China considers probing French wine; DXY slightly lower heading into US NFP data - Newsquawk US Opening News

- China is reportedly considering probing wine from France; could consider launching anti-dumping duty to French wine, and potentially take counter measures against the EU if it adopt duties.

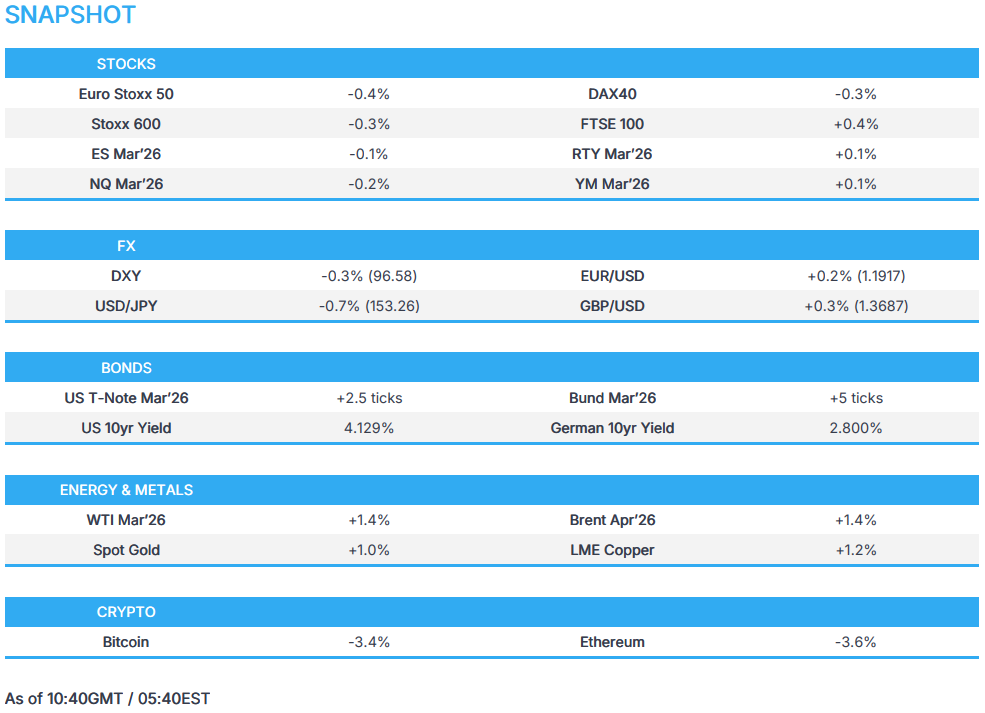

- European bourses are trading on the backfoot; FTSE 100 outperforms on the back of firmer commodity prices; US equity futures mixed.

- DXY slightly lower heading into US NFP, JPY continues to gain, AUD bid after RBA's Hauser said inflation is "too high".

- Fixed income rangebound; Bunds little moved following tepid auction.

- Crude edges higher as Trump mulls sending another carrier near Iran; Gold rangebound; Base metals rise, led by nickel prices following an cut in output from the world's largest mine.

- Looking ahead, highlights include US NFP (Jan), Japanese PPI (Jan), BoC Minutes (Jan), OPEC MOMR. Speakers include ECB’s Schnabel, Fed's Schmid, Bowman & Hammack. Supply from the US. Earnings from T-Mobile, McDonalds, AppLovin, Equinix, Motorola Solutions, Hilton and Kraft Heinz.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European Bourses (STOXX 600 -0.3%) opened mixed, but now display a mostly negative picture (ex-FTSE 100, buoyed by strength in oil/mining names).

- Sectors hold a negative bias. Energy and Basic Resources are towards the top of the pile, whilst Tech lags.

- Movers today include; Siemens Energy (+5%, strong Q1 results), Dassault Systemes (-17%, poor results and weak outlook), Lufthansa (-4%, pilots threaten to strike). Elsewhere, some modest pressure was seen in Pernod Ricard (+0.5%) following reports that China could consider an anti-dumping duty on French wine.

- US equity futures (ES +0.1%, NQ -0.1%, RTY +0.2%) are trading on either side of the unchanged mark, with trade tentative heading into the US NFP report; recent price action has seen contracts dip off best levels. In the pre-market; Ford (+1%, guided stronger profits for 2026), Robinhood (-7%, Q4 revenue below expectations).

- TotalEnergies (TTE FP) Q4 (USD): Adj. EPS 1.73 (exp. 1.75), Adj. Net Income 3.84bln (exp. 3.81bln), Adj. EBITDA 10.07bln (exp. 9.87bln), plans USD 750mln share buyback in Q1 and confirms FY26 share buyback guidance of around USD 15bln.

- Siemens Energy (ENR GY) Q1 (EUR): Revenue 9.6bln (exp. 9.83bln), Profit Before Special Items 1.16bln (exp. 992.4mln), Orders 17.61bln (exp. 14.17bln); affirms guidance.

- Dassault Systemes (DSY FP) Q4 (EUR): EPS 0.33 (exp. 0.33), Adj. EBIT 622mln (exp. 654.6mln), Non-IFRS Revenue 1.68bln (exp. 1.74bln), Non-IFRS Revenue ex-FX +1% (exp. +3.49%); Sees Q1'26 Revenue ex-FX 1-5%, EPS 0.25-0.31 (exp. 0.33).

- Ford Motor Company (F) Q4 2025 (USD): Adj. EPS 0.13 (exp. 0.18), Revenue 45.9bln (exp. 43.60bln). To continue building on the foundation to achieve the target of 8% adj. EBIT margin by 2029. Tariff relief delay dealt an unexpected blow and Ford discloses additional USD 900mln tariff hit.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is slightly lower this morning and trades towards the lower end of a 96.49-96.91 range. Focus for the day lies solely on the US NFP report in the afternoon. The delayed January jobs data is expected to show 70k nonfarm payrolls added in the month (vs a prev. 50k; with the range of forecasts between -10k to +108k); the unemployment rate is expected to remain steady at 4.4%. Recent labour metrics are painting a subdued picture for the labour market, and commentary via WH Economic Adviser Hassett also dampened expectations ahead of the report today. Following his remarks, Bloomberg’s NFP whisper number dropped to 37k (prev. 50k).

- JPY remains at the top of the pile, continuing to extend on the recent strength seen following PM Takaichi’s landslide victory. As mentioned in the coverage since the election, there are numerous factors helping buoy the JPY; a) BoJ potentially to normalise faster, b) less friction for Japanese officials to conduct intervention, c) hefty flows to Japanese equities, d) FinMin Katayama suggesting that surplus foreign reserves could help to fund the food tax suspension. USD/JPY briefly dipped below the 153.00 mark, and currently holds within a 152.79-154.51 band. The pair is now approaching the touted rate check/intervention lows seen late Jan (152.09).

- G10s are firmer against the USD to varying degrees. JPY outperforms (mentioned above), whilst the Aussie follows closely behind. AUD/USD has now breached above the 0.70 mark, to now trade at levels not seen since Feb’23. The pair currently trades around 0.7113, and further upside could see a test of the high from 2nd Feb 2023 at 0.7157. Recent strength comes amidst the continued strength in underlying metals prices, and after commentary from RBA’s Hauser. He noted that inflation is too high, which they can't let persist and will do what is needed to bring inflation back to the target band.

- Elsewhere, EUR is slightly firmer and trades around the 1.19 mark, and off recent highs which saw the single currency top 1.2000 in late January. A weak US jobs report could see another bid higher for EUR/USD, which may lead to ECB doves to push for an FX-led rate cut. No move was seen after the ECB Wage Tracker, where the 2026 annual estimate was increased to 2.388% (prev. 2.316%).

- The NOK continues to strengthen against the EUR in the aftermath of Tuesday’s hotter-than-expected Norwegian inflation data; a report which led some banks to push back calls for Spring cuts. EUR/NOK is currently at session lows, in a 11.2638-11.3300 range.

- Click for NY OpEx Details

FIXED INCOME

- In brief, benchmarks are contained into today's NFP report (delayed due to the brief shutdown), which includes benchmark revisions. US labour data during the window has been on the softer side of things, with claims steady, continuing easing, ADP weak and Revelio posting job losses. Furthermore, Challenger cuts were the highest for January since 2009, and JOLTS were at the lowest since September 2020.

- USTs approach this, and then data and Fed speak afterwards, firmer by a tick or two in a thin 112-15 to 112-18 band; note, trade was quiet overnight with no cash trade due to Japan's market holiday. For the Fed, markets currently fully price a cut in June (-25.2bps implied), with around a 20% chance of one occurring earlier in March and c. 40% in April.

- EGBs in-fitting with the above, Bunds firmer but only marginally so in a 128.60-74 band. ECB speak this morning once again sticking to the script. Interestingly, the latest ECB wage tracker was hot across the board and factors in favour of those who think the next move will be a hike rather than a cut. Adding to the hawkish narrative from/affecting some global central banks in recent sessions, i.e. the RBA and Norges Bank.

- Gilts are contained in a 90.71-90 band. UK specifics are much quieter thus far vs the last few sessions, with a busy docket of data scheduled for next week. Much of the UK press is focused on Angela Rayner after it was revealed that a "Rayner for leader" site briefly went live in January; a Bloomberg write-up on the subject characterises the discussion/view of insiders neatly as "Buy Rayner and Sell Streeting".

- Germany sells EUR 750mln vs exp. EUR 1bln 2.90% 2056 and EUR 1.16bln vs exp. EUR 1.5bln 2.50% 2054 Bund.

- UK sells GBP 300mln 4.25% 2049 Gilt via Tender: b/c 4.32x, average yield 5.256%.

- China's Ministry of Finance issues CNY 14 bln of treasury bonds in Hong Kong.

- Australia sold AUD 700mln 3.75% April 2037 bonds, b/c 4.14, avg. yield 4.8342%.

- JPMorgan launches USD 1.5bln tender offer for EA bonds ahead of USD 20bln buyout financing; buyback includes USD 750mln each of 2031 and 2051 maturities, expiring March 11th.

COMMODITIES

- Crude benchmarks have steadily moved higher as the European session gets underway, with traders digesting a report by Axios quoting President Trump saying that he might send a second carrier to strike Iran if talks fail, pushing aside the larger-than-expected US private inventory build. WTI and Brent rebounded from a trough of USD 63.65/bbl and USD 68.49/bbl respectively in the later hours of Tuesday's trading session, and oscillated in a tight c. USD 0.50/bbl range during the APAC session, with WTI nearing USD 65/bbl to the upside.

- Spot gold remains contained in a USD 4965-5086/oz band that has been formed so far this week, ahead of a busy week of tier-1 US data.

- Base metals have been steadily bidding higher with 3M LME Copper reaching USD 13.25k/t. The broad-based move seems to have been driven by nickel prices. Weda Bay, the world's largest nickel mine, has been told by Indonesian authorities to cut its output by 70% in an effort to boost global prices. Indeed, LME nickel futures prices did lift higher following the report, rising from USD 17.75k/t to USD 17.95k/t, but have since pared back slightly.

- Indian state-owned refiners are to consider buying more US and Venezuelan crude after the trade deal with the US, Bloomberg reported.

- SHFE is adjusting the automatic conversion standard for hedging position limits in silver futures. "...starting from the last trading day of February 2026, the hedging transaction position limits for all silver contracts that have not obtained hedging transaction position limits for the near-delivery month will be temporarily adjusted to 0 lots for both buy and sell hedging transactions in the near-delivery month (the month preceding the delivery month and the delivery month itself).".

- Russia to complete building two ice-class LNG tankers in 2026, according to IFX.

- World's biggest nickel mine in Indonesia, Weda Bay, has been told to slash output by 70% to 12mln tonnes, Bloomberg reported.

- Syria taps energy majors to explore for trillions of cubic meters of gas with the state oil chief noting that Chevron (CVX) , ConocoPhillips (COP) and TotalEnergies (TTE FP) and Eni (ENI IM) are interested in exploration, according to FT.

- US Private Energy Inventory Data (bbls): Crude +13.4mln (exp. +0.8mln), Distillates -2.0mln (exp. -1.3mln), Gasoline +3.3mln (exp. -0.4mln), Cushing +1.4mln.

- US issues Venezuela related license authorizing certain transactions necessary to ports and airport operations, also authorising certain activities involving Venezuelan-origin oil.

- Wells Fargo raises its 2026 gold target to USD 6,100-6,300/oz citing geopolitical risks, market volatility, and strong central-bank demand.

TRADE/TARIFFS

- China is reportedly considering probing wine from France; could consider launching anti-dumping duty to French wine, and potentially take counter measures against the EU if it adopt duties.

- China plans to extend import VAT breaks on cancer and rare disease drugs until the end of 2027.

- White House revised Fact Sheet on US-India trade deal with reference to pulses dropped and it changed the wording around India's proposed USD 500bln purchase from a firm "commitment" to an "intent".

- US House Speaker Johnson fails in an effort to block votes on measures to rescind Trump’s tariff policies, according to CNN's Manu Raju.

- US Treasury Secretary Bessent said US-China ties are stable but competitive, aiming for fair competition and de-risking, not decoupling, while he adds China must rebalance amid persistent USD 1tln trade imbalance.

NOTABLE EUROPEAN HEADLINES

- EU's von der Leyen said the EU needs one large, deep and liquid capital market, adding that its currently too fragmented. Completing their own single market also means completing their own energy union, which is crucial when it comes to bringing prices down even further.

NOTABLE EUROPEAN DATA RECAP

- Italian Industrial Production YoY (Dec) Y/Y 3.2% (Prev. 1.4%).

- Italian Industrial Production MoM (Dec) M/M -0.4% vs. Exp. -0.5% (Prev. 1.5%).

CENTRAL BANKS

- ECB Wage Tracker: 2026 Annual 2.388% (prev. 2.316%).

- ECB’s Makhlouf said uncertainty means the ECB should take a meeting-by-meeting approach.

- RBA Deputy Governor Hauser said Australia's economy is not just 'dig it and ship it', many parts of the economy are doing quite well, adds inflation is too high which they can't let persist and will do what is needed to return it to the band.

- Westpac anticipates RBNZ hiking rates more quickly in 2027.

NOTABLE US HEADLINES

- Negotiations between US Democrats and the White House are ongoing, but right now, a deal on a stopgap funding measure seems unlikely, Punchbowl reports.

- US President Trump said our employment numbers are really good and remain good after government job cuts.

- US President Trump said the US should have the lowest interest rates in the world.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said that the US has prohibited Russia and China from dealing with Venezuelan oil and are looking to discuss with the US about the restriction.

- Russia to complete building two ice-class LNG tankers in 2026, according to IFX.

- Ukrainian President Zelensky plans spring elections alongside a referendum on the peace deal after US push, according to FT.

MIDDLE EAST

- Iranian Supreme leader Khamenei's advisor says that Iranian negotiators have no authority to discuss missiles.

- Iran's Foreign Minister Araqchi said the date for the next round of US negotiations have not been set.

- Iranian Foreign Ministry said they are ready to negotiate on the percentage of uranium enrichment and the size of its enriched stockpile.

- Iran's President said that the country is not seeking nuclear weapons and are ready for any kind of verification.

- US President Trump said Iran wants to make a deal and it would be foolish if they didn't.

OTHERS

- Australia charges two Chinese nationals with foreign interference.

- Taiwan's President Lai said Indo-Pacific nations are raising defense budgets and Taiwan must do the same, while he thanks US for its support of Taiwan's defence.

- UK expands settlement visa for Hong Kongers following Jimmy Lai's sentence.

CRYPTO

- Bitcoin slipped below USD 67k as Ethereum returned below USD 2k.

APAC TRADE

- APAC stocks traded higher but with some of the gains in the region capped after the weak handover from the US and with the NFP report on the horizon, while participants also digested earnings and data in thinned conditions, with Japanese markets shut for a holiday.

- ASX 200 outperformed with the index led higher by the top-weighted financial sector after shares in Australia's largest lender and company by market cap, CBA, rallied following a 5% increase in H1 profits.

- Hang Seng and Shanghai Comp were kept afloat following the PBoC's liquidity operations and recent pledge to continue implementing an appropriately loose monetary policy in its quarterly implementation report. However, the upside was limited as participants also reflected on the mixed Chinese inflation data in which CPI printed softer-than-expected, while PPI was slightly better-than-feared but remained in deep deflationary territory.

NOTABLE ASIA-PAC HEADLINES

- Goldman Sachs revised its 2026 China PPI forecast to -0.5% Y/Y.

- ByteDance reportedly plans to produce 100k-300k units of AI chips this year, while it is developing the AI chip and is in talks with Samsung (005930 KS) to manufacture it, according to sources.

- Tencent Cloud (0700 HK) partners with Tesla (TSLA) to upgrade its cockpit experience.

- NetEase (9999 HK / NTES) Q4 (USD): EPS 1.58 (exp. 2.03), Revenue 3.90bln (exp. 4.10bln).

NOTABLE APAC DATA RECAP

- Chinese PPI YoY (Jan) Y/Y -1.4% vs. Exp. -1.5% (Prev. -1.9%, Low. -1.9%, High. -1.0%).

- Chinese CPI MM (Jan) 0.2% vs. Exp. 0.3% (Prev. 0.2%).

- Chinese CPI YY (Jan) 0.2% vs. Exp. 0.4% (Prev. 0.8%).

- Australian Investment Lending for Homes (Q4) 7.9% (Prev. 17.6%).

- Australian Home Loans QQ (Q4) 9.5% vs Exp. 4.8% (Prev. 9.6%).

- Australian Owner Occupied Loan Value QQ (Q4) Q/Q 10.6% (Prev. 4.7%).

- South Korea Unemployment Rate (Jan) 3.0% (Prev. 4.0%, Rev. From 4%).