Chinese EVs Flood Europe, Signals Hollowing Out Of Bloc's Industrial Core

The rapid growth of China's electric vehicles on Europe's streets and highways isn't just a market share story. In fact, it's an industrial security threat for the bloc. When Chinese manufacturers undercut domestic car brands, the damage goes well beyond margin pressure and shuttered production lines. The much larger and alarming issue is the hollowing out of Europe's industrial core.

While Europe deindustrialises and focuses on Wokeism

— Chay Bowes (@BowesChay) February 3, 2026

Chinese company BYD is building a mega factory larger than San Francisco (Not AI)

At this scale, and such low costs, vast human resources, and its own market, it will become impossible for Europe to compete. pic.twitter.com/SnRjvO0Wp9

Goldman analyst Christian Frenes released the latest Chinese OEM Competition Monitor, which covers January registrations of Chinese EVs across Europe.

Even though Chinese brand EV sales softened in January, volumes remain elevated at 31,000 units in Jan-26 versus 40,100 in Dec-25 and 8,700 a year earlier, representing a whopping 257% year-over-year growth.

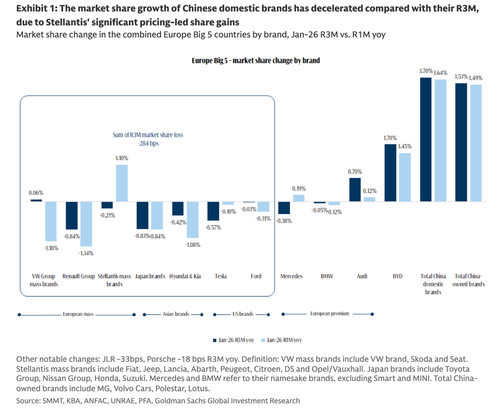

In Europe's Big 5 markets (Germany, the United Kingdom, France, Italy, Spain), Chinese domestic brands nearly topped 5% of market share in January, up from 3.64% one year ago.

Market share growth of Chinese domestic brands outpaces that of local car companies.

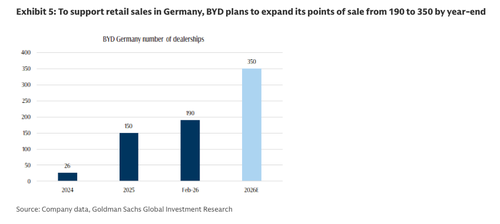

"Heading into 2026, we expect Chinese OEMs to further intensify their European expansion plans, e.g., BYD offering c.30% price discounts while aiming to double its volume in Germany this year," Frenes said.

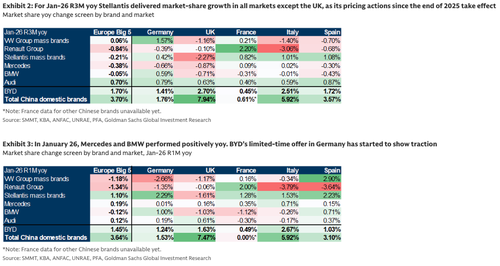

Here's the demand of Chinese and local car companies for January.

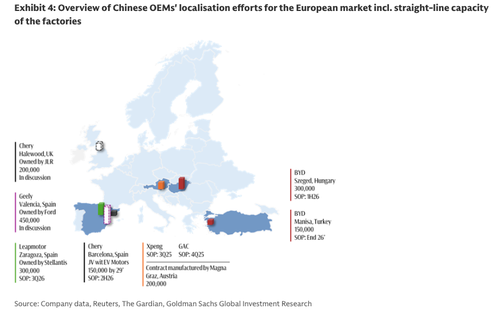

Where these Chinese car brands are invading Europe.

Frenes highlights several key developments of Chinese brand expansion across the bloc:

Chery & Jaguar Land Rover (JLR): Chery is reportedly exploring a manufacturing partnership with JLR that would leverage spare capacity at JLR's Halewood plant in the UK (link). The plant, which has an annual capacity of c.200,000 units, was significantly underutilized in the past few years. We estimate the average utilization rate at c.60%. This initiative would build on the existing Chery–JLR relationship, as the two companies have operated a manufacturing joint venture in China since 2012. Discussions reportedly involve the UK government and JLR leadership, and Chery has publicly highlighted the UK as a potential production base as part of its localization strategy. No definitive agreement has been announced.

Geely & Ford: Both companies are reportedly in advanced discussions for a partnership under which Geely would utilize Ford's manufacturing facilities in Valencia, Spain (link). We estimate the average ulilization rate of this factory to be at c.70% over the last 5 years. This approach is consistent with Geely's established strategy of partnering with other automakers, such as its existing deal with Renault to leverage their factories in South Korea and Brazil. No definitive agreement has been announced.

Uncertainty over reported suspension of BYD's Turkey plant: BYD has reportedly halted plans for its USD 1bn EV factory in Manisa, Turkey. Media cites that a dispute over core technology transfer requirements, along with parliamentary scrutiny, may have contributed to the investment being paused. The statement was rejected by the Turkish Trade Minister while the company has not issued any official confirmation.

BYD is planning for explosive demand across the bloc this year.

Our assessment here is much deeper than just market share; the fact that Brussels is allowing this invasion to occur in the first place puts severe pressure on European OEMs and suppliers.

Anduril Industries founder Palmer Luckey outlined exactly this threat in a recent Joe Rogan podcast.

"If you let them (US car manufacturers) freely compete, like if you let them go toe to toe, China would be thrilled if they could subsidise their way into destroying the American automotive apparatus, partly for economic reasons. But there's another reason," Luckey said.

He continued, "How did the United States win World War II … Manufacturing – some of it was new factories, but most of it was taking over old factories."

"We took all of our farm implement factories, like John Deere and Caterpillar. They were building tanks and guns. We took all our automotive factories. We had them building aircraft, we had them building weapons, we had them building missiles," he said.

He said, "In fact, we even designed those weapons so they could be manufactured by those plants … We won because we had all of this automotive and other industrial capacity."

Luckey warned, "China would love to wipe out the American automotive industry, partly for economic reasons, because it also means we will never be able to fight a war against them. Imagine in America with like, we've lost a lot of manufacturing … If China could wipe out our industrial capacity entirely, they never need to worry about fighting a war with the US again because they know that we wouldn't be able to get back in the game fast enough to matter."

It's as if Brussels is allowing its own decline, whether by letting a flood of Chinese EVs pour onto European streets or by pursuing climate policies that have weakened reliable power generation and eroded core industrial capacity.

However, we do think the bloc is starting to recognize where this trajectory ends and, as the world fractures and the war in Eastern Europe grinds on. That reality was reflected last week, when industrial leaders urged Brussels to dial back its carbon pricing regime to restore competitiveness.

Professional subscribers can read the full note Goldman on our new Marketdesk.ai portal