Bank of America Slides Despite Top, Bottom Line Beat As Underwriting, FICC Miss

After some rather soggy earnings from JPM yesterday, in which the largest US bank disappointed with declining underwriting fees, and spooked markets with a jump in loan loss reserves on its Apple credit card deal as well as downbeat commentary from Jamie Dimon on what a credit card cap would mean for the bank, moments ago Bank of America reported Q4 results which at first glance were stronger, and sent its stock higher premarket, but as analysts read between the lines and noticed the weak parts of the report (underwriting fees, FICC miss), BofA stock has since sunk 2% in the premarket.

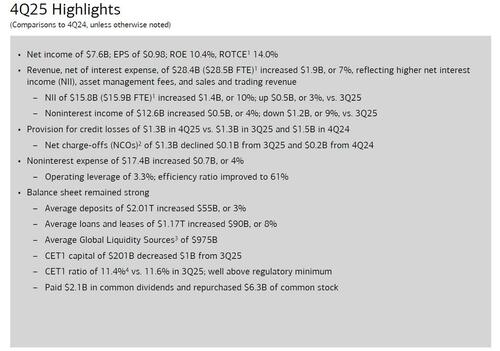

Here are the highlights: BofA Q4 net interest income beat expectations; $15.75 bn versus $15.48 bn expected by Bloomberg consensus. In the Q4 earnings report, total revenue (net of interest expense) for Q4 was $28.4 bn, slightly lower than Q3's $29 bn but above Bloomberg expectations of $27.76 bn, similar to JPMorgan's strong markets beat, as BofA traders reaped the benefits of a volatile Q4 for markets. Revenue from equity trading rose 23% to $2.02 billion in the final three months of the year, beating estimates of $1.9 billion. That helped give Bank of America earnings of 98 cents a share, just barely topping analysts’ estimates of 96 cents. Net income for the fourth quarter was $7.6bn, up 12% YoY, but down 8% from the $8.3bn in Q3. That was the good news. The bad news was an unexpected miss in the bank's all important, high-margin FICC group, coupled with a miss across both debt and equity underwriting.

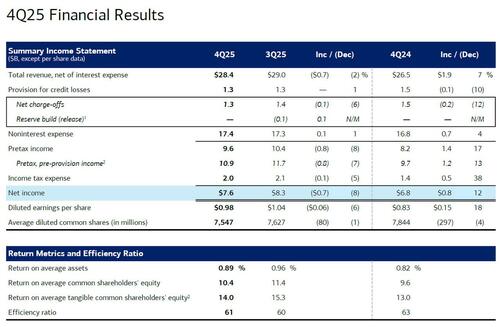

Here is a snapshot of what BofA reported in Q4:

- EPS $0.98, up 18% YoY from $0.83, beating estimates of $0.96

- Revenue net of interest expense $28.37 billion, up 7% YoY from $26.5 billion, beating estimate $27.78 billion; reflecting higher net interest income (NII), asset management fees, and sales and trading revenue

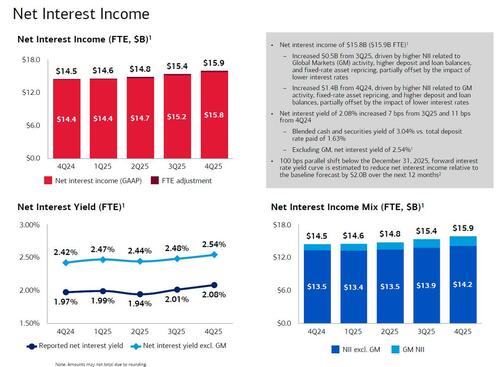

- Net interest income $15.75 billion, beating estimate $15.48 billion

- Net interest income FTE $15.92 billion, +9.7% y/y, analysts had expected a 7.8% increase for NII

- Trading revenue excluding DVA $4.53 billion, beating estimate $4.33 billion

- FICC trading revenue excluding DVA $2.52 billion, missing estimate $2.62 billion

- Equities trading revenue excluding DVA $2.02 billion, beating estimate $1.89 billion

- Investment banking revenue $1.67 billion, beating estimate $1.66 billion

- Advisory fees $590 million, beating estimate $495.3 million

- Debt underwriting rev. $810 million, missing estimate $864 million

- Equity underwriting rev. $297 million, missing estimate $301 million

- Wealth & investment management total revenue $6.62 billion, beating estimate $6.45 billion

- Net interest income $15.75 billion, beating estimate $15.48 billion

Here are the highlights visually:

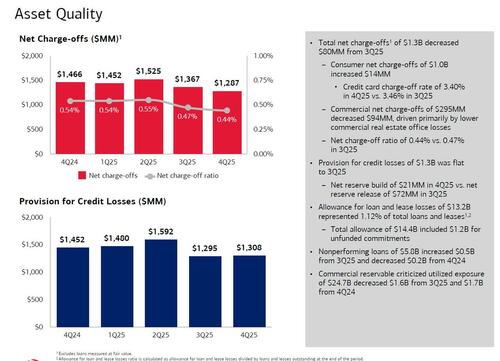

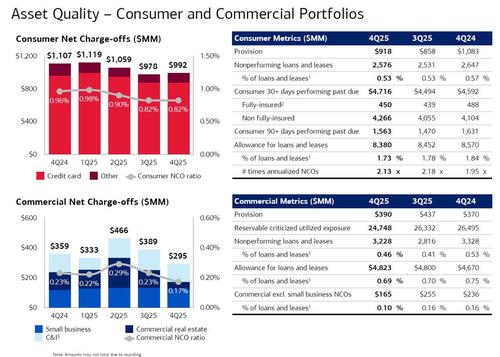

BofA's provision for credit losses of $1.3B in 4Q25 vs. $1.3B in 3Q25 and $1.5B in 4Q24, and below estimates of $1.48BN

- Net charge-offs (NCOs) of $1.29B declined $0.1B from 3Q25 and $0.2B from 4Q24 and below estimates of $1.44BN

“With consumers and businesses proving resilient, as well as the regulatory environment and tax and trade policies coming into sharper focus, we expect further economic growth in the year ahead,” CEO Brian Moynihan said in the press release. “While any number of risks continue, we are bullish on the US economy in 2026.”

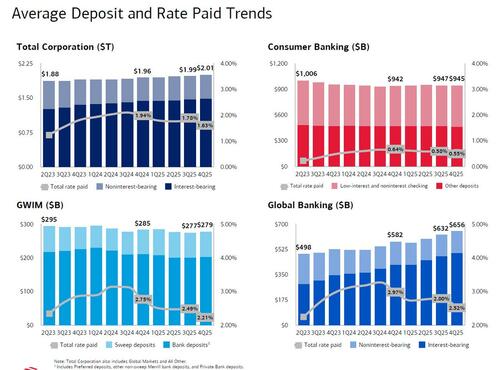

The bank's all important net interest income rose $0.5BN from Q3 to $15.9BN, "driven by higher NII related to Global Markets (GM) activity, higher deposit and loan balances, and fixed-rate asset repricing, partially offset by the impact of lower interest rates." The Net Interest yield of 2.08% rose 7bps sequentially, beating estimates of 2.04%, and was the highest in years. Blended cash and securities yield of 3.04% vs. total deposit rate paid of 1.63%.

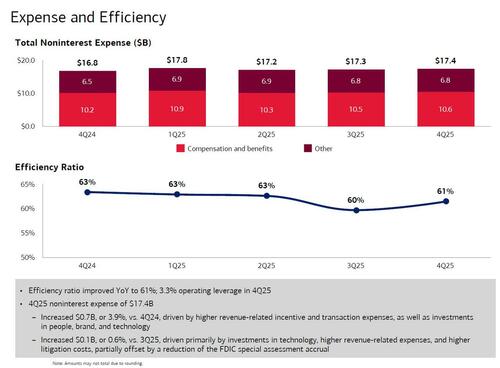

BofA's Q3 efficiency ratio was 61.5% down from 63.4% y/y as noninterest expenses rose to $17.44 billion, but was below estimates of $17.47 billion. Compensation expenses $10.60 billion, estimate $10.55 billion

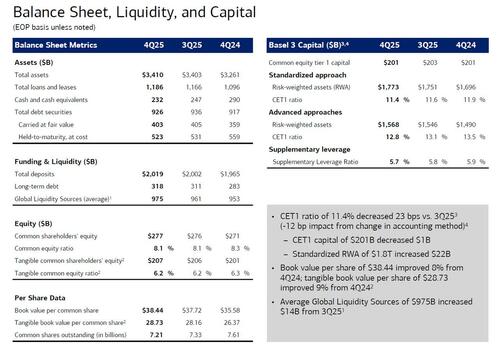

Taking a closer look at the bank's balance sheet, we find ample liquidity:

- Average Global Liquidity Sources of $975B

- CET1 capital of $201B decreased $1B from 3Q25

- CET1 ratio of 11.4%4 vs. 11.6% in 3Q25; well above regulatory minimum

- Efficiency ratio 61.5% vs. 63.4% y/y

- Paid $2.1B in common dividends and repurchased $6.3B of common stock

- Basel III common equity Tier 1 ratio fully phased-in, advanced approach 12.8%, estimate 13%

- Standardized CET1 ratio 11.4%, estimate 11.5%

Total deposits of $2.02TN increased $55B, or 3%, below estimates of $2.03TN

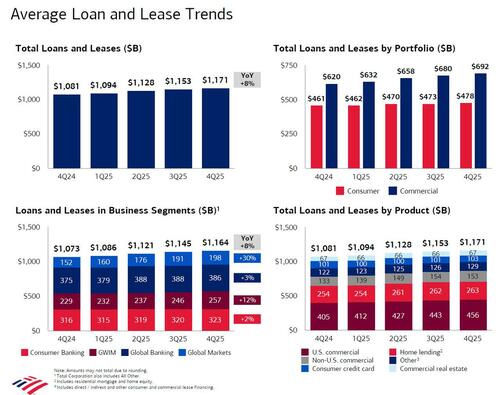

Total loans and leases of $1.19T increased $90B, or 8%, above estimates of $1.18TN

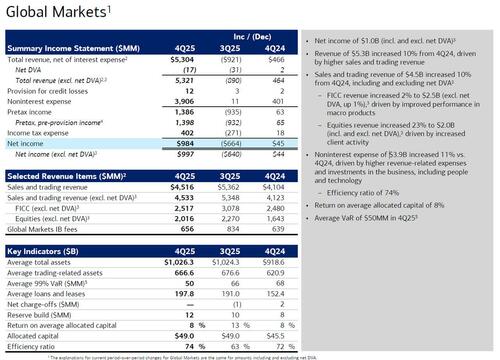

Turning to the all important Markets/Banking division, we find that just like JPM, markets revenue was ok, with Equities beating/FICC missedm while investment banking also saw underwriting weakness. Here are the details:

- Total Markets Revenue of $5.3B increased 10% YoY, driven by higher sales and trading revenue

- Trading revenue excluding DVA $4.53 billion, beating estimate $4.33 billion

- FICC trading revenue excluding DVA $2.52 billion, missing estimate $2.62 billion, and was "driven by improved performance in macro products"

- Equities trading revenue excluding DVA $2.02 billion, beating estimate $1.89 billion, and was "driven by increased client activity"

- Noninterest expense of $3.9B increased 11% vs. 4Q24, driven by higher revenue-related expenses and investments in the business, including people and technology

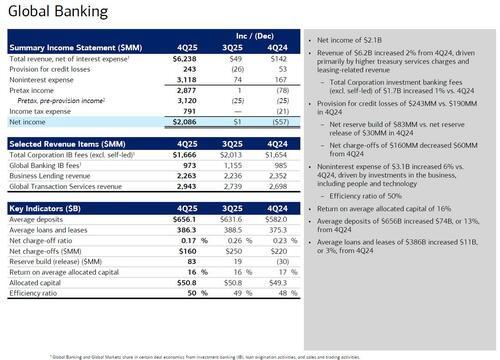

But while Markets was ok, the same weakness JPM observed in Investment Banking was also palpable at BofA, where advisory fees came in strong, but were offset by very poor debt and equity underwriting environment.

- Investment banking revenue $1.67 billion, beating estimate $1.66 billion

- Advisory fees $590 million, beating estimate $495.3 million

- Debt underwriting rev. $810 million, missing estimate $864 million

- Equity underwriting rev. $297 million, missing estimate $301 million

- Noninterest expense of $3.1B increased 6% vs. 4Q, driven by investments in the business, including people and technology

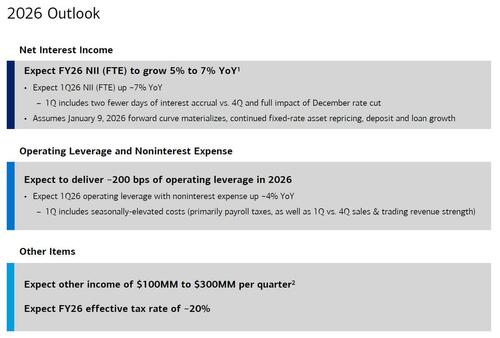

Looking ahead, the bank's 2026 outlook was solid, just like JPM, with the bank expecting NII to grow 5-7%, a solid increase but a slowdown from the 10% YoY increase in Q4. The bank also expects to deliver 200bps of operating leverage in 2026, although costs will be elevated in Q1.

Bank of America’s results offer a further look at how the biggest US banks fared during the first year of Trump’s return to office. On Tuesday, JPMorgan reported earnings that beat analysts’ estimates, with trading activity boosting results, despite an unexpected decline in investment-banking fees, similar to BofA. The market was not impressed and the stock tumbled 4%, its worst post-earnings reaction since Q1 2024.

That said, execs expect deals to pick up in 2026, with a strong pipeline and corporate clients who pushed off activity coming back to the market.

Shares of Charlotte, North Carolina-based Bank of America, slumped 1% in premarket trading as algos realized read the fine print below the superficial beat. BofA had gained 19% in the 12 months through Tuesday, more than the 12% increase in the S&P 500 Financials Index.

BofA's full investor presentation can be found here: pdf link.