CME Reopens After Chicago Data Center "Cooling Issue"

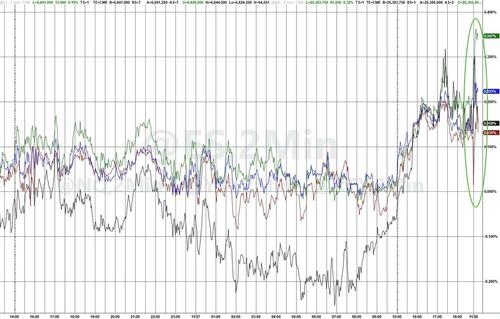

Update (0830ET): CME Globex Futures & Options markets have officially reopened after their overnight 'cooling issue'. For now, Nasdaq futs are rallying...

* * *

Update (0820ET): Headlines crossing over the Terminal show that CME Globex Futures & Options Markets will open at 08:30 ET after hours of being offline due to a "cooling issue" at data centers operated by CyrusOne in Chicago.

Here are the headlines:

CME GLOBEX FUTURES & OPTIONS MARKETS TO OPEN 7:30 CENTRAL TIME

CME: ALL GTCS THAT HAVE BEEN ACKNOWLEDGED WILL REMAIN WORKING

CME GLOBEX FUTURES & OPTIONS MARKETS TO PRE-OPEN 07:00 CENTRAL

CME Partially Restores Operations as Forex Platform Restarts

What a mess for this shortened post-Thanksgiving session to end the week.

* * *

A major "cooling issue" at data centers operated by CyrusOne forced the Chicago Mercantile Exchange to halt futures and options trading early Friday morning, disrupting activity across equities, FX, Treasuries, energy, and agricultural markets.

"Due to a cooling issue at CyrusOne data centers, our markets are currently halted. Support is working to resolve the issue in the near term and will advise clients of Pre-Open details as soon as they are available," CME wrote on X late Thursday night.

Due to a cooling issue at CyrusOne data centers, our markets are currently halted. Support is working to resolve the issue in the near term and will advise clients of Pre-Open details as soon as they are available.

— CME Group (@CMEGroup) November 28, 2025

CME provided an update around 0500 ET, indicating, "BrokerTec EU markets are open and trading. All other CME Group markets remain halted due to a data center cooling issue at CyrusOne. We will provide updates as they are available."

BrokerTec EU markets are open and trading. All other CME Group markets remain halted due to a data center cooling issue at CyrusOne. We will provide updates as they are available.

— CME Group (@CMEGroup) November 28, 2025

The disruption, now longer than a similar 2019 outage, paralyzed CME's Globex platform, prompting traders to describe conditions as "flying dark" as liquidity, price discovery, and market signaling disappeared in seconds.

Exchanges connected to CME, including CBOT, NYMEX, COMEX, and even the Gulf Mercantile Exchange, also experienced disruptions. CME has not provided a reopening time.

Thomas Helaine, head of equity sales at TP ICAP Europe in Paris, told Bloomberg the outage is "a bit like flying dark," adding, "When you're trading cash equity like us, US futures give you an indication of where the market is going before the open. I can only imagine how complicated it must be for derivatives desks."

"Traders sitting with a position are certainly quite angry," said Gnanasekar Thiagarajan, head of trading and hedging strategies at Kaleesuwari Intercontinental.

Nick Twidale, chief analyst at AT Global Markets in Sydney, noted that traders "will be switching to alternative liquidity tools where they can. We've lost one of the market's major liquidity sources. This heightens the risk of exacerbated moves if a big event occurs."

The outage creates headaches for traders as they roll monthly contracts, leaving positions frozen. With US markets reopening for a shortened post-Thanksgiving session, broader equity markets in Europe and Asia were rather muted.

Also, the outage highlights the extent to which CME serves as a backbone of global markets, where one data center cooling issue can ripple across exchanges worldwide.

Silver had to get cooled off

— marc friedrich (@marcfriedrich7) November 28, 2025

German analyst Marc Friedrich joked at CME's X post, "Silver had to get cooled off."