pretending its ad revenue will also increase almost dollar for dollar with the new capex), and then there was TESLA which first dropped, then jumped, then dropped as the market digested the company's complete conversion from an auto company (now without the S and X models) and into a robotaxi "story" stock. As such, many are looking to AAPL to break the tie when it reports at 3pm today.

But before we look at the numbers, here’s what Wall Street is expecting:

- Revenue estimate $138.4 billion

- Products revenue estimate $107.69 billion

- Mac revenue estimate $9.13 billion

- IPad revenue estimate $8.18 billion

- Wearables, home and accessories estimate $12.13 billion

- Services revenue estimate $30.02 billion

Recall that during its fourth quarter conference call, Apple took the rare step of saying that it expects double-digit iPhone growth as well as 10-12% overall revenue growth. There was no way Apple would report such numbers unless it was 100% confident in that being the case.

As Bloomberg's Mark Gurman notes, Apple is projecting a monster quarter yet given the current climate around its AI crisis, the future of the company really hangs in the balance here, as it may be fair to say that if Apple beats estimates - or least meets expectations today - the current management of the company and way forward has some staying power. If, for some odd reason, the company misses expectations, we’re in for an extremely tough news cycle and the potential of real change in the months ahead.

In retrospect, AAPL was not making it up, because the stock has moved higher (even if it has erased much of the gains) after the smartphone company reported earnings which beat many expectations, while the iPhone had its best ever quarter largely thanks to China.

Here are the details:

- EPS $2.84 vs. $2.40 y/y, beating estimates of $2.68

- Revenue $143.76 billion, +16% y/y, beating estimate $138.4 billion

- Products revenue $113.74 billion, +16% y/y, beating estimate $107.69 billion

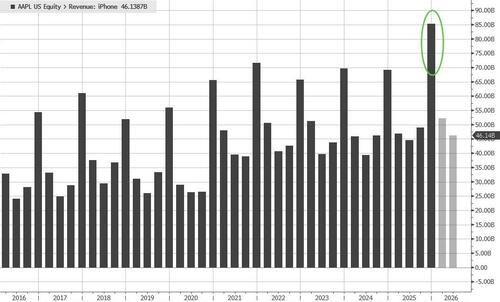

- IPhone revenue $85.27 billion, +23% y/y, beating estimate $78.31 billion

- Mac revenue $8.39 billion, -6.7% y/y, missing estimate $9.13 billion

- IPad revenue $8.60 billion, +6.3% y/y, beating estimate $8.18 billion

- Wearables, home and accessories $11.49 billion, -2.2% y/y, missing estimate $12.13 billion

- Services revenue $30.01 billion, +14% y/y, missing estimate $30.02 billion

- Products revenue $113.74 billion, +16% y/y, beating estimate $107.69 billion

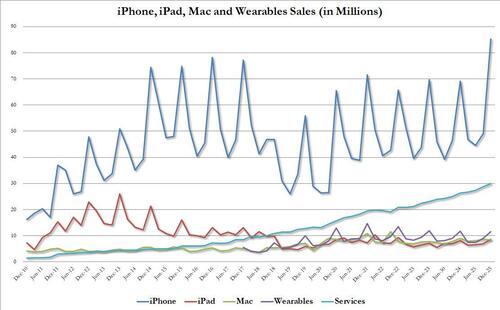

Broken down by product...

... show that iPhone revenue - which hit a record high in Q1 thanks to China - was the most notable:

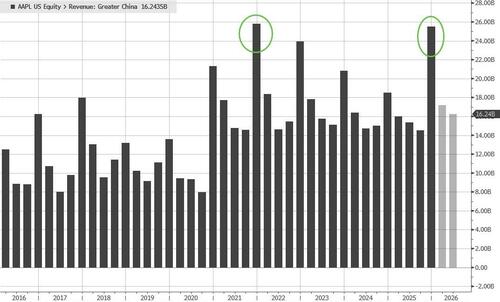

Taking a closer look at the Geographic breakdown, one region stands out:

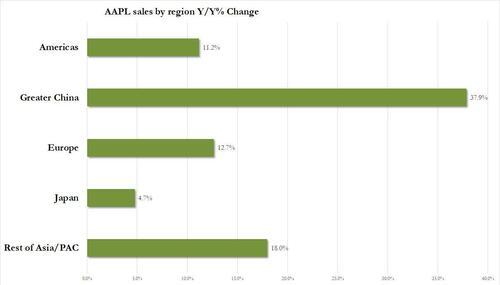

- Americas rev. $58.53 billion, +11% y/y, missing estimate $59.06 billion

- Europe revenue $38.15 billion, +13% y/y, beating estimate $36.82 billion

- Japan revenue $9.41 billion, +4.7% y/y, beating estimate $9.24 billion

- Rest of Asia Pacific revenue $12.14 billion, +18% y/y, beating estimate $11.39 billion

and...

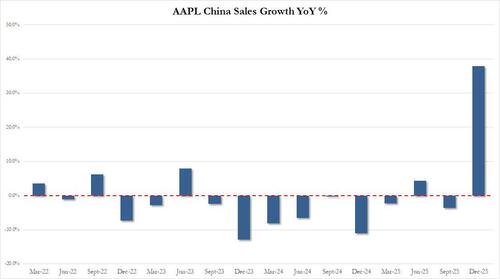

- Greater China rev. $25.53 billion, +38% y/y, smashing estimate $21.82 billion

Yes: it was all about China, because while sales in the US actually missed, it was that country where no number is ever cooked - pardon the pun - where revenues (mostly iPhone revenues) grew a stunning 38% to $25.53bn, smashing estimates of a $21.82bn number...

... yet which in context seems very, very fishy, and makes one wonder if Cook cooked numbers with Xi's help.

Going down the income statement:

- Total operating expenses $18.38 billion, +19% y/y, above estimate $18.18 billion

- Research and development operating expenses $10.89 billion, +32% y/y, above estimate $10.14 billion

- SG&A operating expense $7.49 billion, +4.4% y/y, below estimate $8.03 billion

- Gross margin $69.23 billion, +19% y/y, beating estimate $65.5 billion

- Cash and cash equivalents $45.32 billion, +50% y/y, below estimate $49.73 billion

Some more details from the press release:

- Installed Base Now Has More Than 2.5B Active Devices

- Declares A Cash Dividend of $0.26 Per Share

- Generated Nearly $54 Billion in Operating Cash Flow

- Declared A Cash Dividend of $0.26 Per Share

Yet while the stocks spiked sharply higher on the news of the massive iPhone revenue beat, it has since faded much of the move once again, perhaps as investors inquire what the revenue/margin hit to iphone will be from buying RAM memory which has triple in price in recent weeks.