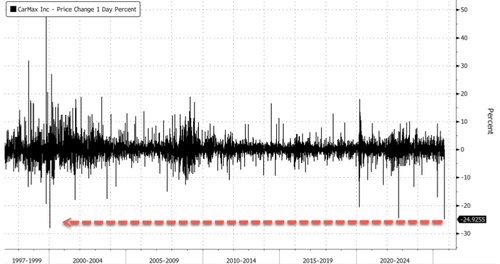

CarMax Shares Crash Most Since Dot-Com Bust

Shares of CarMax crashed 25% in early New York trading. If the losses hold through the close, it would mark the largest daily decline since the Dot-Com bust. The selloff was sparked by second-quarter earnings that Truist Financial Services analysts described as a "miss across the board," with "really nothing good to see." The news also dragged down peers, including Carvana.

CarMax's second-quarter results shocked Wall Street desks earlier with profit, sales, and pricing misses, signaling a very challenging used-car market in the second half of the year.

Snapshot of the earnings results:

Earnings Miss: Net income fell to $95.4M (64c/share) from $132.8 (85c/share) last year, far below the FactSet consensus estimate of $1.04/share.

Used Car Sales Weakness: Total revenue fell 6% to $6.6B vs. $7B expected. Used-car sales slid 7.2% to $5.27B, missing forecasts for growth, while same-store sales dropped 6.3% against the FactSet consensus estimate for a 1.1% rise.

Statement from CEO: William D. Nash described the quarter as "challenging" and announced a $150M cost-cutting plan over 18 months.

The market's reaction to the results has so far been armageddon. Shares fell 25% in early trading, hitting lows last seen in 2014.

If the losses hold through the close, it would mark the largest daily decline since January 20, 2000.

Wall Street desks were stunned by the dismal results (courtesy of Bloomberg):

Truist (hold, PT $74)

Trends came in softer than expected, according to analysts led by Scot Ciccarelli, and second-quarter comparable sales fell 6%, marking a material slowdown on a two-year stack

Total used units came in at 200,000, falling short of Truist's 219,000 estimates, and wholesale units were 138,000 versus their estimate of 146,000

Truist says weaker trends have continued into the third quarter thus far

CarMax Auto Finance receivables were close to flat year-over- year, which will have a negative impact on future income

Wedbush (cut to neutral from outperform, PT to $54 from $84)

Wedbush analysts led by Scott Devitt downgraded CarMax after second-quarter results underperformed on all key metrics

Wedbush said its estimates are under review and may be revised following the earnings call

CarMax's results have amplified investor concerns around the company's ability to maintain market leadership and drive growth

"The narrative has turned cautious, and we believe KMX is now losing share at an accelerating pace relative to its closest competitor," the analysts wrote

JPMorgan

JPMorgan said there is "very little redeeming" CarMax's results and sees downside to $45

CarMax's second quarter EPS was $0.64, materially below JPMorgan's estimate of $0.90, street consensus of $1.03 as well as "the buy-side bogey" of $0.90-$0.95

The quarter's soft results derive from weak same store sales, soft GPUs, underperformance across gross profit and weaker CarMax Auto Finance income, according to analysts led by Rajat Gupta

RBC Capital Markets (outperform, PT $81)

Analyst Steven Shemesh described the quarter as "tough," citing a sharp reversal in retail net sales

Shemesh said he will be watching the earnings call for color on whether the quarter's weakness is company-specific or a broader market trend

CarMax's pledged $150 million in SG&A savings by the end of 2027, which RBC considers a positive sign

RBC holds a negative sentiment on CarMax

Here's a solid take from X user EndGame Macro, highlighting that CarMax's dismal earnings come amid mounting stress in the used car market (something we've flagged here and here):"

CarMax's breakdown is a symptom of stress building across the entire auto credit chain. The company missed earnings and revenue, with the stock plunging more than 20%, but that drop is happening against the backdrop of auto loan delinquencies climbing to 5.0–5.1% right at the levels last seen during the Great Financial Crisis. Subprime borrowers are already running above GFC peaks, repossessions are the highest since 2009, and lenders are pulling back. That matters for CarMax because its model depends on the flow of financing to keep used cars moving.

With car prices still elevated, interest rates pushing monthly payments to records, and inflation eating into budgets, buyers at the lower end are falling out of the market. Prime borrowers are holding up better, but the marginal buyer that CarMax depends on is being squeezed. What used to be a financing tailwind has turned into a choke point with fewer approvals, more repossessions, and shrinking affordability. Investors are reading this not just as a hit to quarterly earnings, but as a structural challenge, CarMax sits right in the firing line of a consumer credit cycle that's rolling over. When delinquencies are flashing red and repossessions are rising, it's no surprise the stock is pricing in more than just a one off miss. It's signaling that the used auto boom has peaked, and the stress starting at subprime is now pulling down the middle of the market too.

CarMax’s breakdown is a symptom of stress building across the entire auto credit chain. The company missed earnings and revenue, with the stock plunging more than 20%, but that drop is happening against the backdrop of auto loan delinquencies climbing to 5.0–5.1% right at the… https://t.co/gg4AEiGkny pic.twitter.com/G1K8m6pO9X

— EndGame Macro (@onechancefreedm) September 25, 2025

. . .