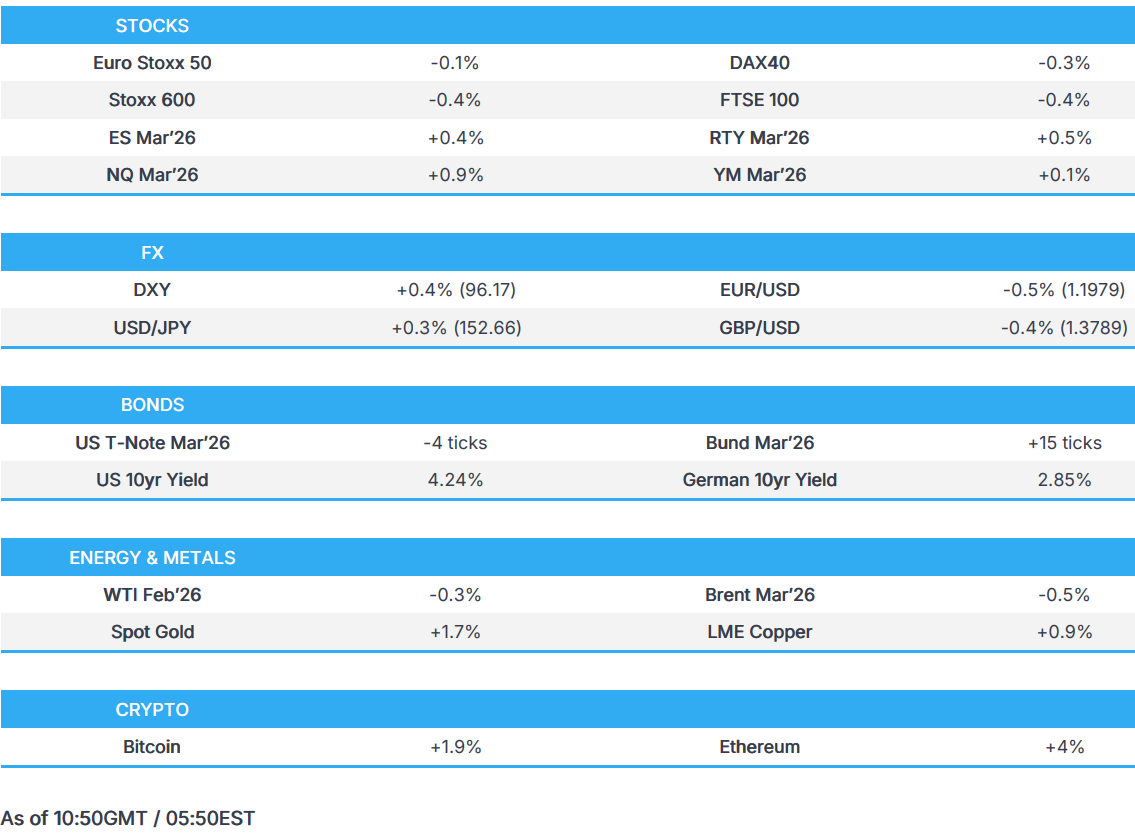

ASML and SK Hynix earnings lift global tech sectors; DXY rebounds slightly, weighing on G10 currencies - Newsquawk US Market Open

- European bourses are broadly lower; LVMH (-8%) sinks post-earnings, whilst ASML (+4.9%) gains after the company beat across its headline metrics, provided a rosy outlook, and announced a EUR 12bln share buyback.

- NQ boosted by ASML & SK Hynix earnings, as well as reports that China is said to have approved the first batch of NVIDIA's (+1.7%) H200 AI chips for import.

- DXY attempts a recovery to the detriment of G10s; AUD among the better performers post-CPI.

- USTs slightly softer pre-Fed, Bunds little moved on a robust auction, JGBs bid overnight.

- Crude benchmarks reverse earlier gains; Spot XAU extends above USD 5,300/oz; Copper regains USD 13k/t.

- Looking ahead, highlights include Fed Policy Announcement, BoC Policy Announcement, BCB Policy Announcement. Speakers include ECB's Schnabel, BoC's Macklem, Fed Chair Powell. Supply from the US. Earnings from Microsoft, Meta, Tesla, Lam, ServiceNow, IBM, Starbucks & AS.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.4%) are generally trading with modest losses, aside from the AEX, which has been boosted by post-earnings strength in heavyweight ASML (+4.8%). The company beat across its headline metrics, provided a rosy outlook, and announced a EUR 12bln share buyback.

- European sectors hold a negative bias. Tech leads (boosted by ASML), whilst Consumer Products has been pressured by losses in LVMH (-7.1%) after its results disappointed.

- US equity futures are mostly positive in the pre-market, with the NQ (+0.8%) outperforming on the back of improved sentiment for the Tech sector following positive ASML and SK Hynix earnings. Furthermore, reports that China has approved imports of over 400,000 NVIDIA H200 chips are further underpinning the tech sector.

- ASML (+4.9%) - Q4 2025 (EUR): Sales 9.72bln (exp. 9.26bln, guided 9.2-9.8bln), Orders 13.2bln (exp. 6.95bln), guides Q1 2026 Revenue 8.2-8.9bln (exp. 8.11bln), guides FY26 sales 34-39bln (exp. 36.5bln); Announces up to EUR 12bln share buyback. "In the last months, many of our customers have shared a notably more positive assessment of the medium-term market situation, primarily based on more robust expectations of the sustainability of AI-related demand. This is reflected in a marked step-up in their medium-term capacity plans and in our record order intake.

- Seagate Tech (+11.5% pre-market) Q2 2026 (USD): Adj. EPS 3.11 (exp. 2.83), Revenue 2.83bln (exp. 2.74bln). Outlook. Q3 adj. EPS 3.40 (exp. 2.99). Q3 revenue 2.9bln (exp. 2.78bln).

- Texas Instruments (+7.5%) Q4 2025 (USD) EPS 1.27 (exp. 1.29), Revenue 4.41bln (exp. 4.45bln), FCF 1.33bln (exp. 884.7mln). Guidance:. Q1 EPS 1.22-1.48 (exp. 1.25). Q1 revenue 4.32-4.68bln (exp. 4.41bln).

- Volvo (+1.5%) Q4 (SEK) EPS 4.73 (exp. 4.34), Sales 123.8bln (exp. 121.7bln), Op. Income 12.8bln (exp. 11.7bln); raises FY26 NA truck orders 265k (prev. guided 250k). The Board of Directors proposes an ordinary dividend of SEK 8.50 per share and an extra dividend of SEK 4.50 per share. noted that there has been a slight improvement in some markets.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is attempting to claw back some of yesterday’s lost ground, after the index dropped from a high of 97.286 to a low of 95.551 amid the ongoing de-dollarisation theme. The data docket is quiet, so focus will be on the FOMC, which is expected to hold rates at 3.50–3.75%. Markets are focused less on the decision itself and more on any hints around how long the Fed remains patient before cutting, with around 45bps of easing priced by year-end.

- USD/JPY is consolidating after its recent slide below the 100 DMA (153.65) yesterday, which saw the pair trade within a 152.09–154.87 range. The pair currently trades around the mid-point of the 152.14–153.06 band at the time of writing.

- EUR/USD reached a high of 1.2082 on Tuesday (vs. a low of 1.1851), levels last seen around mid-2021, supported by broader USD weakness. The pair’s strength comes ahead of next week’s ECB meeting, where commentary will be watched for signs of concern that the ECB may miss its inflation target to the downside. The pair currently trades below 1.2000 within a 1.1970–1.2045 intraday range.

- Antipodeans are among the better performers. AUD/USD briefly rose following Australian CPI data, where the monthly December reading printed firmer than expected, while the headline quarterly figures matched estimates. However, the RBA-preferred trimmed mean inflation measure exceeded forecasts and remained above the RBA’s 2–3% inflation target. The data prompted banks such as ANZ, Westpac, CBA, and NAB to back a February rate hike from the RBA, with markets pricing a 70%+ probability of this outcome.

- South Korea's Presidential Adviser said that US Treasury Secretary Bessent's earlier comment on KRW reflects views that Korea's investment might become difficult if it raises anxiety in the FX market. Hopes that Korea's US investment bill will be passed in February and will communicate with the US to prevent tariffs from being raised. Alaska LNG project has not been discussed between both countries and will be reviewed under principle of commercial feasibility after investment fund is launched.

FIXED INCOME

- JGBs were bid overnight. Initial gains were exacerbated by a strong 40yr auction, which helped lift the benchmark to a 131.77 peak, with gains of just under 50 ticks at best. Aside from this, focus was on comments from Trump suggesting that Japan and China are always looking to devalue their currencies—remarks which may have weighed on Japanese yields from the start of trade.

- USTs trod water overnight in the typical pre-FOMC holding pattern. Since then, a bout of pressure has emerged, with USTs sliding to a 111-21 base, down just over 4 ticks at worst. For the Fed, the full Newsquawk preview is available: rates are expected to remain unchanged in the 3.50–3.75% range, with focus on the number of dissents, any changes to statement language around the labour market, and/or additional adjustments.

- Bunds have been grinding higher through the morning, reaching a 128.12 peak as, despite strong ASML earnings, European sentiment remains on the back foot. There has been no move from ECB speakers thus far, who have stuck to the script. A robust 2036 Bund auction (b/c 1.65x vs prev. 1.29x) had little impact on the benchmark.

- Gilts opened around 10 ticks higher, reaching a 91.11 peak, before fading back to the figure, where they currently reside. As such, the benchmark is broadly flat on the day, with UK-specific drivers light and the bias likely to remain contained into the Fed.

- Japan sold JPY 400bln in 40-year JGBs; b/c 2.76x (prev. 2.59x), highest accepted yield 3.720% (prev. 3.555%). Price at the highest accepted yield 87.27 (prev. 90.40).

- Germany sells EUR 4.604bln vs exp. EUR 6bln 2.90% 2036 Bund: b/c 1.65x (prev. 1.29x), average yield 2.85% (prev. 2.83%), retention 23.3% (prev. 24.3%)

COMMODITIES

- Crude benchmarks initially gained at the start of the Asia-Pac session, following on from Tuesday’s bid, before paring back those gains. As of writing, WTI and Brent are trading near session lows of USD 62.08/bbl and USD 66.14/bbl, respectively, after peaking earlier in the session at USD 63.00/bbl and USD 67.13/bbl. News flow has been light so far, as markets continue to absorb the effects of the Arctic storm.

- With gas output slowly returning as the worst of the Arctic storm passes, natural gas futures continue to pare back gains made in recent sessions. Henry Hub futures have fallen back below USD 4.00/MMBtu, currently trading around USD 3.63/MMBtu, while Dutch TTF remains below EUR 38/MWh.

- Precious metals continue to trade at record levels, with spot gold extending to another ATH at USD 5,311/oz, supported by the weaker dollar in Tuesday’s session following Trump’s comments indicating comfort with the recent decline in the greenback. Spot silver remains near record highs at USD 113.80/oz, as the London liquidity squeeze persists.

- 3M LME copper gained throughout the APAC session, aided by a weaker dollar and outperformance in Chinese equities. The red metal reclaimed the USD 13,000/t handle, peaking at USD 13.25k/t, before oscillating within a roughly USD 100/t range as the European session gets underway.

- Vitol Asia forecasts H1 2026 crude build of 700k BPD.

- China's Shanghai Futures Exchange to adjust price limits and margin requirement for some gold and silver futures contracts from the 30th January closing settlement.

- Standard Chartered forecasts copper prices in H1'26 at USD 12.96k compared with USD 11.47k in H2'26; USD softness and sharp moves in gold and silver has supported copper.

- Kazakhstan's Energy Minister said oil output decline will ensure the country remains within OPEC+ quotas, adds Kazakhstan's energy minister said, oil production in Kazakhstan declined around 900,000 tons after halts at Tengiz and Korolev.

- ExxonMobil (XOM) executive said LNG demand will remain strong for the next 10 years and LNG demand forecast to double between now and 2050.

- Thailand Central Bank Governor said cap in gold trading will take effect in March.

- US Weekly Private Inventory Data (bbls): Crude -0.2mln (exp. +1.8mln), Distillate +2.0mln (exp. -0.6mln), Gasoline-0.4mln (exp. +1.0mln), Cushing -0.0mln.

TRADE/TARIFFS

- China has resumed the purchase of Canadian canola, Bloomberg reported citing sources; crushers in China have booked cargoes for loading in the next few months.

- South Korea's Presidential Adviser said they cannot rule out the possibility of the US mentioning a tariff hike again because of future disagreement over investment.

- EU and Vietnam in a joint statement are set to agree on a deeper connection on critical minerals and semiconductors.

- US President Trump said we will find a solution together with South Korea when asked about his announcement of raising tariffs against Korea.

- US President Trump said we're making a lot of good deals, Fox News interview.

- USTR's Greer said Chinese EVs won't enter the US from Canada without heavy levies, Fox Business reported; criticizes South Korean digital services legislation. The US is still imposing a 50% tariff rate on Indian goods. India has made a lot of progress weaning off Russian oil.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer delays decision on Chinese-built wind farm factory after security fears, according to The Times.

- Leaders of Dutch political parties reach an agreement on forming minority government.

- Maersk (MAERSKB DC) announces a stoppage in operations in the West Mediterranean terminals, adding that there's no clear sign on when operations are to resume.

NOTABLE EUROPEAN DATA RECAP

- UK ONS announces the final ‘Go’ decision for the introduction of supermarket scanner data into consumer inflation statistics.

- German GfK Consumer Confidence (Feb) -24.1 vs. Exp. -25.5 (Prev. -26.9, Low. -28, High. -22).

- German GfK Consumer Confidence (Feb) -24.1 (Prev. -26.9, Low. -28, High. -22).

CENTRAL BANKS

- US President Trump affirms that he will announce Fed chair pick soon.

- Minutes from BoJ's December 18th-19th meeting noted that members said it is appropriate to keep raising rates if the outlook is met, while a member said waiting another meeting in raising rates would be risky given impacts of FX on inflation. Most members said BoJ should not have a preset idea on rate hike pace and must scrutinise the economy, prices and markets in making decisions at each meeting. A few members said adjusting degree of monetary support will help stabilise markets and have merits to the economy. A member warned that divergence of real rates from equilibrium may impair long-term economic growth.

- ECB's Villeroy said the ECB are closely monitoring the euro and its effect on inflation, adds there is no target for the euro exchange rate.

- ECB's Cipollone said uncertainty may increase, hitting a recovery, and warned that global turbulence could hit the euro area, according to Bloomberg.

- ECB's Kocher said the central bank would need to act if the euro keeps gaining, according to FT.

- ANZ now sees the RBA raising rates by 25bps at its meeting next week, while it views this as a single insurance tightening and not the start of a series of hikes.

- New Zealand Finance Minister Willis said the RBNZ said we'll be easing off the accelerator at some point and will be guided by data.

- Thailand Central Bank Governor Vitai said the economy may grow 1.5%-1.7% in 2026, adds need to tackle structural issues, and that Thailand is facing US tariffs and structural problems.

NOTABLE US HEADLINES

- US President Trump said under his leadership, economic growth is exploding to numbers not seen before.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin Spokesperson Peskov said work on Ukraine peace talks is underway, however they are very complicated negotiations.

- "Russia and India to conduct naval exercises in the Indian Ocean in February", Al Arabiya reported citing Tass.

- USTR's Greer said Chinese EVs won't enter the US from Canada without heavy levies, Fox Business reported; criticizes South Korean digital services legislation. The US is still imposing a 50% tariff rate on Indian goods. India has made a lot of progress weaning off Russian oil.

MIDDLE EAST

- Iran's Foreign Minister said he hasn't been in contact with US Envoy Witkoff recently, adding that there hasn't been any negotiation requests.

- Military source in the Houthi ranks in Yemen told the Lebanese newspaper that the Houthis will not allow any ship or American aircraft carrier to approach the Red Sea or the Arabian Sea due to the threat to Yemen, via X.

- The Rafah crossing will open next Sunday in both directions, according to the Israeli Walla website.

OTHERS

- EU's Defence Commissioner said Europe must quickly build their defence independently.

- "Russia and India to conduct naval exercises in the Indian Ocean in February", Al Arabiya reported citing Tass.

- South Korea and Japan will conduct defence ministerial talks in Yokusuka this week, according to Yonhap.

- North Korea said it had tested a large calibre multiple rocket launch system, according to KCNA.

CRYPTO

- Bitcoin is on a firmer footing and back above USD 89k; Ethereum outperforms and holds around USD 3k.

APAC TRADE

- APAC stocks traded mixed with an early positive bias seen following the mostly constructive handover from Wall Street, although some cautiousness began to seep through ahead of looming key risk events.

- ASX 200 was subdued with the index dragged lower by weakness in tech and consumer stocks, while the predominantly firmer-than-expected inflation data from Australia supports the case for a hike at next week's RBA meeting.

- Nikkei 225 underperformed from the open, following the recent currency strength spurred by intervention speculation and US President Trump's FX-related rhetoric.

- Hang Seng and Shanghai Comp were in the green with energy and telecom stocks among the index leaders in Hong Kong, while the mainland was kept afloat after developer China Vanke won creditor approval to extend another two CNY bonds and with a report noting that China approved the first batch of NVIDIA's H200 AI chips for import involving several hundred thousand H200 AI chips.

NOTABLE ASIA-PAC HEADLINES

- China is reportedly expected to move to more targeted measures across different sectors to reduce excessive competition and result in quality developments, Securities Times reported citing sources.

NOTABLE APAC DATA RECAP

- Australian CPI QQ (Q4) 0.6% vs Exp. 0.6% (Prev. 1.3%).

- Australian RBA Trimmed Mean CPI YoY (Dec) Y/Y 3.3% vs. Exp. 3.3% (Prev. 3.2%, Low. 3.1%, High. 3.3%).

- Australian Inflation Rate YoY (Dec) Y/Y 3.8% vs. Exp. 3.6% (Prev. 3.4%, Low. 3.0%, High. 3.8%).

- Australian RBA Quarterly Weighted Median CPI Y/Y (Q4) 3.20% vs. Exp. 3.10% (Prev. 2.80%).

- Australian RBA Quarterly Weighted Median CPI Q/Q (Q4) 0.90% vs. Exp. 0.80% (Prev. 1.00%).

- Australian RBA Quarterly Trimmed Mean CPI Y/Y (Q4) 3.40% vs. Exp. 3.30% (Prev. 3.00%).

- Australian RBA Quarterly Trimmed Mean CPI Q/Q (Q4) 0.90% vs. Exp. 0.80% (Prev. 1.00%).

- Australian Trimmed Mean CPI YY (Dec) 3.3% vs. Exp. 3.3% (Prev. 3.2%).

- Australian CPI YY (Q4) 3.6% vs Exp. 3.6% (Prev. 3.2%).

NOTABLE APAC EQUITY HEADLINES

- SK Hynix (000660 KS), on the earnings call, said they are to establish a US unit specialised in AI solutions.

- SK Hynix (000660 KS) expects a considerable increase in capex during 2026. Sees server set growth in the high-teen percentages. Expect short-term shipment adjustments due to deteriorated consumer sentiment. PC and mobile memory demand will trail the market. Expect 2026 DRAM demand to increase by over 20% Y/Y. HBM revenue more than doubled Y/Y. Growth momentum accelerated further in Q4. Sees considerable supply tightness in Q1.

- UMC (2303 TT / UMC) FY25 (TWD): Revenue 237.6bln (exp. 235.6bln), Net 41.7bln (exp. 42.1bln). Q4:. Revenue 61.81bln (prev. 59.13bln). Gross Margin 30.7% (prev. 29.8%). Net Income 10.06bln (prev. 14.98bln). EPS 0.81/shr (prev. 1.20/shr). Co-president Wang:. "... flattish wafer shipments amid mild demand across most markets.". Into Q1, "expect wafer demand to remain firm". "Confident that 2026 will be another growth year as tape-outs on our 22nm platforms accelerate and other new solutions continue to gain business traction.".