The Coming AI Debt Deluge

Authored by MBI Deep Dives

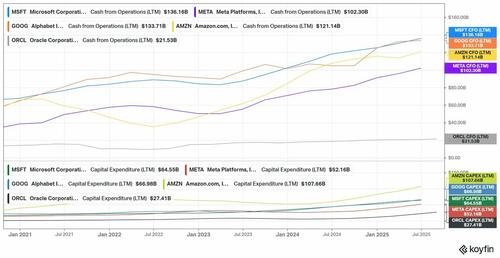

One of the core differences of the current AI revolution from the earlier bubble periods was that almost all of the funding so far has come from operating cash flow (OCF) of some of the most profitable companies on earth. Despite massive capex increases in recent years, all the major public companies (except Oracle) participating in this investment cycle has healthy Free Cash Flow (FCF) so far. Meta, for example, generated ~$50 Billion FCF in the last 12 months although one-third of it was just SBC. But cash is cash…if you need hundreds of billions over multiple periods to get to the promised land, there is still a healthy difference between OCF and Capex of some of these big tech. Investments funded by internally generated cash can go on for a long time as long as market remains receptive to such investments.

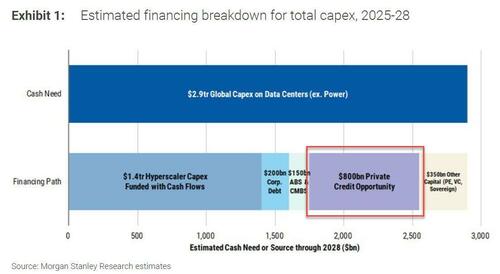

However, we are starting to see some changes in funding mix as debt has gradually come to the scene. One thing about debt entering the conversation is debt itself can be a great forcing function to manage the potential overinvestment cycle as interest payment obligations and balance sheet leverage can put some hard constraints to keep you disciplined.

Big tech understands this and hence are resorting to some “helping hands” in their investment journey. For example, last week Meta entered in a Joint Venture (JV) with Blue Owl Capital for their $27-Billion Hyperion Data Center campus, of which Meta will own 20% and the rest will be owned by funds managed by Blue Owl Capital. Meta is signing an “operating lease” with an initial term of only four years. They have the option to extend the lease every four years, but they are not obligated to.

To persuade the JV to accept the short four-year leases, Meta provided a “Residual Value Guarantee” (RVG) covering the first 16 years of operations. If Meta decides to leave (by not renewing or terminating the lease) within the first 16 years, they guarantee the campus will still be worth a certain amount of money (undisclosed). This payment is “capped” i.e. there is a pre-agreed maximum limit to how much Meta would have to pay. Again, we don’t know the exact capped limit in this deal.

The structure of this deal, featuring short 4-year leases combined with a long-term RVG on a highly specialized asset, closely resembles a financial tool known as a Synthetic Lease.

Continue reading here.