Brent dips below USD 60/bbl for the first time since May; US equity futures point to a weaker open ahead of jobs report - Newsquawk US Market Open

- Ukrainian President Zelensky said there is still no ideal peace plan as of now, and the current draft is a working version; Russia's Ryabkov said they are ready to make efforts to overcome disagreements relating to the Ukraine crisis.

- China Securities Times commentary noted that China should set a positive yet 'pragmatic' 2026 GDP growth target with leeway, while researchers are said to be divided between an around 5% or 4.5%-5.0% growth target for 2026.

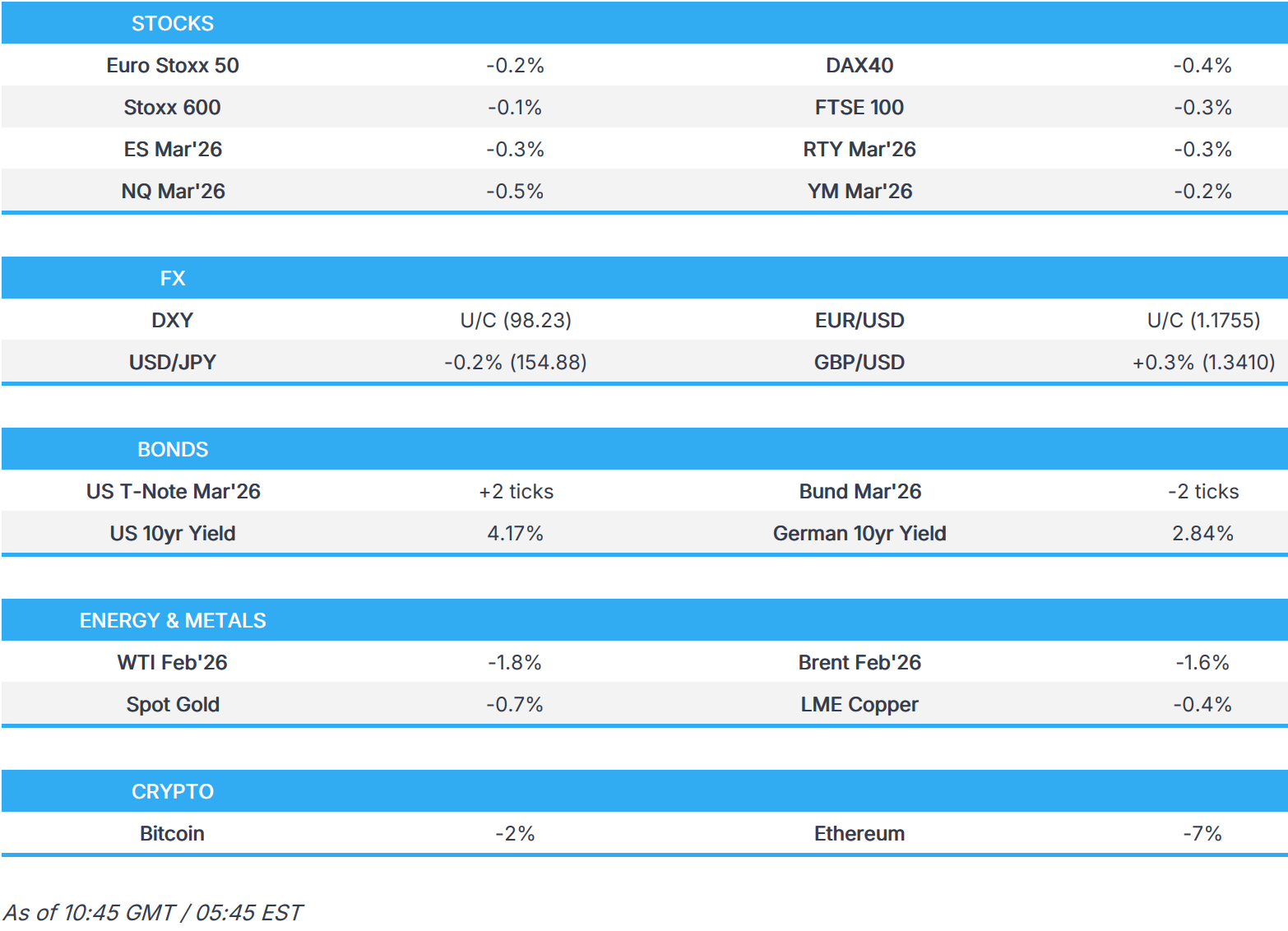

- European bourses are broadly lower, with US equity futures also in the red as the NQ continues to underperform.

- USD awaits data deluge, GBP outperforms following hawkish LFS and PMI & JPY continues gains into BoJ on Friday.

- USTs trade steady into NFP, Bunds chop on PMI metrics whilst Gilts underperform post-jobs data.

- Brent dips below USD 60/bbl for the first time since May as geopolitical tensions ease; metals are broadly subdued.

- Looking ahead, highlights include US Flash PMIs (Dec), US Average Weekly Prelim Estimate ADP (4-week, w/e 29 Nov), Non-Farm Payrolls (Oct), Jobs Report (Nov), Retail Sales (Oct), Business Inventories (Sep), NBH Announcement, Comments from BoC’s Macklem.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFF/TRADE

- US suspended implementing a technology deal it struck with the UK amid growing frustrations in Washington over progress of trade talks with London, according to FT.

- China's Commerce Ministry said China will charge tariffs of 19.8% on EU pork effective Dec 17th; Tariff range will be from 4.9-19.8%. Adds that investigation found pork products being dumped, harming Chinese producers.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) opened broadly lower, and then some indices gradually clambered into the green, to now display a mixed/mostly lower picture. Initial pressure followed on from a downbeat mood in Asia, which in turn was weighed on by tech-related downside in the US.

- European sectors opened mixed, but now hold a positive bias. Chemicals leads, followed closely by Autos, whilst Tech lags. For the autos sector, sentiment has been boosted following comments by an EU Lawmaker who suggested that the EU will have a 90% reduction in CO2 emissions for auto fleet targets from 2035.

- US equity futures (ES -0.2%, NQ -0.5%, RTY -0.3%) are lower across the board, with underperformance seen in the NQ, continuing the tech-related pressure seen in the prior session.

- Three Democratic Senators are investigating the role of AI data centres in rising electricity costs, the NYT reports; Google (GOOGL), Amazon (AMZN), Meta (META) and Microsoft (MSFT) among companies that received letters.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is flat and trades within narrow 98.17 to 98.32 range, with price action incredibly lacklustre as traders count down their clocks into the US NFP Payrolls figure for October, and the full November jobs report. In brief, the November NFP is expected to show 35k jobs added, while the unemployment rate is seen at 4.4%. November's delayed employment report will incorporate October payrolls, though October's unemployment rate will be absent after the shutdown halted household survey collection. [Full preview in the Newsquawk Research Suite]

- GBP/USD is firmer against both the EUR and USD after hawkish PMI and LFS reports, the latter which saw wage figures above consensus and the priors subject to upward revisions. Employment figures signalled continued weakening in hiring, with the unemployment rate ticking up in line with expectations and payroll change across public and private sectors remaining in contraction. Currently trading at the upper end of a 1.3356 to 1.3415 range.

- JPY outperforms vs peers, in continuation of the strength seen in the prior session as markets look towards the BoJ at the end of the week where a 25bps hike is widely expected. Overnight, Japanese PMIs were mixed with surprising strength in manufacturing but weakness in services; metrics ultimately did little to move the yen. USD/JPY trades within a 154.69-155.26 range.

- EUR/USD is little changed, but did chop surrounding the release of differing PMI reports across the EZ. EUR initially saw marginal strength after French manufacturing PMI surprisingly rose into expansionary territory, with the report citing the robust aviation industry - but earlier strength was then reversed on the weak German report which showed manufacturing slip further into contraction. EUR is flat against the USD in narrow 1.1745-1.1763 parameters. The next level to the upside is Monday's high at 1.1769.

- Barclays FX month and Quarter end rebalancing indicates "Weak USD buying" against most majors. Sees a weak sign for USD/JPY. Sees Moderate buying vs EUR and GBP.

- PBoC set USD/CNY mid-point at 7.0602 vs exp. 7.0444 (Prev. 7.0656)

FIXED INCOME

- USTs are trading within a narrow sub-5 tick range (112-10+ to 112-14), with price action incredibly lacklustre this morning as traders wait for the US NFP Payrolls figure for October, and the full November jobs report [Full preview in the Newsquawk Research Suite]. In brief, the November NFP is expected to show 35k jobs added, while the unemployment rate is seen at 4.4%. November's delayed employment report will incorporate October payrolls, though October's unemployment rate will be absent after the shutdown halted household survey collection.

- Bunds have chopped and changed within a 127.49 to 127.65 range, but currently trading just off best levels. Initial action was slightly bearish, following Gilt pressure after the UK’s jobs report (see below). Thereafter, French PMI figures (which were mixed, but Manufacturing surprisingly climbed in expansionary territory), sparked modest pressure in the benchmark to a session low. This then entirely reversed on a poor German report, which missed expectations across the board, taking Bund Mar’26 to a session high. EZ PMI figures also printed below expectations, putting the blame on Germany; the inner report highlighted that “it is clear that price pressure, driven in part by wage increases, is still noticeable”.

- Gilts opened near enough unchanged from the close yesterday, but then tumbled lower as markets digested the UK’s jobs report. In essence, the unemployment rate ticked higher, in-line with expectations, whilst Employment Chance was a better than feared. Focus is also on the Wages components, which topped expectations. Overall, metrics should not change much for policymakers at the BoE, with something for both the doves (cooling labour market), and the hawks (rising wages); a view also shared by analysts at Pantheon Macro, writing that “today’s data will keep the balance of views on the MPC little changed”. Money markets continue to assign a 91% chance of a 25bps reduction this Thursday. Thereafter, UK paper took another leg lower on the region’s PMI figures, which topped expectations – taking the benchmark below the 91.00 mark to a fresh tough of 90.83 vs current 90.90.

- UK sells GBP 4.25bln 4.125% 2031 Gilt: b/c 3.23x (prev. 3.01x), average yield 4.093% (prev. 4.088%), tail 0.2bps (prev. 0.6bps)

COMMODITIES

- Crude benchmarks have continued to sell off with Brent dipping below USD 60/bbl for the first time since May 2025. WTI and Brent traded rangebound in a USD 56.19-56.54/bbl and USD 60.08-60.39/bbl band throughout the APAC session as the markets consolidated following Monday’s selloff. As the European traders entered, benchmarks extended lower, aided by comments from Russia’s Ryabkov stating that a resolution on the Ukraine war is near. WTI and Brent dipped to a trough of USD 55.69/bbl and USD 59.42/bbl before slightly paring back earlier losses. However, Brent continues to trade below USD 60/bbl.

- Spot XAU has continued to grind lower, dipping below USD 4.3k/oz, but losses remain relatively contained compared to silver and copper. XAU peaked to a high of USD 4318/oz during the APAC session before selling off, with losses accelerating as the yellow metal broke USD 4300/oz to the downside, before buyers stepped in at USD 4272/oz. Thus far, XAU trades in a tight USD 4276-4292/oz band near lows as the European session gets underway.

- 3M LME Copper fell as the APAC session commenced, and as the stateside risk-off mood rolled over into Asia-Pac equities. The red metal opened at USD 11.64k/t and initially saw slight upside to peak at USD 11.68k/t before falling to a trough of USD 11.53k/t. In the European morning, 3M LME copper continues to trade near USD 11.6k/t as markets await a flurry of US data.

NOTABLE DATA RECAP

- UK ILO Unemployment Rate (Oct) 5.1% vs. Exp. 5.1% (Prev. 5.0%)

- UK Avg Wk Earnings 3M YY (Oct) 4.7% vs. Exp. 4.4% (Prev. 4.8%, Rev. 4.9%)

- UK Avg Earnings (Ex-Bonus) (Oct) 4.6% vs. Exp. 4.5% (Prev. 4.6%, Rev. 4.7%)

- UK Employment Change (Oct) -16k vs. Exp. -67k (Prev. -22k)

- UK HMRC Payrolls Change (Nov) -38k (Prev. -32k, Rev. -22k)

- UK Private Sector 3 Month Avg Growth YY (Oct) 3.9% (Prev. 4.2%)

- UK Claimant Count Unem Change (Nov) 20.1k (Prev. 29.0k, Rev. -3.9k)

- French HCOB Composite Flash PMI (Dec) 50.1 vs. Exp. 50.3 (Prev. 50.4); Services Flash PMI (Dec) 50.2 vs. Exp. 51.1 (Prev. 51.4); Manufacturing Flash PMI (Dec) 50.6 vs. Exp. 48.1 (Prev. 47.8)

- German HCOB Services Flash PMI (Dec) 52.6 vs. Exp. 53 (Prev. 53.1); Composite Flash PMI (Dec) 51.5 vs. Exp. 52.4 (Prev. 52.4); Manufacturing Flash PMI (Dec) 47.7 vs. Exp. 48.5 (Prev. 48.2)

- EU HCOB Manufacturing Flash PMI (Dec) 49.2 vs. Exp. 49.9 (Prev. 49.6); Services Flash PMI (Dec) 52.6 vs. Exp. 53.3 (Prev. 53.6); Composite Flash PMI (Dec) 51.9 vs. Exp. 52.7 (Prev. 52.8)

- UK Flash Composite PMI (Dec) 52.1 vs. Exp. 51.6 (Prev. 51.2); Manufacturing PMI (Dec) 51.2 vs. Exp. 50.4 (Prev. 50.2); Services PMI (Dec) 52.1 vs. Exp. 51.6 (Prev. 51.3)

- German ZEW Economic Sentiment (Dec) 45.8 vs. Exp. 38.7 (Prev. 38.5); Current Conditions (Dec) -81.0 vs. Exp. -80.0 (Prev. -78.7)

- EU ZEW Survey Expectations (Dec) 33.7 (Prev. 25.0)

NOTABLE EUROPEAN HEADLINES

- UK financial regulator is considering a revamp of capital requirements for specialist trading firms and sees a real opportunity to make rules more proportionate and boost UK competitiveness, while options on the table include tweaking EU-aligned rules, aligning with the US approach, or allowing trading firms to use internal models.

- EU Lawmaker Weber said the EU will have a 90% reduction in CO2 emissions for auto fleet targets from 2035.

- EU Commission to propose extending the carbon border levy to downstream aluminium and steel products, according to Reuters detailing a draft document.

- The EU is to propose a new fund to support EU industries by using 25% of revenues collect from carbon border levy, according to Reuters citing a draft proposal

NOTABLE US HEADLINES

- US Treasury Secretary Bessent reiterated that Congressional stock trading must end.

- Nasdaq exchange is reportedly planning to submit paperwork with the US SEC for 23-hour weekday trading, according to Reuters.

GEOPOLITICS

MIDDLE EAST

- Al Jazeera correspondent reports Israeli airstrikes in areas east of Gaza City.

RUSSIA-UKRAINE

- Ukrainian President Zelensky later said there was still no ideal peace plan as of now, and the current draft is a working version, while he added the US wants to proceed quickly to peace and that Ukraine needs to ensure the quality of this peace. Zelensky said there is agreement that security guarantees should be put to a vote in Congress and said they are really close to strong security guarantees, while he hopes to meet with US President Trump when the final framework for peace is ready. He also stated that there will be no free economic zone in Donbas under Russian control and that Ukraine will not recognise Donbas as Russian either de jure or de facto, as well as noted that Ukraine will ask the US for more weapons if Russia rejects the peace plan. Furthermore, he said Ukraine and US negotiators could meet this weekend in the US, and that Ukraine and the US support German Chancellor Merz's idea of a Christmas ceasefire, with an energy ceasefire an option.

- Russia's Deputy Foreign Minister Ryabkov said certain Ukraine war resolution is near, according to TASS. Ryabkov also said Russia has no understanding of Berlin talks outcome so far, via RIA. They are ready to make efforts to overcome disagreements relating to the Ukraine crisis, via Ria. Not willing to make any concessions re. Crimea, Donbas and Novorossiya. Russia will not agree to the deployment of NATO troops in Ukraine under any circumstances, via RIA.

- Russia's Kremlin said do not want a ceasefire which will provide a pause for Ukraine to better prepare for continuation of war. On the Ukrainian proposal for Christmas truce, said "depends whether we reach a deal or not.". Did not see the details of the proposals on security guarantees for Ukraine yet.

OTHER

- US is preparing to seize more sanctioned oil-filled tankers off Venezuela, according to Axios citing officials. The president has many tools in the toolbox, and "this is a big one". So far, Trump doesn't want to move into Venezuelan waters to seize ships. "But if they make us wait too long, we might get a warrant to get them there," in Venezuelan waters.

- US military said it carried out strikes on free vessels in international waters, which killed eight people.

- China's Foreign Ministry on Japan's comments about Chinese defence spending said Japan 'groundlessly accused' China and maliciously smearing China's legitimate national defence building

CRYPTO

- Bitcoin is on the backfoot and holds around the USD 86.5k mark, whilst Ethereum extends recent losses below the USD 3k mark.

APAC TRADE

- APAC stocks were mostly lower after the weak lead from Wall Street, as the tech-related pressure rolled over into the region.

- ASX 200 marginally declined amid underperformance in the tech, energy and resources sectors, while data showed consumer sentiment deteriorated.

- Nikkei 225 fell beneath the 50,000 level amid a firmer currency, BoJ rate hike expectations and underperformance in tech and electronics stocks.

- Hang Seng and Shanghai Comp were hit amid the tech woes, with the sector heavily represented in the list of worst-performing stocks in the Hong Kong benchmark.

NOTABLE ASIA-PAC HEADLINES

- China Securities Times commentary noted that China should set a positive yet 'pragmatic' 2026 GDP growth target with leeway, while researchers are said to be divided between an around 5% or 4.5%-5.0% growth target for 2026.

- XPeng (9868 HK) has obtained a Level 3 autonomous driving road test licence in Guangzhou, via Yicai.

- Japan's FY26 initial draft budget will be in excess of JPY 120tln, via Kyodo.

DATA RECAP

- Australian S&P Global Manufacturing PMI Flash (Dec) 52.2 (Prev. 51.6); Composite PMI Flash (Dec) 51.1 (Prev. 52.6); Services PMI Flash (Dec) 51.0 (Prev. 52.8)

- Japanese S&P Global Manufacturing PMI Flash SA (Dec) 49.7 (Prev. 48.7); Services PMI Flash SA (Dec) 52.5 (Prev. 53.2); Composite Op Flash SA (Dec) 51.5 (Prev. 52.0)

- Australian Westpac Consumer Sentiment (Dec) -9.0% (Prev. 12.8%)

- Australian Westpac Consumer Sentiment Index (Dec) 94.5 (Prev. 103.8)