Bitcoin Crashes To Nov 2024 Lows Amid $1.5 Billion In Levered Liquidations

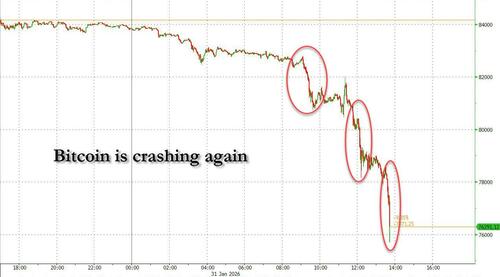

In an otherwise quiet session - as one would expect for a Saturday, certainly the algos would - starting early this morning there has been concerted pressure to sell into the bitcoin spot price following yesterday's Warsh-inspired rout which repriced bitcoin from 88K to 84K, pressure which grew into a liquidation firehose just after 9am ET and especially at noon, when we saw massive algo-driven volumes hitting the bid.

The selling has pushed Bitcoin as low as $74,000 (it was almost at $100K last week), and is at the lowest price since Trump became president (the April 2025 liberation day low of $74k was just taken out).

The selloff has liquidated over $110 billion from the crypto market’s total value in the past 24 hours.

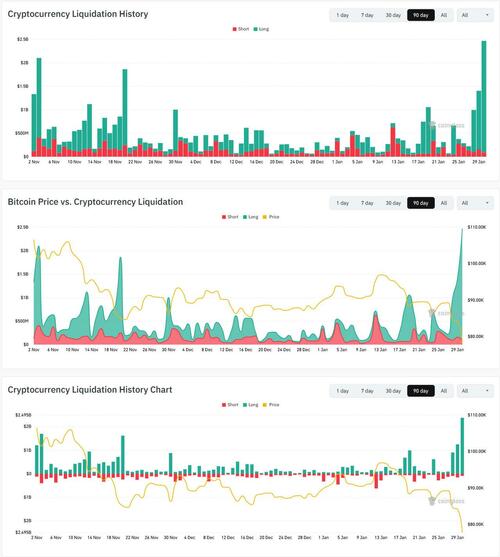

While algos were the initial spark that prompted the selling, the target - as usual - were heavily levered longs: in the past 4 hours more than $1.5 billion in levered positions, mostly longs, were liquidated according to CoinGlass. For reference, on October 10, aka "Black Friday", about $19 billion in crypto leverage was liquidated.

The liquidations have been spread between both bitcoin and ether...

Some big bitcoin liquidations yesterday.

— Velo (@velo_xyz) January 31, 2026

Some big ethereum liquidations today. pic.twitter.com/5zBlQ2WTpb

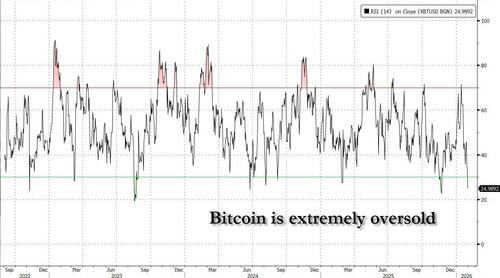

... with bitcoin fast approaching the most oversold on record.

Which doesn't mean that it can't be even more oversold: after all, the market is now convinced that Kevin Warsh will hike rates as soon as he can, which is why we warned that appointing Warsh would collapse Trump's crypto empire on very short notice.

*TRUMP ADMINISTRATION SAID TO BE PREPARING WARSH FED NOMINATION

— zerohedge (@zerohedge) January 30, 2026

crashing his own crypto fortune is a bold choice, cotton

That's precisely what is happening right now.

The latest crash in a long series, adds to weeks of disappointment for Bitcoin, which has failed to respond to a series of market developments that previously would have supported the asset. The dollar weakened for much of January, but the move did little to lift sentiment in crypto markets; if anything bitcoin slumped alongside the dollar. Likewise, Bitcoin offered no meaningful response during gold’s rally to record highs, nor has it attracted inflows in the wake of gold and silver’s sharp reversal on Friday.

Most notably, after tracking global liquidity injections by central banks for much of the past two years, bitcoin has become the only assets the drops the most liquidity central banks inject.

The big question now is that bitcoin briefly fell as low as $75K (and will likely revisit), what happens to Strategy's massive stash of 712.6 bitcoins which was acquired at an average price of $76,037: will Michael Saylor be forced to start selling?

Strategy has acquired 2,932 BTC for ~$264.1 million at ~$90,061 per bitcoin. As of 1/25/2026, we hodl 712,647 $BTC acquired for ~$54.19 billion at ~$76,037 per bitcoin. $MSTR $STRC https://t.co/RooLfEvniX

— Michael Saylor (@saylor) January 26, 2026