Axios reports that the Trump admin are edging closer to a war with Iran than people realise; US equity futures are in the green - Newsquawk US Opening News

- The Trump administration is closer to a major war with Iran than people realise, Axios reports citing sources; a military operation would likely be a massive, weeks long campaign that will be a joint US-Israeli attack.

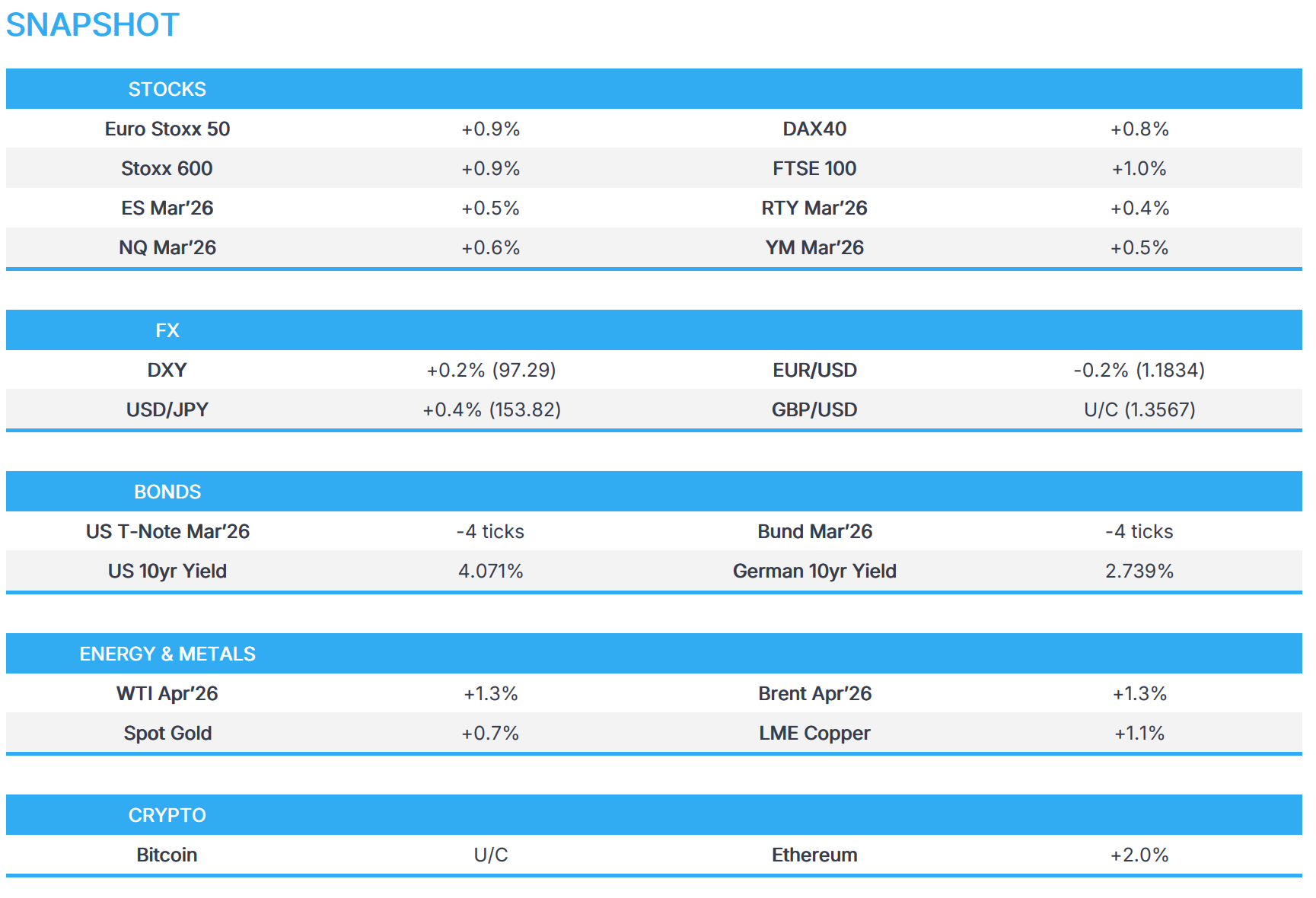

- European equities entirely in the green, with IBEX leading the way; US equity futures continue to extend Tuesday's gains.

- DXY firmer, Kiwi hit post-RBNZ while Cable holds afloat following UK inflation.

- Gilts choppy post-CPI; USTs slightly lower ahead of FOMC minutes.

- WTI and Brent nurse prior day losses as Ukraine talks conclude; Metals rebound.

- Looking ahead, highlights include US Durable Goods, Industrial Production (Jan), Housing Starts (Nov/Dec), Atlanta Fed GDP, FOMC Minutes (Jan). Speakers include ECB’s Schnabel & Fed's Bowman. Supply from the US. Earnings from Analog, Carvana, DoorDash, Booking Holdings, Moody's, Garmin & Orange.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.7%) are trading entirely in the green, with the IBEX (+1.1%) leading gains, closely followed by the FTSE MIB (+0.9%) and the FTSE 100 (+0.7%).

- European sectors are broadly in the green, with Basic Resources (+1.9%) and Banks (+1.5%) leading the way while Chemicals (-1.1%) lags. A rebound in metals prices and positive Glencore (+3.3%) earnings are helping lift the Basic Resources sector, while the Board of Monte dei Paschi approved a plan to fully integrate Mediobanca and delist the bank while preserving the brand.

- US equity futures (ES +0.5%, NQ +0.6%, RTY +0.4%) are entirely in the green, continuing to reverse the losses seen early in Tuesday's trading session.

- BAE Systems (BA/ LN) FY (GBP): Underlying EBIT 3.32bln (exp. 3.27bln), Div/shr 36.3p (exp. 35.5p), Revenue 30.7bln (exp. 30.7bln); guides FY26 underlying EBIT +9-11%, Revenue +7-9%.

- Glencore (GLEN LN) FY (USD): Revenue 247.5bln (exp. 233.9bln); Adj. EBITDA 13.51bln (exp. 13.22bln), Adj. EBIT 5.98bln (exp. 5.72bln), is to return USD 2bln to shareholders.

- Nvidia Corp (NVDA) announces multiyear strategic partnership with Meta (META); collaborating on deploying Nvidia Vera CPUs, with potential for large-scale deployment in 2027; Meta builds AI infrastructure with Nvidia.

- Palo Alto Networks Inc. (PANW) Q2 2026 (USD): Adj. EPS 1.03 (exp. 0.94), Revenue 2.594bln (exp. 2.58bln). Guidance: Q3 adj. EPS 0.78-0.80 (exp. 0.92). Q3 revenue 2.941-2.945bln (exp. 2.60bln).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- G10s are mostly lower across the board; GBP remains afloat following above-expected Core and Services metrics, whilst the NZD is the clear laggard in the aftermath of the RBNZ’s decision to keep rates steady (as expected), but held a dovish skew.

- DXY is mildly firmer this morning, and currently trades at the upper end of a 97.11-97.32 range, holding just above its 21 DMA at 92.20. Further upside could see a test of the prior day’s high at 97.54. Really not much driving things for the index this morning, but could face some volatility on a) geopols, b) US data, c) FOMC Minutes.

- GBP remains resilient vs the USD strength this morning, following the region’s inflation report, with particular focus on the hotter-than-expected Services and Core metrics. In more detail, the headline printed in line with the market consensus at 3.0% Y/Y, and as such, slightly hotter than the BoE's 2.9% forecast for the period. The headline was also accompanied by a hotter-than-expected core and services figure. M/M metrics were broadly as expected, unwinding the December base effects. Taking a look at food inflation, it fell to 3.6% (prev. 4.5%); ING suggests that hawks can become “a little more relaxed about the upside risks to inflation”. ING sticks with its call for a March cut and then another by June. Market pricing shifted a little dovishly, with the probability of a March cut now seen at 95% vs 84% pre-release. Cable initially knee-jerked lower, and then immediately reversed that move to print a session peak at 1.3577; the upside then gradually petered out, to now trade within a 1.3549-1.3577 range.

- NZD is the clear underperformer this morning, following the RBNZ’s decision to keep rates steady (as expected), though the accompanying commentary held a dovish skew. In brief, the Bank stated that the committee will continue to assess incoming data carefully and if the economy evolves as expected, monetary policy is likely to remain accommodative for some time. Furthermore, it stated that inflation is most likely returning to within the committee's 1–3% target band in the current quarter and that, conditional on the central economic outlook, the OCR is projected to remain around its current level in the near term before increasing from late 2026. NZD/USD currently trades around the 0.60 mark (coincides with its 21 DMA), within a 0.5989-0.6053 range.

FIXED INCOME

- A bearish start for fixed income, though only modestly with USTs lower by a handful of ticks in a narrow 112-30+ to 113-05+ band. US specifics thus far are a little light as we continue to digest the better-than-expected data on Tuesday and Fed speak that was a little hawkish from voter Barr, weighing on the complex. More insight will be derived from the FOMC Minutes this evening, which follows a 20yr auction and Fed's Bowman.

- The main focus point this morning is Gilts, though the benchmark is little changed as things stand. Opened lower by 17 ticks and then fell one more to a 92.03 trough in reaction to the morning's CPI data, while the headline Y/Y was in-line with market consensus, it was hotter than the BoE's view; additionally, core and services figures came in hotter than the market forecast. However, the net takeaway from the release is that it doesn't definitely solve the March vs April debate, with the decision in March looking like another 5-4 with Bailey to tie-break.

- Bunds are little moved in a 129.15-39 band, no move to the morning's Final French CPI series. The main point of focus for the EZ is reporting in the FT, among others, that ECB President Lagarde could step down before her term ends in October 2027. The FT outlines, citing sources, that this would ensure both French President Macron and German Chancellor Merz are in power and have a significant say in appointing a successor. No move to a tepid 2036 Bund auction.

- Germany sells EUR 4.238bln vs exp. EUR 5.5bln 2.90% 2036 Bund: b/c 1.46x (prev. 1.65x), average yield 2.73% (prev. 2.85%), retention 22.9% (prev. 23.3%).

- Kenya reportedly intends to issue additional USD denominated noted, potentially in multiple series, Bloomberg reported.

- Australia sold AUD 1.2bln 4.25% October 2035 bonds, b/c 3.90, avg. yield 4.7439%.

COMMODITIES

- Crude prices are nursing prior day losses following yesterday's geopolitical development between the US and Iran, which ended on a more positive note, though caution remains. Thus far, officials suggest that talks were substantive and some issues were clarified, but highlighted that talks were difficult. Thereafter, the crude complex notched session highs following an Axios report, which suggested that the Trump administration is closer to a major war with Iran than people realise. Brent Apr'26 moved higher from USD 67.74/bbl to a high of USD 68.08/bbl over six minutes.

- In the metal space, spot gold and silver made gradual strides higher during the APAC session. XAU trades above the USD 4,900/oz within a USD 4869.95-4961.4/oz range, whilst XAG trades just above USD 75/oz within the 72.2305-57.783 range. Newsflow has been light for precious metals thus far in the European session.

- Copper prices are also rebounding, nursing prior day losses and in tandem with the improving risk tone. 3LME copper trades in the upper end range of USD 12.649-12.731.2k/t. Reminder that China, the largest market for copper, remains closed due to the Chinese new year’s.

- Hungary seeks EU approval to import Russian seaborne crude, says the Hungarian Minister of Foreign Affairs and Trade.

- Slovakia has declared an oil emergency and will release oil from its state reserves.

- US Energy Secretary Wright said they are looking to end Iran's progress towards nuclear weapons and want IEA nations to focus on energy security.

- Study shows that US has enough raw copper to meet domestic demand and can meet 146% of annual demand using raw copper from overseas and domestic mines and from scrap, while China 40% of its demand, according to Benchmark Mineral Intelligence cited by FT.

TRADE/TARIFFS

- Japanese PM Takeichi confirms to have agreed with the US on the first set of investment projects.

NOTABLE EUROPEAN DATA RECAP

- UK Services Inflation Rate (Jan) Y/Y 4.4% (exp. 4.3%, Prev. 4.5%).

- UK Inflation Rate MoM (Jan) M/M -0.5% vs. Exp. -0.5% (Prev. 0.4%, Low. -0.6%, High. -0.4%).

- UK Inflation Rate YoY (Jan) Y/Y 3.0% vs. Exp. 3.0% (Prev. 3.4%, Low. 2.9%, High. 3.5%).

- UK Core Inflation Rate MoM (Jan) M/M -0.6% vs. Exp. -0.7% (Prev. 0.3%, Low. -0.8%, High. -0.6%).

- UK Core Inflation Rate YoY (Jan) Y/Y 3.1% vs. Exp. 3.1% (Prev. 3.2%, Low. 2.9%, High. 3.3%).

- UK PPI Output MoM (Jan) M/M 0% vs. Exp. 0.2% (Prev. 0%).

- UK PPI Core Output MoM (Jan) M/M 0.2% (Prev. -0.2%, Rev. From -0.1%).

- UK PPI Input YoY (Jan) Y/Y -0.2% (Prev. 0.5%, Rev. From 0.8%).

- UK PPI Input MoM (Jan) M/M 0.4% vs. Exp. 0.4% (Prev. -0.5%, Rev. From -0.2%).

- UK PPI Output YoY (Jan) Y/Y 2.5% (Prev. 3.1%, Rev. From 3.4%).

- UK PPI Core Output YoY (Jan) Y/Y 2.9% (Prev. 3.1%, Rev. From 3.2%).

- UK Retail Price Index MoM (Jan) M/M -0.5% vs. Exp. -0.4% (Prev. 0.7%, Low. -0.6%, High. -0.2%).

- UK Retail Price Index YoY (Jan) Y/Y 3.8% vs. Exp. 3.9% (Prev. 4.2%, Low. 3.7%, High. 4.1%).

- French Inflation Rate YoY Final (Jan) Y/Y 0.3% vs. Exp. 0.3% (Prev. 0.8%).

- French Inflation Rate MoM Final (Jan) M/M -0.4% vs. Exp. -0.3% (Prev. 0.1%).

NOTABLE EUROPEAN HEADLINES

- UK Chancellor Reeves reiterates that the UK will take defense spend past 2.6% in future budgets.

CENTRAL BANKS

- RBNZ keeps the OCR at 2.25%, as expected, while it stated that the committee will continue to assess incoming data carefully. If the economy evolves as expected, monetary policy is likely to remain accommodative for some time. Committee is confident that inflation will fall to the 2% midpoint over the next 12 months due to spare capacity in the economy, modest wage growth, and core inflation within the target band. Inflation is most likely returning to within the committee's 1–3% target band in the current quarter.

- RBNZ Governor Breman said OCR trajectory is aligned with the anticipated evolution of the economy, adds OCR track indicates there is a possibility of a hike towards the end of the year but noted Q4 hike is not fully priced in to the OCR track.

- RBNZ Governor Breman said forward path reflects stronger economic outlook.

- Fed's Daly (2027 voter) said models show productivity gains are lifting the neutral rates, labour market shows less churn and dynamism, adds impact on neutral rate is unlikely in the near term and growth is solid, but firms cite uncertain demand.

- ECB's Villeroy said the ECB has won the battle against inflation, domestic French inflation is undershooting on temporary factors but it is not too low.

- ECB President Lagarde is expected to leave the ECB, before her eight-year term ends in October 2027, according to FT citing a person familiar with her thinking. However, ECB said that Lagarde remains committed to her role and has not made a decision on her departure.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine's President Zelensky tells reporters that they've agreed to continue peace discussions, adds that talks were difficult and positions are different for now.

- Head of Ukrainian delegation says negotiations were substantive and there was progress; a number of issues were clarified.

- Update of new round of Ukraine talks is that there's been no concrete date set, IFX reported.

- The top Russian negotiator said the talks were difficult but business-like, RIA reported.

- Ukraine talks in Geneva have ended, new round of talks will be held soon, RIA reported.

- US Special Envoy Witkoff said US facilitated the third trilateral meeting between Ukraine and Russia, adds Ukraine and Russia agreed to update leaders and pursue an agreement.

MIDDLE EAST

- The Trump administration is closer to a major war with Iran than people realise, Axios reports citing sources; a military operation would likely be a massive, weeks long campaign that will be a joint US-Israeli attack.

- US Energy Secretary Wright said they are looking to end Iran's progress towards nuclear weapons and want IEA nations to focus on energy security.

- Iran and Russia are reportedly said to conduct navy drills in the Sea of Oman and Northern Indian Ocean on February 19th.

OTHERS

- US Secretary of State Rubio has been holding secret talks with the grandson of Cuba's Castro, Axios reported citing sources.

- US State Department senior official said the US would resume nuclear tests to match 'opaque' Chinese activity and flagged new details about a 2020 test the US recently accused China of secretly conducting, according to SCMP.

CRYPTO

- Bitcoin is trading rangebound around USD 68,000 while Ethereum returns above USD 2,000.

APAC TRADE

- APAC stocks traded higher in continued thin conditions as many regional bourses remained closed for holidays.

- ASX 200 mildly gained amid outperformance in real estate, tech and financials, with the latter helped by gains in Big 4 bank NAB post-earnings, although miners, materials and resources were at the other end of the spectrum after the prior day's commodities-related pressure.

- Nikkei 225 rallied back above the 57,000 level with sentiment in Japan underpinned by the better-than-expected trade data for January, which showed the fastest pace of increase in exports in more than three years.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi affirms will consider revision of constitution and wants to pass budget and tax reform bill quickly, adds to consider revision of imperial household law.

- Japan's Finance Minister Katayama said will carry out responsible fiscal policy, while keeping in mind the IMF's preliminary policy recommendation.

- IMF said if volatility hits market liquidity, the BoJ should be ready for targeted interventions, such as emergency bond buying, and that Japan should avoid cutting consumption tax as it would weaken fiscal space and raise fiscal risks.

NOTABLE APAC DATA RECAP

- Australian Wage Price Index QoQ (Q4) Q/Q 0.8% vs. Exp. 0.8% (Prev. 0.8%, Low. 0.7%, High. 0.8%).

- Australian Wage Price Index YoY (Q4) Y/Y 3.4% (Prev. 3.4%, Low. 3.3%, High. 3.4%).

- Australian Westpac Leading Index MoM (Jan) M/M -0.1% (Prev. 0.1%).

- Australian Westpac Leading Index MM (Jan) -0.1% (Prev. 0.1%).

- Japanese Imports YoY (Jan) Y/Y -2.5% vs. Exp. 3% (Prev. 5.2%, Rev. From 5.3%, Low. -3.3%, High. 7%).

- Japanese Exports YoY (Jan) Y/Y 16.8% vs. Exp. 12% (Prev. 5.1%, Low. 4.9%, High. 16.1%).

- Japanese Balance of Trade (Jan) -1152.7B vs. Exp. -2142.1B (Prev. 113.5B, Rev. From 105.7B, Low. -2770B, High. -1775.1B).

- New Zealand PPI Input QoQ (Q4) Q/Q -0.5% vs. Exp. 0.5% (Prev. 0.2%).

- New Zealand PPI Output QoQ (Q4) Q/Q 0.1% vs. Exp. 0.7% (Prev. 0.6%).