China to limit access of NVDA's H200 chips despite Trump approval; Markets await ADP and JOLTs - Newsquawk US Market Open

- US President Trump announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers. Though the FT reported that China is set to limit access of NVIDIA's H200 chips; NVDA shares off best levels, last +0.5%.

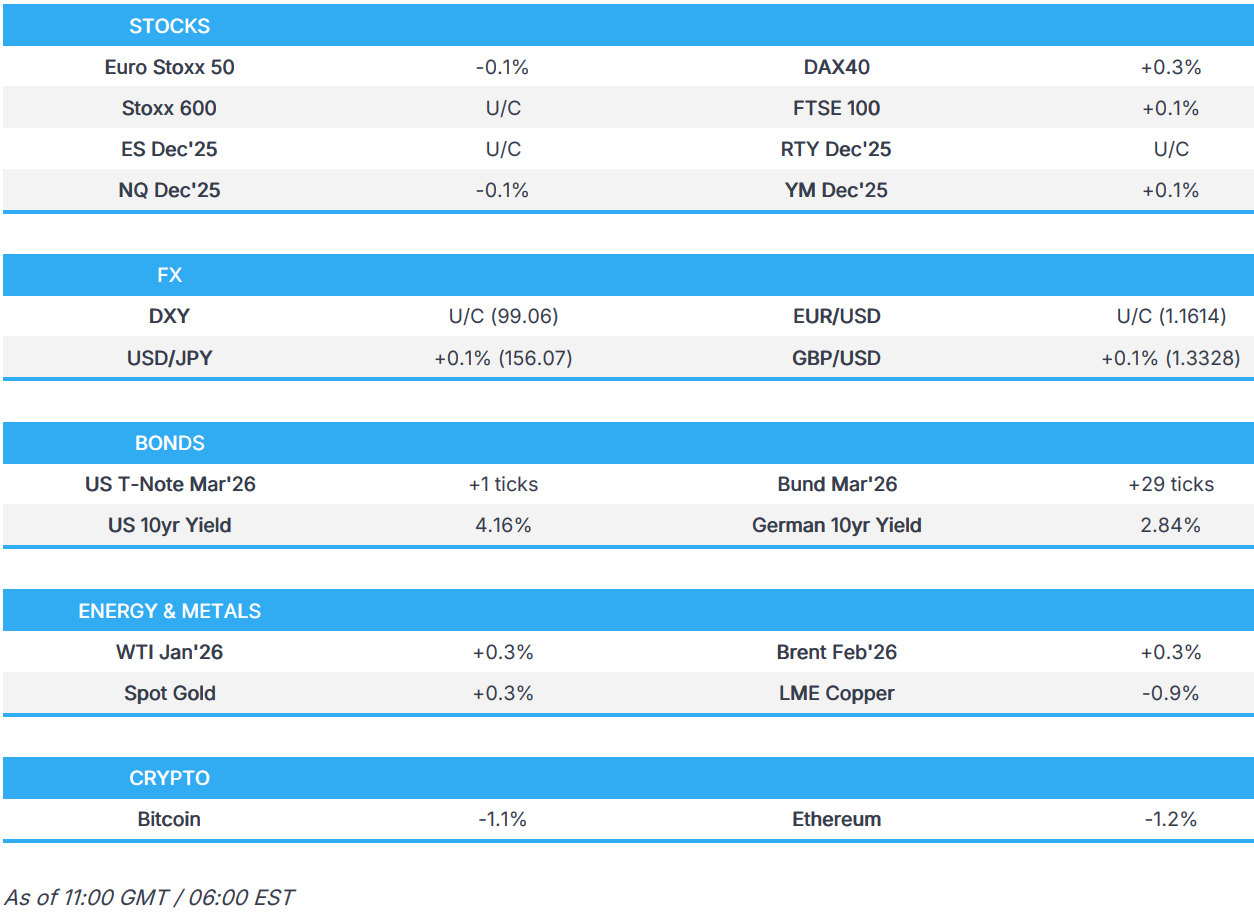

- European bourses are broadly lower, US equity futures are mixed with the NQ dipping into modest negative territory after the FT report on NVIDIA.

- DXY hovers around 99.00, Antipodeans rise post RBA, and JPY remains subdued, but did gain on Ueda-FX related commentary.

- Global paper was initially subdued but now firmer, OATs await French vote.

- Crude benchmarks trade rangebound ahead of the EIA STEO, Copper continues to pull back from ATHs.

- Looking ahead, highlights include US Average Weekly Prelim Estimate ADP (4-week, w/e 22 Nov), JOLTS (Sep), EIA STEO, Speakers including BoE's Ramsden, Lombardelli, Mann, Dhingra & RBNZ's Breman, Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TARIFFS/TRADE

- US President Trump said he spoke with Chinese President Xi very recently and thinks that China will buy even more soybeans than promised. Trump separately announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers in China and other countries, while Trump added that President Xi responded positively, and that 25% will be paid to the US. Furthermore, Trump said the Department of Commerce is finalising the details, and that the same approach will apply to AMD (AMD), Intel (INTC) and other great US companies.

- China is set to limit access of NVIDIA's (NVDA) H200 chips despite export approval from US President Trump, via FT citing sources; no decision has been made on the matter

- US President Trump posted that ''Mexico continues to violate our comprehensive Water Treaty, and this violation is seriously hurting our BEAUTIFUL TEXAS CROPS AND LIVESTOCK. Mexico still owes the U.S over 800,000 acre-feet of water for failing to comply with our Treaty over the past five years." Trump added that the "U.S needs Mexico to release 200,000 acre-feet of water before December 31st, and the rest must come soon after. As of now, Mexico is not responding, and it is very unfair to our U.S. Farmers who deserve this much needed water. That is why I have authorized documentation to impose a 5% Tariff on Mexico if this water isn’t released, IMMEDIATELY."

- US lawmakers urged US President Trump to ease Japan tariffs amid Chinese economic coercion, according to Nikkei.

- US Treasury Secretary Bessent said they are working on an India trade deal.

- Chinese Premier Li said at the '1 + 10' dialogue with the heads of major international economic organisations that the global economy in 2025 is marked by turbulence and twists, creating urgent demand for reforming and improving global economic governance, while he added that tariffs have dominated global discussions on the economy this year and that mutually destructive consequences of tariffs becoming increasingly evident. Li said calls for free trade are growing louder and that AI is also becoming central to global trade discussions.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 U/C) opened with mild gains, then clambered higher soon after the cash open - a move which ultimately proved fleeting, with indices now broadly in the red.

- European sectors opened without bias and continue to fare this way. Financials, Insurance and Banks lead the charge, helped by the continued constructive yield environment, while Basic Resources underperforms as the metals rally loses steam.

- Stateside, are mixed, with the NQ initially boosted after President Trump said he would now allow H200 chip shipments to China. Do note that contracts came under some mild pressure after the FT reported that China is set to limit access of NVIDIA's (NVDA) H200 chips despite export approval from US President Trump. In reaction, the NQ flicked slightly into the red with NVIDIA shares coming off best levels in pre-market trade; last +0.6% vs posting earlier gains of 1.6%.

- European Commission opens investigation into possible anticompetitive conduct by Google (GOOGL) in the use of online content for AI purposes.

- Home Depot (HD) reaffirms FY25 guidance and 2026 outlook.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides within a narrow 98.97-99.14 range with the index testing 99.00 to the downside shortly after the European cash equity open, with newsflow on the quieter side as trades look ahead to tomorrow's FOMC with eyes on the dot plots. The index remains well within yesterday's 98.79-99.22 parameter. Trade headlines have been more conciliatory between the US and China, after US President Trump announced that he informed Chinese President Xi that the US will allow NVIDIA (NVDA) to ship its H200 products to approved customers in China and other countries. On the docket ahead, the US data slate features weekly ADP jobs data, as well as JOLTs data for September (7.199mln expected vs a prior 7.227mln; in August, the vacancy rate was unchanged at 4.3%, while the quits rate eased by 0.1ppts to 1.9%).

- AUD is the outperformer this morning after the RBA maintained its Cash Rate at 3.60%, as unanimously forecast, while support was seen during the post-meeting press conference where RBA Governor Bullock noted that it looks like more rate cuts are not needed. AUD/USD tested levels near 0.6650 from a 0.6610 base.

- JPY lags following yesterday's weakness on the 7.6 magnitude earthquake, which did later see all advisories eventually lifted. USD/JPY saw a dip lower on hawkish commentary from BoJ Governor Ueda after he noted, "How exchange rates will affect our inflation outlook is "very important question for us." USD/JPY resides in a 155.74-156.43 range after tipping yesterday's 155.98 peak, with the next upside level the 28th Nov peak at 156.58.

- GBP and EUR trade with modest gains in quiet newsflow, with GBP/USD on either side of 1.3350 and EUR/USD printing on either end of 1.1650. Strength in the GBP in the early part of this morning's session lacked a clear catalyst.

- PBoC set USD/CNY mid-point at 7.0773 vs exp. 7.0748 (Prev. 7.0764).

- Click for NY OpEx Details

FIXED INCOME

- USTs were initially slightly this morning, but then caught a slight bid. Currently trading at the upper end of a 112-05+ to 112-12+ range. The upside seen in the morning came alongside FX-related commentary by BoJ Governor Ueda, which sparked some demand in the Yen, which led to a broader pick-up across havens (bonds/gold). On the trade front, President Trump said he would allow NVIDIA H200 chip shipments to China, which has seemingly lifted sentiment a touch in Europe/US equity futures. Elsewhere, Trump threatened Mexico with an extra 5% tariff amidst a water dispute. Ahead, markets await the Weekly US ADP Prelim Average, JOLTS data and a 10-year auction.

- Bunds started the European session with modest strength, attempting to scale back some of its recent losses; currently trading within a 127.26 to 127.66 range; the low for the day is a couple of ticks below Monday’s trough. Though soon after the cash open, Bunds moved a touch lower amidst a pick-up in European equities – a move which ultimately proved fleeting, with Bunds now back in the green by roughly 15 ticks. Earlier, German Exports rose 0.1% (exp. -0.5%), whilst Imports disappointed – overall, ING suggests the data shows that Germany is unlikely to be pulled out of stagnation by its exports. Most recently, in line with peers, the benchmark has picked up to trade near highs.

- OATs are higher, but underperforming vs European peers, as traders count down their clocks to a key National Assembly Vote on the 2026 social security budget; if passed, PM Lecornu would have successfully resolved issues which have led to failure for the prior two PMs. In brief, recent pension/healthcare spending concessions have earned Lecornu support from the Socialists, who are expected to vote in favour of the bill, whilst support from the right has waned – Politico writes that “it’s not looking great”. Overall, the outcome could heighten political turbulence and uncertainty over France’s plans to address gaps in its public finances.

- Gilts trade higher alongside peers; currently at the upper end of a 90.63 to 91.22 range. Focus ahead will be on the BoE TSC hearing, with the likes of Ramsden (Dove), Lombardelli (Neutral), Mann (Hawk) and Dhingra (Dove) all set to appear.

- UK sells GBP 0.75bln 4.25% 2032 Gilt via tender: b/c 4.35x (prev. 3.72x), average yield 4.109% (prev. 4.206%), tail 0.4bps (0.2bps).

COMMODITIES

- WTI and Brent have seemed to have stabilised following Monday's risk-off selloff. Benchmarks extended below Monday's trough of USD 58.62/bbl and USD 62.34/bbl, respectively, to a low of USD 58.59/bbl and USD 62.24/bbl as the APAC session came to an end. Thus far, benchmarks trade muted in a c. USD 0.40/bbl range with the EIA to release its STEO later today.

- Spot XAU failed to extend beyond the key support level at USD 4176/oz, troughing at USD 4170/oz, before reversing higher as the dollar continued to weaken ahead of the FOMC meeting on Wednesday. XAU gradually rose c. USD 35/oz higher to a session high of USD 4209/oz as the European session gets underway, aided by hawkish comments by BoJ's Ueda, which pressured USD/JPY and in turn, weakened DXY.

- 3M LME Copper continued to pull back from its ATH formed in Monday's session, set at USD 11.75k/t, following a disappointing readout from the Politburo and a cautious risk tone ahead of the FOMC meeting. The red metal gradually fell from a session high of USD 11.66k/t to a trough of USD 11.43k/t throughout the APAC session. Currently, losses have been slightly pared back as the European session gets underway, with 3M LME Copper trading back above USD 11.5k/t

- Iraq sets January Basrah medium crude official selling price to Asia at -USD 1.05/bbl to Oman/Dubai average.

- Ukraine's Naftogaz says Russian drones attacked its gas infrastructure

NOTABLE DATA RECAP

- UK BRC Retail Sales YY (Nov) 1.2% (Prev. 1.5%).

- UK BRC Total Sales YY (Nov) 1.4% (Prev. 1.6%).

- Barclays UK November Consumer Spending fell 1.1% Y/Y (prev. -0.8%), the largest decline since February 2021.

- UK Grocery Inflation was 4.7% in 4 weeks to Nov 30th, via Worldpanel; +3.6% in 12 weeks to Nov 30th Y/Y.

- German Imports MM SA (Oct) -1.2% vs. Exp. -0.5% (Prev. 3.1%); Exports MM SA (Oct) 0.1% vs. Exp. -0.5% (Prev. 1.4%); Trade Balance, EUR, SA (Oct) 16.9B vs. Exp. 15.6B (Prev. 15.3B).

NOTABLE EUROPEAN HEADLINES

- European Parliament said parliament and member state negotiators reached a provisional deal to update EU rules on sustainability reporting and due diligence requirements for companies. Furthermore, it stated that companies with more than 1,000 employees and annual turnover over EUR 450mln are to report on their sustainability, while large corporations with more than 5,000 employees and annual turnover of more than EUR 1.5bln are to carry out due diligence on their adverse impacts.

- Germany is to approve EUR 52bln in military orders, via Bloomberg.

- NBP's Duda said it is necessary to wait before cutting rates to assess the impact of reductions already made on the economy.

NOTABLE US HEADLINES

- US farmers said the Trump administration’s USD 12bln aid package brings temporary relief, but is unlikely to kickstart a lasting recovery for the American farm economy, according to Bloomberg.

GEOPOLITICS

MIDDLE EAST

- Israeli military announced it struck infrastructure belonging to Hezbollah in several areas in southern Lebanon.

RUSSIA-UKRAINE

- EU Commission President von der Leyen said as peace talks are ongoing, the EU remains ironclad in its support for Ukraine, while she added that the goal is a strong Ukraine, on the battlefield and at the negotiating table. Furthermore, she said Ukraine's sovereignty must be respected, and Ukraine's security must be guaranteed in the long term as a first line of defence for our union.

- Russia's Kremlin said European claims that Russian President Putin plans to attack NATO are "complete nonsense".

CRYPTO

- Bitcoin is a little lower and holds around USD 90k, with Ethereum also in the red and holding just above the USD 3.1k mark.

APAC TRADE

- APAC stocks were subdued following the lacklustre lead from Wall Street with markets cautious ahead of the FOMC policy announcement on Wednesday, where participants will also be eyeing the central bank's latest dot plot projections, while downside was stemmed in the region amid a further warming of US-China trade relations after US President Trump confirmed that the US will permit NVIDIA (NVDA) to sell its H200 chips to China.

- ASX 200 was pressured following the RBA rate decision where the central bank unsurprisingly kept the Cash Rate unchanged at 3.60%, although comments from RBA Governor Bullock at the press conference leaned hawkish as she stated that it looks like more rate cuts are not needed and she doesn't see rate cuts in the foreseeable future, while she added that the outlook is for an extended pause or hikes, but would not put a probability on it.

- Nikkei 225 lacked conviction and swung between gains and losses within a narrow range following recent currency weakness and anticipation that the BoJ will hike rates next week.

- Hang Seng and Shanghai Comp were subdued after the readout from yesterday's Politburo meeting underwhelmed, as some were hoping for more forceful measures, while chipmakers in China were pressured in early trade after US President Trump's announcement to allow NVIDIA to sell chips to approved customers in China.

NOTABLE ASIA-PAC HEADLINES

- RBA kept the Cash Rate unchanged at 3.60%, as expected, with the decision unanimous and noted that recent data suggests the risk to inflation have tilted to the upside, but it will take a little longer to assess persistence of inflationary pressures, while it added that private demand is recovering, and labour market conditions still appear a little tight, though modest easing is expected. RBA said the board judged it appropriate to remain cautious and update its outlook as the data evolves, with the board to be attentive to the data and evolving assessment of the outlook and risks to guide its decisions. Furthermore, the board judged that some of the recent increase in underlying inflation was due to temporary factors, while it is focused on its mandate to deliver price stability and full employment, and will do what it considers necessary to achieve that.

- RBA Governor Bullock said at the post-meeting press conference that inflation and jobs data will be important for the board meeting in February, while she added that it looks like more rate cuts are not needed. Bullock stated they did not consider a rate cut and did not explicitly consider the case for a rate hike at this meeting, but discussed the circumstances in which tightening might be required. Bullock said if inflation looks persistent, it will raise questions for policy, while she would not put timing on any future move and will proceed meeting by meeting. Furthermore, she doesn't see rate cuts in the foreseeable future and noted the outlook is for an extended pause or hikes, but would not put a probability on it.

- China's Premier said "we are confident in completing economic goals this year", according to Xinhua.

- BoJ Governor Ueda said he believes that the economy will go back to positive growth in Q4 and beyond that. "Because we are foreseeing convergence to 2% of the underlying component, we have been adjusting the degree of easing slowly". As Japanese automakers have chosen to lower export prices without passing them to US consumers, this has stabilised the volume of auto exports, not creating negative effects on employment and production in Japan. Strong enough momentum in domestic price and wage dynamics to prevent negative shocks from having a large impact on inflation. At the moment, not seeing a very high risk of inflation, especially underlying inflation accelerating in the wake of fiscal stimulus. Watching the possibility of food inflation and JPY weakness altering inflation expectations. It is the government's job to deliver on medium to long-term fiscal sustainability. Keep an eye on bank exposure to non-bank financial institutions abroad. Exchange rates should follow fundamentals. How exchange rates will affect our inflation outlook is a "very important question for us."

- BoJ Governor Ueda said he won't comment on specifics on interest rates but noted that long-term interest rates are rising rather rapidly recently, adding that it will increase JGB purchases if long-term rates make abrupt moves.

DATA RECAP

- Australian NAB Business Confidence (Nov) 1.0 (Prev. 6.0)

- Australian NAB Business Conditions (Nov) 7.0 (Prev. 9.0, Rev. 10)