Chinese imposes export controls on Japan; Trump to deliver remarks at a GOP retreat - Newsquawk US Opening News

- US President Trump is scheduled to deliver remarks at a GOP member retreat at 10:00EST/15:00GMT on Tuesday and will participate in a meeting at 14.30EST/19:30GMT on Tuesday.

- China Commerce Ministry imposes export controls on dual-use items to Japan, effective immediately.

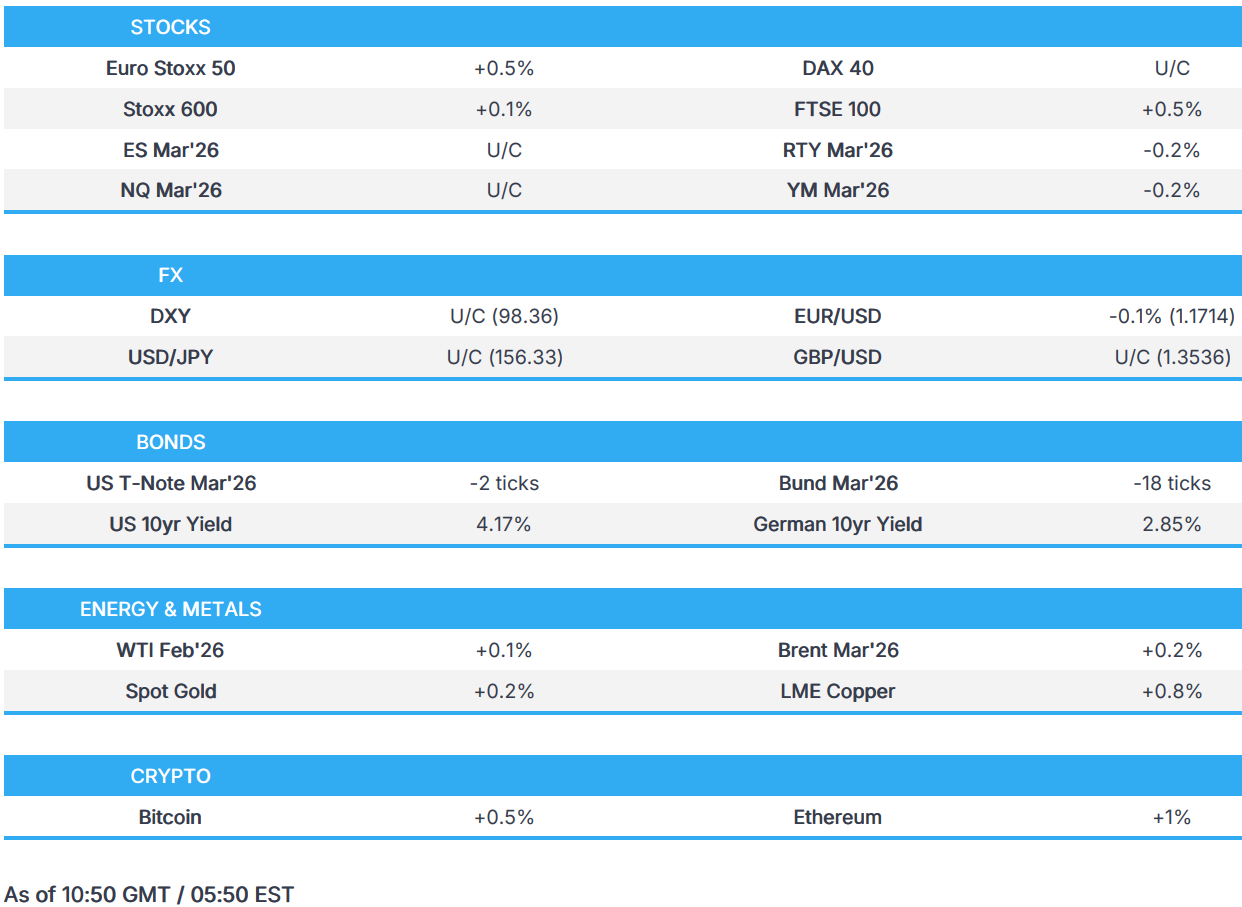

- European bourses are mostly firmer; US equity futures are mixed, with the RTY under slight pressure.

- Mostly uneventful trade across G10s but EUR subdued post-PMI & German State CPI.

- Bonds initially pressured before EGBs benefitting from German State CPIs ahead of the 13:00GMT mainland print.

- Crude initially lower but now a touch in the green; XAU extends on Monday's gains as Copper reaches another ATH.

- Looking ahead, German CPI (Dec), US S&P PMI Final (Dec), Speakers including Fed's Barkin, US President Trump, Fed Discount Rate Minutes.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 U/C) opened with very modest gains, but have indices have since slipped a touch off best levels to show a bit more of a mixed picture in Europe.

- European sectors are mixed, with Health Care, Energy, and Basic Resource leading. Energy is advancing on higher crude prices, despite the absence of a clear catalyst. On a stock-specific basis, the sector is also being supported by gains in heavyweight names such as Shell (+1.6%) and BP (+1.9%). Meanwhile, sentiment in Basic Resources has been underpinned by strength in metal prices.

- US Equity futures are modestly lower/flat. Early pressure in indices were seen after China's Commerce Ministry imposed export controls on dual-use items to Japan; this weighed on Nikkei 225 futures, and eventually weighed on global equity sentiment.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY resides in a narrow 98.161-98.425 range after recovering from worst levels on the back of some EUR softness (more below), although price action across FX thus far has been muted vs other markets (Equities, Fixed Income, Commodities). The US docket for today only consists of S&P Services and Composite Final PMIs alongside commentary from Fed's Barkin and Miran. Perhaps more importantly, US President Trump is due to give remarks later today.

- EUR is on a softer footing, with early weakness commencing shortly after the revisions lower to the French PMIs, whilst downward revisions in German Composite and EZ PMIs further weighed on the single currency. Moreover, German State CPIs were more dovish than the Nationwide figure (at 13:00 GMT) implies. EUR/USD resides towards the bottom end of a 1.1708-1.1743.

- GBP/USD trades flat towards the bottom of a 1.3528-1.3568 range with little immediate move seen on the slight revision higher in UK Services and Composite PMIs, with EUR/GBP flat intraday in a narrow 0.8644-0.8660. USD/JPY is also flat in a 156.17-156.80 range and largely trading at the whim of the USD.

- Antipodeans also see little price action but AUD continues to be supported by the recent rally in copper and gold.

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks began the morning on the backfoot, with downside of around five and 20 ticks for USTs and Bunds respectively. Action that came as the benchmarks trimmed into and through the APAC session, with further pressure emanating from weak demand at the Japanese 10yr tap; an auction that sent JGBs lower from 132.23 to a 131.93 session trough, trimming initial gains of around 15 ticks to losses of 16 at worst.

- Since, the complex generally benefited incrementally from a dip in the risk tone as China imposed export-controls on dual-use items to Japan.

- For EGBs, no real move to the French Prelim. HICP metrics, which came in as expected M/M and slightly cooler than expected Y/Y at 0.7% (prev. 0.8%). More pertinently, the German State CPIs ahead of the 13:00GMT nationwide figure, where consensus is for the headline Y/Y to moderate to 2.0% (prev. 2.3%) and the HICP Y/Y to 2.2% (prev. 2.6%); for the respective M/M, at 0.3% (prev. -0.2%) and 0.4% (prev. -0.5%). State CPIs lifted Bunds to a 127.67 high, firmer by 27 ticks at most. A move perhaps driven by the M/M for North Rhine-Westphalia coming in at 0.0% (prev. -0.3%), cooler than the nationwide expectations, as above, for a lift to 0.2% (prev. -0.2%).

- Ahead, USTs look to remarks from Fed's 2027 voter Barkin, text and Q&A expected, before the region's own Final PMIs.

- Germany sells EUR 4.4547bln vs exp. EUR 6bln 2.00% 2027 Schatz: b/c 1.93x (prev. 1.7x), average yield 2.11% (prev. 2.05%), retention 24.22% (prev. 20.82%).

COMMODITIES

- Crude benchmarks started the APAC session on the backfoot, paring back some of Monday's gains before extending higher as the European session gets underway, despite a lack of crude-specific drivers.

- WTI and Brent pulled back to a low of USD 57.85/bbl and USD 61.31/bbl respectively after peaking at USD 58.51/bbl and USD 61.89/bbl in Monday's session. Benchmarks then bid higher pretty aggressively despite a clear explanation for the move, reaching a session high of USD 58.67/bbl and USD 62.14/bbl before pulling back slightly.

- Spot XAU trades choppy but managing to hold onto modest gains as the yellow metal sits above USD 4450/oz. After dipping to a trough of USD 4428/oz early in the APAC session, XAU extended on Monday's gains to peak at USD 4476/oz as European traders entered the market. Thus far, the yellow metal is trading in a tight USD 26/oz band above USD 4450/oz.

- 3M LME Copper continued its bid to new ATHs throughout the Asia-Pac session, following the risk-on tone in Asian equities. The red metal opened at USD 13.1k/t and immediately bid higher, peaking at USD 13.39k/t as the European session gets underway. As equities started to pull back, led by Nikkei 225 futures, following the imposition of export controls on dual-use items to Japan by China, 3M LME Copper has started to fall lower and is currently trading at USD 13.24k/t.

- China skips retail gasoline and diesel price adjustment.

- Goldman Sachs said Chinese steel mills face an extended period of depressed margins as efforts to cut capacity in the sector goes slower than expected, while exports remain high.

- ANZ said Venezuela oil output increase is unlikely until the end of the decade as aging infrastructure will require billions of dollars in spending, according to Bloomberg.

- Morgan Stanley expects another period of softness for crude ahead, Brent to fall into the mid-high USD 50/bbl region for the majority of 2026. Expect the market to be in a "significant" surplus before then returning to balance in H2-2027.

TRADE/TARIFFS

- China Commerce Ministry imposes export controls on dual-use items to Japan, effective immediately.

NOTABLE EUROPEAN DATA RECAP

- UK S&P Global Services PMI Final (Dec) 51.4 vs. Exp. 51.3 (Prev. 51.3).

- UK S&P Global Composite PMI Final (Dec) 51.4 vs. Exp. 51.2 (Prev. 51.2).

- UK BRC Shop Price Index YY (Dec) 0.7% (Prev. 0.6%).

- German North Rhine Westphalia CPI YoY (Dec) 1.8% Y/Y (Prev. 2.3%).

- German Hesse CPI YoY (Dec) 2.2% Y/Y (Prev. 2.5%).

- German Hesse CPI MoM (Dec) +0.1% M/M (Prev. -0.2%).

- German North Rhine Westphalia CPI MoM (Dec) 0.0% M/M (Prev. -0.3%).

- German Brandenburg CPI YoY (Dec) 2.2% Y/Y (Prev. 2.6%).

- German Brandenburg CPI MoM (Dec) 0.4% M/M (Prev. -0.2%).

- German Saxony CPI YoY (Dec) 1.9% Y/Y (Prev. 2.2%).

- German Saxony CPI MoM (Dec) 0.2% M/M (Prev. -0.2% ).

- German HCOB Composite Final PMI (Dec) 51.3 vs. Exp. 51.5 (Prev. 51.5).

- German HCOB Services PMI (Dec) 52.7 vs. Exp. 52.6 (Prev. 52.6).

- EU HCOB Composite PMI Final (Dec) 51.5 vs. Exp. 51.9 (Prev. 52.8).

- EU HCOB Services PMI Final (Dec) 52.4 vs. Exp. 52.6 (Prev. 53.6).

- French HCOB Services PMI (Dec) 50.1 vs. Exp. 50.2 (Prev. 50.2).

- French HCOB Composite PMI (Dec) 50.0 vs. Exp. 50.1 (Prev. 50.1).

- French CPI (EU Norm) Prelim YY (Dec) 0.70% vs. Exp. 0.80% (Prev. -0.80%); MM (Dec) 0.10% vs. Exp. 0.10% (Prev. -0.20%).

- Italian HCOB Composite PMI (Dec) 50.3 (Prev. 53.8).

- Italian HCOB Services PMI (Dec) 51.5 vs. Exp. 54.2 (Prev. 55.0).

- Spanish Services PMI (Dec) 57.1 vs. Exp. 54.5 (Prev. 55.6).

- Spanish Composite PMI (Dec) 55.6 vs. Exp. 54.3 (Prev. 55.1).

- UK grocery inflation 4.3% in the four weeks to Dec 28th (prev. 4.7% in Nov); grocery sales +3.8% Y/Y over the four-week period.

CENTRAL BANKS

- ECB's Villeroy said recent French CPI reading is good news for favourable rates.

- PBoC held a meeting on Jan 5-6; continue moderating easing, integrate incremental and stock policy effects; will intensify counter cyclical and cross-cyclical adjustments. Will make efforts to expand domestic demands. Will prudently defuse risks in key areas. Will keep liquidity ample. Will flexibly use RRR cut and rate cut. Will keep Yuan exchange rate basically stable at a reasonable and balanced level. Vows to strengthen market expectation guidance. Will enhance supervision on bond market and gold market. Will boost market confidence.

- PBoC set USD/CNY mid-point at 7.0173 vs Exp. 6.9730 (Prev. 7.0230).

NOTABLE US HEADLINES

- US President Trump is scheduled to deliver remarks at a GOP member retreat at 10:00EST/15:00GMT on Tuesday and will participate in a policy meeting at 14.30EST/19:30GMT on Tuesday.

- US President Trump posted "Pregnant Women, DON’T USE TYLENOL UNLESS ABSOLUTELY NECESSARY, DON’T GIVE TYLENOL TO YOUR YOUNG CHILD FOR VIRTUALLY ANY REASON, BREAK UP THE MMR SHOT INTO THREE TOTALLY SEPARATE SHOTS". Full post "Pregnant Women, DON’T USE TYLENOL UNLESS ABSOLUTELY NECESSARY, DON’T GIVE TYLENOL TO YOUR YOUNG CHILD FOR VIRTUALLY ANY REASON, BREAK UP THE MMR SHOT INTO THREE TOTALLY SEPARATE SHOTS (NOT MIXED!), TAKE CHICKEN P SHOT SEPARATELY, TAKE HEPATITAS B SHOT AT 12 YEARS OLD, OR OLDER, AND, IMPORTANTLY, TAKE VACCINE IN 5 SEPARATE MEDICAL VISITS! President DJT".

NOTABLE US EQUITY HEADLINES

- NVIDIA (NVDA) CEO said there is strong demand from China for H200, while Co. has applied for licenses to ship H200 chips to China, and US government is working to process them. Co. said DRIVE Hyperion ecosystem is expanding to include tier 1 suppliers, automotive integrators and sensor partners, including Aeva (AEVA), AUMOVIO (AMV0 GY), Astemo, Arbe (ARBE), Bosch, Hesai (HSAI), Magna (MGA), Omnivision (603501 CH), Quanta, Sony (6758 JT) and ZF Group.

- Microchip Technology (MCHP) sees Q3 revenue at USD 1.19bln (exp. 1.182bln, prev saw. 1.11-1.15bln); preparing to ramp factories in March to lower charges and seen substantial inventory reduction to lower write-off.

GEOPOLITICS

OTHERS

- "Syria: Israeli forces infiltrate the southern countryside of Quneitra", according to Al Arabiya.

- Israeli Air Force struck multiple sites in Lebanon on Monday and early Tuesday, ahead of a key disarmament meeting, according to POLITICO.

- North Korea accuses Japan of reinvasion plotting over record-high defence budget, according to Yonhap.

- Shooting reported near presidential palace in Caracas, although Venezuelan government said situation is under control.

- US House Speaker Johnson said not expecting US troops on the ground in Venezuela, according to Bloomberg's Erik Wasson.

- Witnesses reportedly heard loud blasts near the Presidential Palace in Caracas, Venezuela, according to Bloomberg's Erik Wasson.

- Al Jazeera notes report of Israeli raid on vicinity of southern Lebanese town of Al-Ghaziyah.

- US President Trump has a list of demands for Venezuela's new leader including stopping oil sales to US rivals, according to POLITICO. "U.S. officials have told Delcy Rodriguez that they want to see at least three moves from her: cracking down on drug flows; kicking out Iranian, Cuban and other operatives of countries or networks hostile to Washington; and stopping the sale of oil to U.S. adversaries".

- US President Trump said Venezuela has to be fixed before elections and that acting President Rodriguez has been cooperating with the US, while Trump's advisor Miller said Venezuela is cooperating with the US and needs US permission to do any commerce. said:. US may subsidise an effort by oil companies to rebuild the country's energy infrastructure. Would not need lawmakers to act in order for him to send US troops back into Venezuela.

- CIA reportedly concluded that Venezuela's Maduro regime loyalists were best placed to lead Venezuela after Maduro, according to WSJ.

CRYPTO

- Bitcoin is a little firmer and trades above USD 93k, with Ethereum also rising beyond USD 3.2k.

APAC TRADE

- APAC stocks were mostly higher following the positive handover from Wall Street, where all major indices gained amid outperformance in energy and a softer yield environment.

- ASX 200 was the laggard with the index dragged lower by weakness in defensives and the top weighted financial sector, while metal and mining stocks were boosted after the recent climb in underlying commodity prices and reports of an AUD 8.8bln takeover offer for BlueScope Steel.

- Nikkei 225 rallied at the open to back above the 52,000 level with the advances led by mining and tech-related stocks.

- Hang Seng and Shanghai Comp conformed to the predominantly upbeat mood, with outperformance in Hong Kong helped by strength in some property names and miners, while aluminium producer China Hongqiao Group led the advances as aluminium prices printed fresh three-year highs.

NOTABLE ASIA-PAC HEADLINES

- Japan sold JPY 1.96tln 10yr JGB, b/c 3.30x (prev. 3.59x), average yield 2.095% (prev. 1.872%). Lowest accepted price 99.99 vs prev. 98.53. Average accepted price 100.04 vs prev. 98.57. Tail in price 0.05 vs prev. 0.04.

- Japan's nuclear regulator said no irregularities at Chugoku Electric's (9504 JT) Shimane nuclear power plant following the earthquake.

- Earthquake with a preliminary magnitude of 6.3 strikes at the Shimane Prefecture in Japan, according to NIED.

NOTABLE APAC DATA RECAP

- Japanese Monetary Base YY (Dec) -9.8% (Prev. -8.5%).

- Australian Composite PMI (Dec F) 51.0 (Prelim. 51.1).

- Australian Services PMI (Dec F) 51.1 (Prelim. 51.0).